Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Jun, 2025

By Allison Good

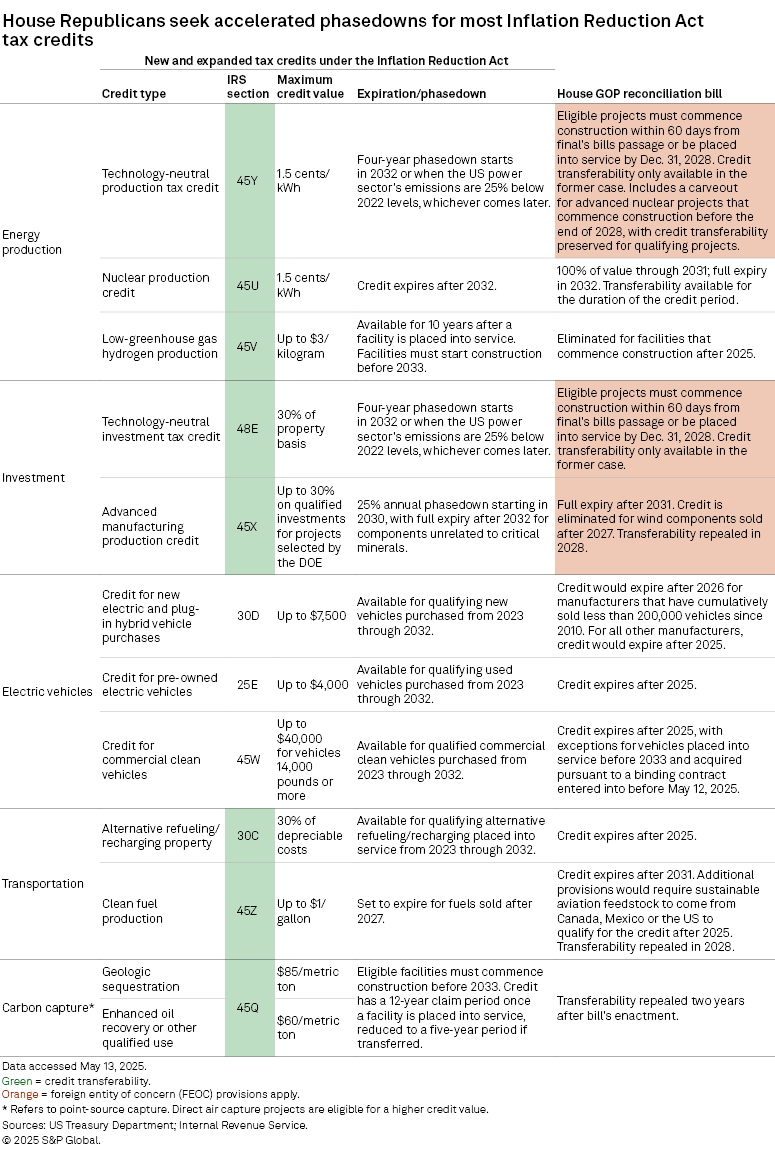

House Republicans' phaseout approach to the Inflation Reduction Act's green energy incentives would eliminate the ability to buy and sell tax credits, significantly shrinking the renewables project finance market, according to industry experts.

In 2024, $40 billion of tax credits were monetized through the transfer market, which allows for-profit project owners to raise cash by selling federal tax credits to a third party, compared to $30 billion of traditional tax equity volume. But if the US Senate does not soften language ending technology-neutral tax credits in 2029, the benefits accrued from the ballooning transferability market will also disappear.

"There is a world in which the underlying tax equity market could grow because banks themselves are looking at a world in which they have fewer limitations on doing those deals, but it won't get anywhere nearly as big as the transferability market," Peter Gardett, head of energy transition research at financial services platform Karbone, said during an interview.

Gardett has seen some transfer deals halt until the legislation is finalized.

"Because of the way these documents are put together, there's often a clause in them that [says] any meaningful change in tax law can result in either side walking away from the deal," Gardett said. "So, I have been part of processes that are just completely stopped until the final language is in place.

