Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jun, 2025

By Brian Scheid

A resilient domestic labor market and slowly declining inflation will keep the US Federal Reserve from cutting interest rates this week. Despite pressure from President Donald Trump to cut rates now, unprecedented uncertainty around trade policy and government spending could push the next cut into 2026, market strategists said.

The rate-setting Federal Open Market Committee begins its latest two-day meeting on June 17 and while officials are expected to update their latest forecasts on inflation, rates, unemployment and economic growth, no changes in monetary policy are likely to be announced at Chairman Jerome Powell's press conference after the meeting June 18.

"Not only are there still many questions around trade and fiscal policy, but inflation remains significantly above the Fed's target, and unemployment hasn't risen sharply," said Julien Lafargue, chief market strategist at Barclays Private Bank. "In this context, the Fed is most likely to continue to wait and see until clearer signals emerge."

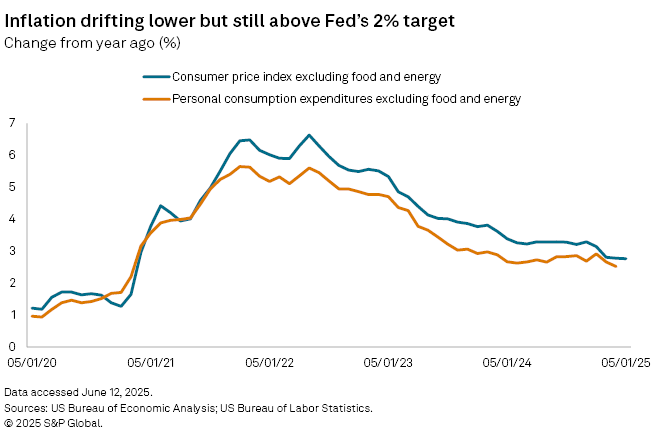

Inflation is moderating lower, but still above the Fed’s 2% target. The core consumer price index for May, which removes volatile energy and food prices, increased 2.8% from May 2024 to May 2025, the smallest annual increase since May 2021, the US Bureau of Labor Statistics reported June 11. The data, economists said, does not yet reflect much impact from Trump's higher tariffs on nearly all global trading partners, a trade policy shift expected to boost inflation in the near term, potentially delaying rate cuts further.

"With inflation risks tilted to the upside and growth risks to the downside, the Fed's preferred course of action will be to stay on hold and wait for clarity on which direction the economy turns," said Oren Klachkin, a financial market economist with Nationwide. "There are still too many open-ended questions to convince them a rate change is prudent at the moment."

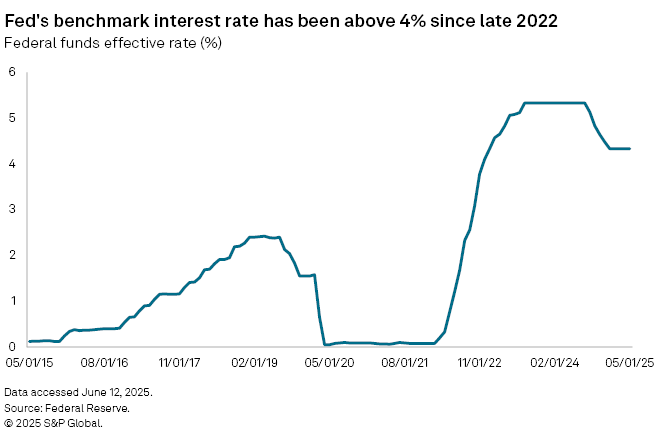

The Fed has held its benchmark interest rate steady in a target of 4.25% to 4.50% since lowering it by 25 basis points in December 2024. Roughly three-quarters of the futures market expects the Fed to cut rates by at least 50 basis points by year-end, with the majority forecasting the first cut in September, according to the CME FedWatch Tool.

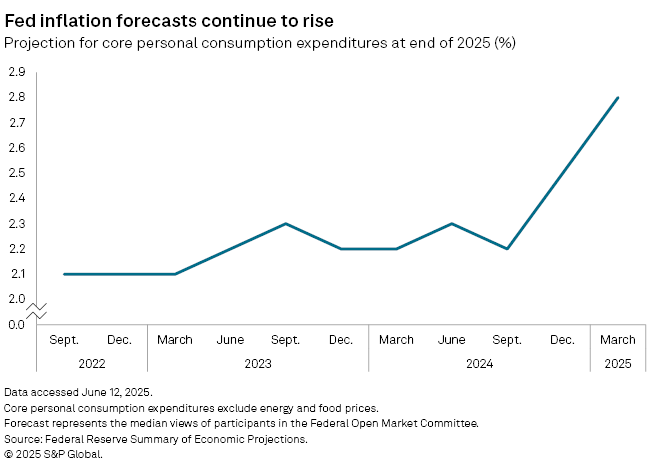

The Fed's updated economic projections on June 19 will likely show officials forecasting just one cut this year, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics. This would be down from the two they projected back in March and the four they projected in September 2024.

"The backdrop is upward revisions to the inflation path but also pessimistic revisions to growth and unemployment," Tang said.

With mounting uncertainty over Trump's trade policy and government spending and its impact on inflation and the labor market, it remains possible that the Fed may not cut until 2026.

"Investors are pricing in about two rate cuts by year-end, but there's a reasonable chance we don't get any, especially if the unemployment rate doesn't surge above 4.5%," said Sonu Varghese, vice president and global macro strategist with Carson Wealth.

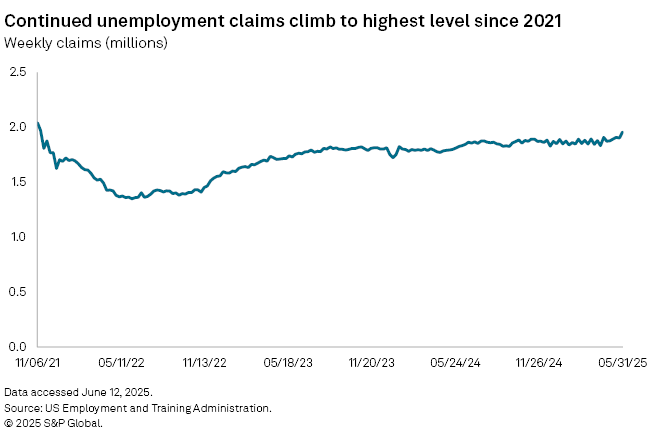

The US unemployment rate was 4.2% in May, flat since March. The unemployment rate has averaged 4.1% over the past 12 months, but there have been signs of weakening in the labor market.

The number of Americans applying to extend their unemployment benefits climbed to 1.96 million in the last week of May, the highest level since November 2021 and a sign that jobs are increasingly more difficult to find.

"Broadly, the data reflect the continued, gradual cooling in the labor market," Thomas Simons, chief US economist at Jefferies, wrote in a June 12 note. "The accumulation of higher continuing claims suggests that people who lose a job are having an incrementally more difficult finding a new one, and initial claims are slowly creeping higher."