Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jun, 2025

By Tim Siccion and Shambhavi Gupta

The value of global private equity and venture capital deals in Japan is on track to exceed the amount reached in 2024 as local family-owned corporations open up to private equity involvement.

Private equity investment in Japan amounted to $14.28 billion across 380 deals from Jan. 1 to May 27, significantly higher than the $2.7 billion reported in the first five months of 2024, according to S&P Global Market Intelligence data. Private equity flows to Japan remain strong after investment for full year 2024 soared from 2023.

"Japan's market is becoming more receptive to private equity," PwC Advisory LLC partner Tomoro Oikawa told Market Intelligence, noting high levels of succession-driven buyouts and corporate carve-outs in the first half of the year, with expectations that the deal environment will remain favorable in the near term.

"Family-owned companies looking to private equity for successions for sure will increase," Oikawa said.

Oikawa also highlighted regulatory changes to the Tokyo Stock Exchange that make IPOs more viable as exit routes. In the year to June 10, there were 28 global private equity IPO exits, 12 of which were from Japan, according to Market Intelligence data.

"Taking a company public is very doable," Oikawa said. "If you have the right setup, even small IPOs can be done in this market."

US firms increase investment in Japan

US private equity flows made up most of the foreign investment in Japan, with $12.97 billion across 32 deals from Jan. 1 to May 27, already 27.4% higher than the $10.18 billion logged in full year 2024, according to Market Intelligence data.

Oikawa believes the ongoing trade dispute between the US and China was a major driver for US private equity deals in Japan.

"American firms have shifted away from deploying capital in China, so for their Asian funds, the allocations to Japan have increased," Oikawa said. Oikawa added that Japan's low valuations, interest rates and stable business regulatory system are macroeconomic tailwinds boosting global investor confidence.

The Carlyle Group Inc. believes "today's private equity market in Japan continues to be the most exciting environment we have seen in our careers," according to a report from the firm, which raised about $2.97 billion for buyout vehicle Carlyle Japan Partners V LP in 2024.

Carlyle cited structural reforms that boosted corporate productivity and accountability, appealing valuation multiples and relatively low interest rates. Another contributing factor is the mindset shift among Japanese CEOs who have shown increased openness to M&A, leading to higher cash distributions to investors.

"The Japanese market is increasingly dynamic for a couple of reasons. ... One, obviously, is this evolution of companies willing to become more dynamic in terms of their corporate stewardship," Carlyle CEO Harvey Schwartz said on the firm's first-quarter earnings call in May.

– Download a spreadsheet with data featured in this story.

– Catch up on venture capital activity in May.

– Read up on private equity trends in food and beverage.

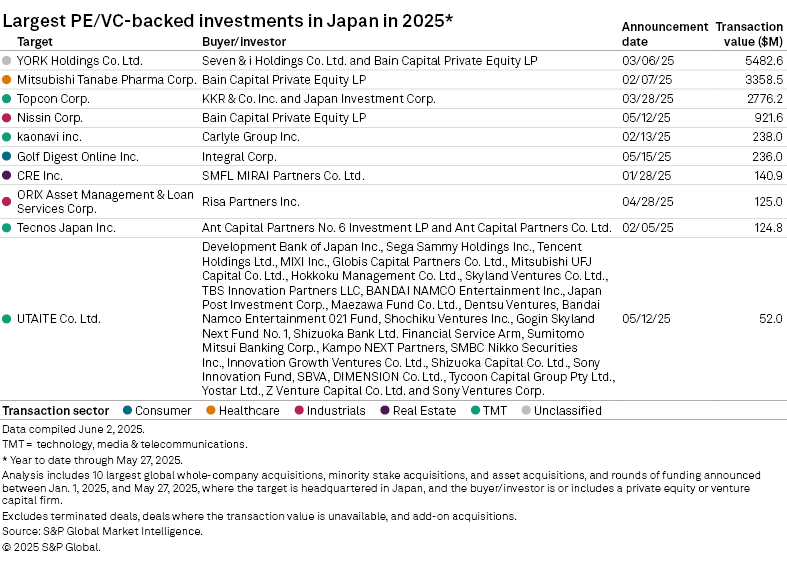

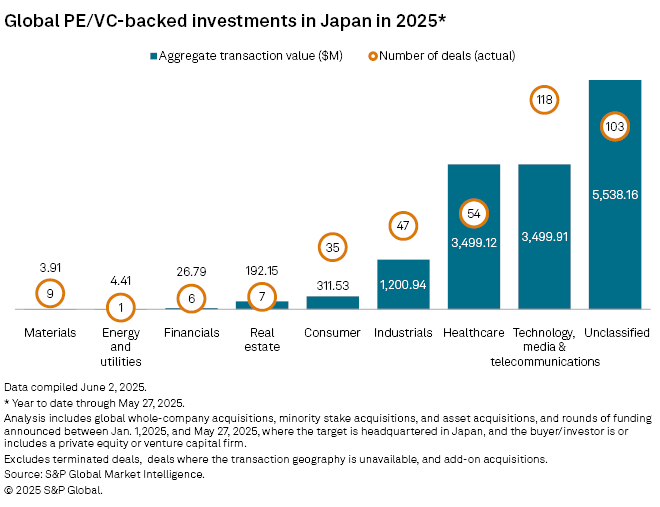

The technology, media and telecommunications sector recorded the most transactions across all covered industries, with 118 deals totaling nearly $3.50 billion, essentially tied with the healthcare sector, which raised approximately the same amount across 54 deals.

Largest PE deals in Japan

The largest private equity-backed deal for the year through May 27 was Bain Capital Private Equity LP's $5.48 billion proposed acquisition of superstore business York Holdings Co. Ltd. from Tokyo-headquartered convenience store operator Seven & i Holdings Co. Ltd.

The second-largest was Bain Capital's planned $3.36 billion buyout of pharmaceutical company Mitsubishi Tanabe Pharma Corp. from Mitsubishi Chemical Group Corp.

Third was KKR & Co. Inc. and Japan Investment Corp.'s $2.78 billion take-private deal for Tokyo-based technology developer Topcon Corp.