"And every day that goes by, that's tens of millions or more dollars at a minimum that isn't being invested. … I've never seen this much of a red light on deal activity."

Participation by third-party corporations in clean energy project finance would effectively end if the 2029 expiration of tech-neutral clean electricity tax credits and the 2028 phaseout of 45X advanced manufacturing credit remains intact in the House bill.

"Transferability brings in a lot of other corporates who just don't want to invest in a partnership but are perfectly happy to acquire tax credits," Matt Shanahan, managing director for Marathon Capital LLC, said during an interview.

Even though the tech-neutral credits would remain in place for another few years, energy projects would need to start construction within 60 days of the bill's passage and be placed in service by the end of 2028 to be eligible.

"We have a few years of activity, but as it stands things are done after that," said Andy Moon, co-founder of tax credit transfer marketplace Reunion Infrastructure Inc.

Many buyers are "coming off the sidelines" now that they know all projects that began construction in 2025 remain eligible for the credits, according to Moon, but Reunion will ultimately have to expand its offerings.

"We'll have to find different ways to serve our customers," Moon said. "The benefit is a platform like ours, we've worked with upwards of 300 developers and 150 buyers, so ... there's a lot of interest in working with us on different products, different ways to finance their projects."

For projects that have not yet started construction, "what we're hearing from developers is the 60-day commence-construction window is largely unworkable," said Rob Collier, LevelTen Energy Inc.'s vice president of energy marketplaces.

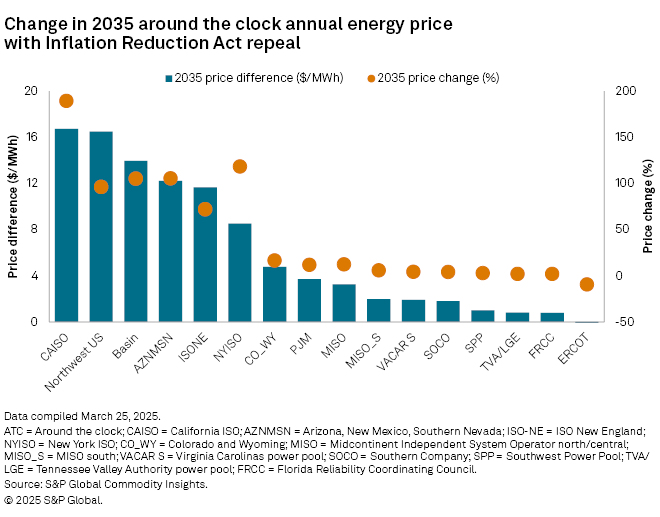

Securing power purchase agreements could also become more difficult if the House language is maintained by the Senate, since the absence of tax credits and transferability would incur higher financing costs that would be passed on to customers, Collier said.

While clean energy trade groups and developers remain optimistic that the Senate will step in, Karbone's Gardett and Reunion's Moon are not as certain.

"People seem remarkably sanguine about the Senate stepping in and essentially preserving the status quo, maybe bringing in some of the sunset dates," Gardett said. "So far, though, we haven't seen any evidence that that's the path of pursuit."

With power demand exponentially increasing, alongside bipartisan support for the tax credits and their benefits for Republican-led states, "in some ways maybe we were too comfortable that things would work themselves out," Moon said.

Clean energy manufacturers and power plant developers have already canceled or delayed more than $14 billion of US investments in 2025, according to a May 29 analysis by Environmental Entrepreneurs. The analysis highlighted sector uncertainties about federal energy and trade policies.

Meanwhile, a recent survey of investors and developers by the American Council on Renewable Energy revealed that 84% of investors and 73% of developers would decrease their activity if the Inflation Reduction Act is not preserved in its current form.

"Three-quarters of developers also reported that transferability had a positive impact on their ability to finance projects in 2024," according to the survey.

Gardett remains confident that many projects could still work in a post-transferability environment, though "finding the new equilibrium will be very scarring."

"It will definitely freeze everything in place for months at a minimum while everyone revisits their entire financing models and kind of starts from zero," Gardett said.