Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jun, 2025

Global private equity and venture capital deal value declined 33.7% in May to $51.79 billion from $78.14 billion the same month a year earlier, according to S&P Global Market Intelligence data.

The number of deals fell to 889 from 1,087 in May 2024.

However, year to date, total deal value increased to $330.25 billion, up from $276.85 billion in the first four months of 2024. Deal count was down to 5,048, compared to 5,434 in the same period the previous year.

– Download a spreadsheet with data featured in this story.

– Read about private equity-backed entries in April.

– Explore more private equity coverage.

Top sectors

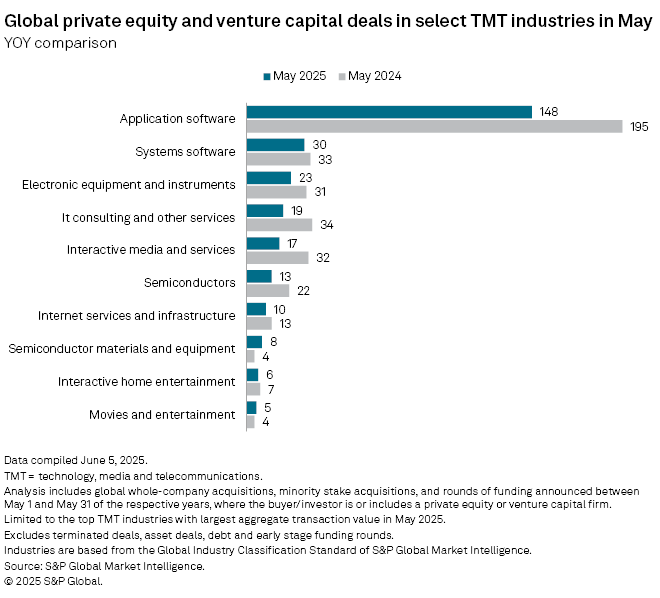

The technology, media and telecommunications sector saw the most deal activity in May, with 302 private equity-backed announced transactions.

Within the sector, application software had the highest number of transactions at 148, followed by systems software and electronic equipment and instruments at 30 and 23, respectively.

Largest deals

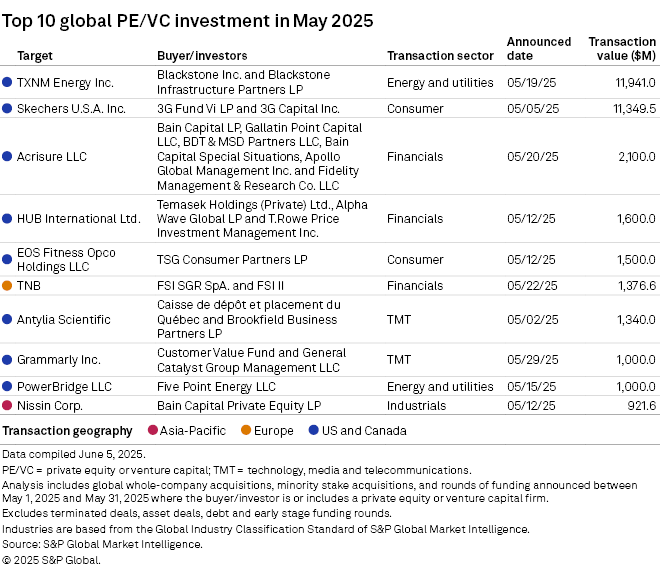

Nine deals with transaction values of at least $1 billion were announced in May.

In the largest transaction of the month, Blackstone Inc.'s Blackstone Infrastructure Partners LP agreed to buy New Mexico-based utility company TXNM Energy Inc. for $11.94 billion. TXNM shareholders will receive $61.25 per share in cash upon closing.

The second-largest deal was 3G Capital Inc.'s acquisition of footwear brand Skechers USA Inc. for $11.35 billion.

In the largest round of funding during the month, insurance broker Acrisure LLC secured a $2.1 billion investment led by Bain Capital LP. Firms including Apollo Global Management Inc. and Gallatin Point Capital LLC participated in the investment.