Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jun, 2025

By Yuvraj Singh and Marissa Ramos

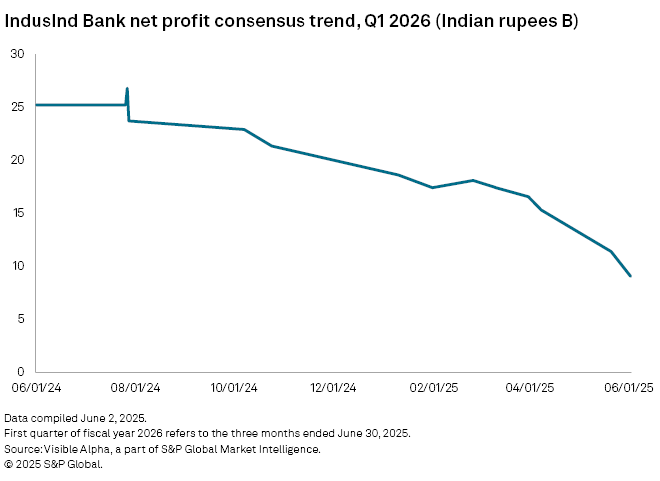

IndusInd Bank Ltd. earnings are likely to take more than two years to regain ground lost to a series of accounting lapses disclosed in March and April.

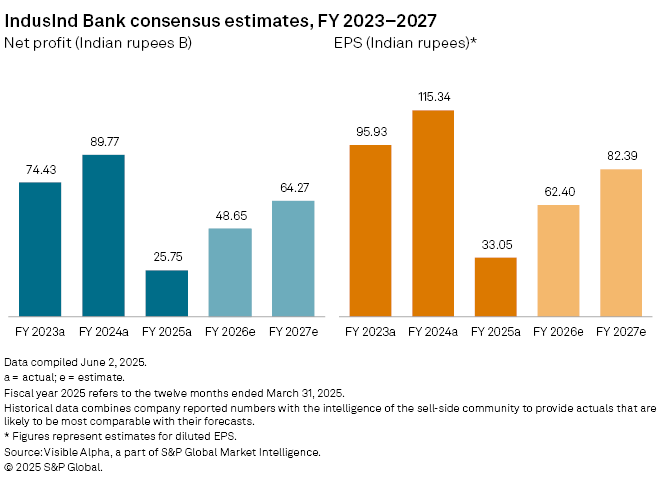

The bank's net profit is projected to nearly double to 48.65 billion rupees in the financial year ending March 2026, and make further recovery the following year. Each forecast is well below the 89.77 billion rupees reported for year that ended in March 2024, according to estimates by Visible Alpha, part of S&P Global Market Intelligence. IndusInd posted a net profit of 25.75 billion rupees for the year ending on March 31, 2025.

Trail of errors

India’s fifth-largest private-sector lender shocked the market on March 10 after an internal review of its derivatives portfolio revealed an estimated adverse impact of approximately 2.35% of the bank's net worth as of December 2024.

The losses were from internal derivative trades used to hedge foreign currency exposure and accumulated over a period of between five and seven years. Senior management was aware of the discrepancies at least 15 months before they were disclosed to the investors, a Securities and Exchange Board of India's interim order on May 28 said.

A forensic review, conducted by independent firm Grant Thornton, assessed a 19.60 billion rupee impact, which was absorbed by the bank through its profit and loss account in the March quarter.

In a March 15 statement, the Reserve Bank of India assured investors that "the bank is well-capitalized and the financial position of the bank remains satisfactory."

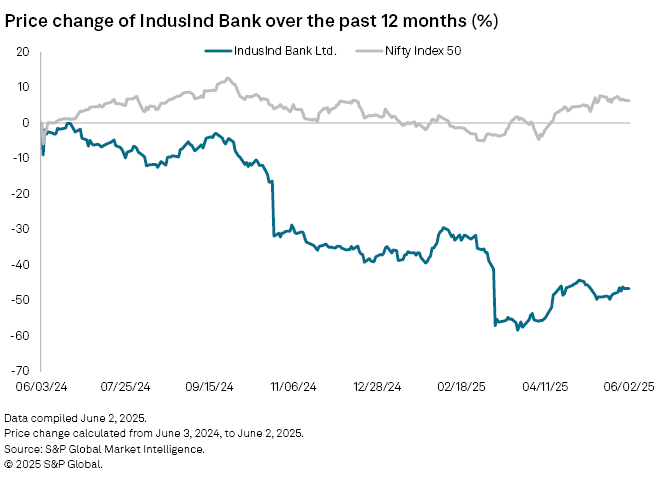

The bank's share price plunged 32% to 637.05 rupees, a five-year low, in the days following the disclosure on March 10. It has since made somewhat of a recovery and closed at 848.00 rupees on June 11.

The bank's CEO and managing director Sumant Kathpalia and Deputy CEO Arun Khurana resigned at the end of April, citing "moral responsibility." The securities regulator barred both, along with three other senior officials, from the stock market, alleging insider trading.

Kathpalia and Khurana did not respond to queries from S&P Global Market Intelligence sent to their social media handles. The bank did not respond to Market Intelligence queries sent via its external communications firm.

Accounting lapses

Separately, the bank announced on May 12 that 6.74 billion rupees was incorrectly recorded as interest income over three quarters of fiscal year 2024-25, which was later reversed.

Accounting lapses were also disclosed in its microfinance business, where fee income was inflated and bad loans were concealed. IndusInd said in a May 21 stock filing that it "suspects the occurrence of fraud against the bank" and the involvement of "certain employees having a significant role in the accounting and financial reporting."

IndusInd Bank's chairman, Sunil Mehta, said in the earnings call on May 21, "we acknowledge as a bank that the lapses that have happened are not expected from a bank like ours. The Board and management are committed to taking all necessary steps to restore the trust and confidence in this institution.

"The financials now reflect all the items brought to the attention of the Board. We are starting the financial year 2025-26 on a clean and strong footing. The balance sheet continues to be robust with healthy capital adequacy, provision coverage and liquidity levels. The core franchise remains strong, and we are focused on growth opportunities backed by capital strength and conservative liquidity."

At a June 6, 2025, press conference, RBI Governor Sanjay Malhotra said: "The bank has taken enough steps to improve its accounting and other practices. On the whole, the bank is doing well."

IndusInd Bank has complied with three priorities laid down by the banking regulator, including a proper accounting for all discrepancies, duly supported by both internal and external audits, a forensic audit to hold individuals accountable for the fraud, and ensuring "no customer is put to any loss or inconvenience," RBI's deputy governor Swaminathan Janakiraman said at the same event.

"Whatever was supposed to play out over the last three months is more or less on track. I'm sure that, if not immediately, at least very soon, it should settle down and be back to normal," Janakiraman said.

Financial impacts

After accounting for the lapses, the bank posted a net loss of 22.36 billion rupees for the quarter ending March 31, down from a net profit of 14.01 billion rupees in the third quarter. It said that its "financials now reflect full and fair representation of all the concerns brought to its attention."

Net non-performing assets grew 121 basis points year over year to 3.13%, with NPAs in the microlending book at about 13%.

"The financial impact of all the above [accounting discrepancies] has been fully taken in the audited financial statements of the bank for the financial year 2024-25," said Sunil Mehta, Independent Chairman of IndusInd Bank's board in the earnings call on May 21. "The bank's approach is to start the financial year 2025-26 on a clean slate without carrying forward any of the past issues."