Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2025

By Liubov Georges and Susan Dlin

The global production of lithium and mined nickel posted sharp declines in the first quarter of 2025 amid persistently low prices, while cobalt output increased and copper production remained relatively stable from year-ago levels, according to the analysis of S&P Global Market Intelligence data.

The quarterly production analysis covers select publicly traded companies with available data tracked by Market Intelligence and may exclude some major producers.

Lithium output plummets; prices linger near multiyear lows

First-quarter lithium production plunged 44.2% year over year to 54,000 metric tons, the lowest level since the fourth quarter of 2022, according to Market Intelligence data. From the prior quarter, global production figures saw an even steeper decline of 59.9% from 134,000 metric tons reported in the fourth quarter of 2024.

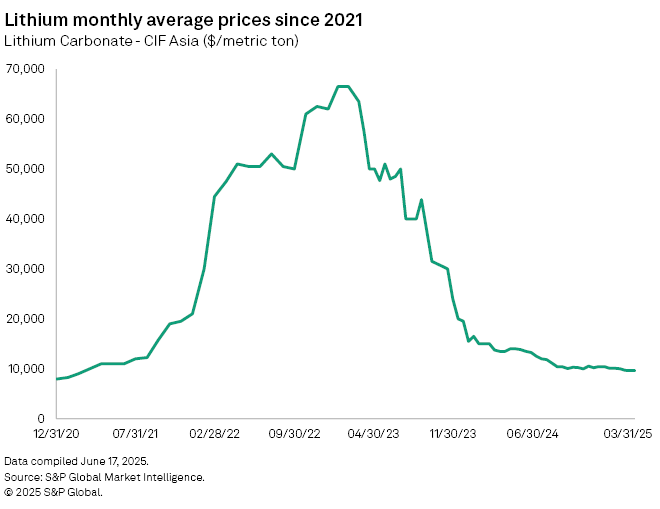

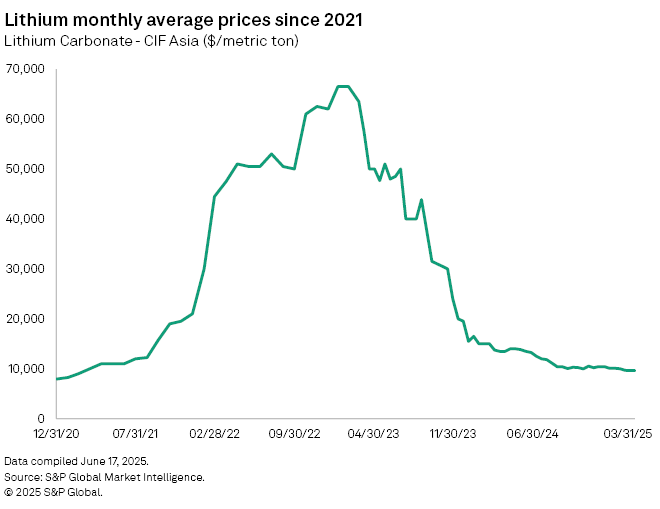

Lithium prices failed to recover during the first three months of the year, further squeezing producers' margins and forcing some higher-cost producers to cut output.

The Platts-assessed price of lithium carbonate CIF North Asia averaged $9,650/t in March, its lowest level since February 2021. Lithium carbonate prices declined further over the second quarter, falling below $9,000/t in May for the first time since January 2021.

"As prices have declined, we now believe that about 40% of global capacity is currently either at or below breakeven, of which only about one-third has come offline," Kent Masters, Albemarle Corp. chairman, president and CEO, said during the company's May 1 earnings call. "Non-integrated hard-rock conversion remains unprofitable, and large integrated producers are facing pressure."

Nickel production falls

Global mined nickel production fell 33% year over year and 24.3% quarter over quarter to 112,000 metric tons during the first three months of 2025. However,

The London Metal Exchange nickel cash price ended the first quarter at $16,159 per metric ton, up 6.9% since the start of the year but well below its peak of above $30,000/t in 2022, excluding a short-squeeze high in the early part of that year.

The decline in nickel production could be a sign that operators are starting to respond to low prices and an oversupplied market. Even the largest nickel producers, including IGO Ltd. and Lundin Mining Corp., cut

Cobalt output rises

First-quarter cobalt production increased 19.2% from year-ago levels but dropped 4.7% the fourth quarter of 2024 to 42,000 metric tons, according to Market Intelligence data.

The Democratic Republic of Congo, which produced 71.4% of the world's cobalt in 2024, imposed a four-month export ban on cobalt hydroxide Feb. 22 to curb market oversupply and stabilize prices. The policy succeeded at raising global cobalt prices but led to the stockpiling of metal within Congo.

The Congolese government on June 22 extended the export ban by three months, citing "high inventory levels."

Analysts and market participants believe that the DRC will eventually replace the ban on cobalt shipments with quotas to fine-tune the policy of managing market balances.

Copper production steady

Copper production in the first quarter fell 2.3% year over year but rose 2.6% from the prior quarter to 3,397 metric tons. The relatively stable production figures could be attributed to a supportive price environment for copper concentrate.

The London Metal Exchange three-month copper price surged to $9,955 per metric ton on March 19, marking the highest level since October 2024.

"This increase was driven by several factors, including fears of supply disruptions outside the US, with material being redirected to the country; a weaker US dollar amid rising concerns about the US economy; and the announcement of a new Chinese government plan aimed at mitigating the economic impacts of US tariffs while enhancing consumer spending." Commodity Insights analysts said in a March report.

Graphite price up YTD

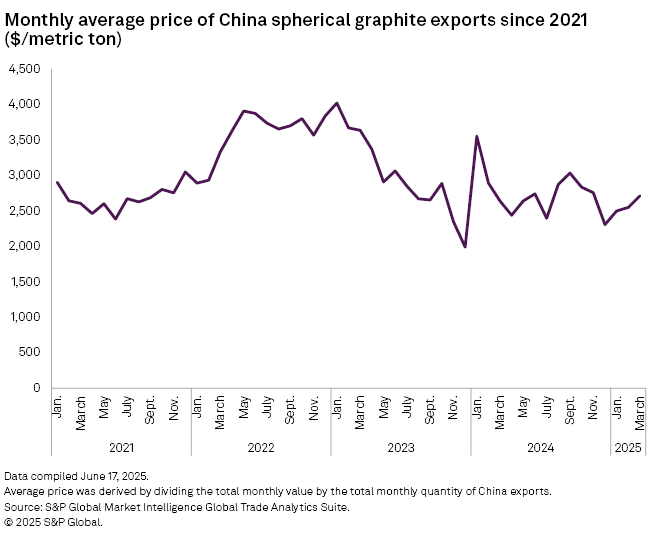

The price of battery-grade spherical graphite exported from China averaged $2,714/t in March, up 17.6% from December 2024, amid uncertainty in the graphite market due to tariffs.

"While underlying demand from the battery sector remains robust, the trade action that has engulfed the graphite industry over the last 18 months or so appears to be one of the main factors weighing on spot prices," Commodity Insights analysts said in their Graphite CBS March 2025 report.