Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Jun, 2025

The rapid growth of datacenters in the US is contributing to rising electricity rates, with the potential to create an affordability crisis, experts said June 3.

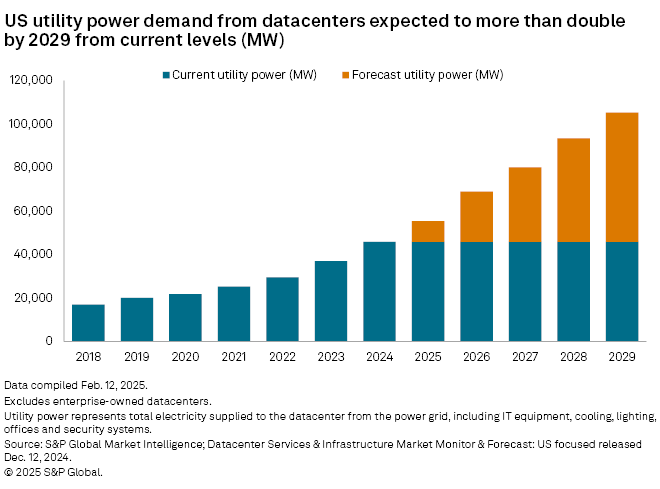

Growing power demand from artificial intelligence activity tied to datacenters has been a major new market for utilities, with S&P Global Market Intelligence 451 Research forecasting 59,000 MW of new datacenter power demand by 2029. However, panelists at a Washington, DC, event hosted by Resources for the Future and Canary Media raised concerns that ratepayers could see higher bills due to the datacenter boom.

"The more energy being utilized by a datacenter in a particular area could cause an increase in spikes in different times of day," Sapna Gheewala-Dowla, associate vice president of policy and research at the Alliance to Save Energy, an energy efficiency advocacy group, said. "It could cause an increase in spikes in the different types of energy being used to supply the datacenter. That could effectively increase rates for people in that area."

Utilities are predicting significant load growth in coming years, with datacenter demand among the most significant drivers of the trend, and plan significant capital investment to meet forecast demand.

In February, Southern Co. increased its five-year capital plan by $14 billion to $63 billion, with some of the spending supporting additional generation and expanded transmission to meet growing power demand from large load customers.

"They're paying for the poles and wires to go up that can build the grid infrastructure that will draw the datacenter. Those costs go in the rate base. Residential, commercial, industrial customers at least need to pay initially for those costs," said Jesse Buchsbaum, a fellow at Resources for the Future, a research organization examining energy and environmental issues. "There's a risk that the datacenter may never materialize. The datacenter may end up going to a different state, in which case, those costs may never be recovered."

Lawmakers representing regions with a high concentration of datacenter development have raised similar concerns about impacts on customer bills.

US Rep. Suhas Subramanyam, a Democrat who represents a congressional district in Northern Virginia nicknamed "Datacenter Alley," has estimated that datacenters will contribute to a $276 annual increase in Northern Virginians' power bills within the next five years.

Some datacenter developers and technology companies have signed deals with nuclear plant operators as a way to guarantee energy supply. Constellation Energy Corp. plans to restart the Three Mile Island Unit 1 plant in Pennsylvania as part of a long-term deal to supply Microsoft Corp. with carbon-free electricity. On June 3, Constellation and Meta Platforms Inc. announced an agreement for the output of the Clinton Power Station nuclear plant in Illinois for 20 years beginning in 2027.

While much of the conversation around datacenter load growth has focused on bringing on new sources of generation to meet the demand, datacenter developers and state regulators also need to prioritize energy efficiency measures, Gheewala-Dowla said.

Datacenter developers have to invest in the "most energy-efficient building installation and windows," Gheewala-Dowla said. "What keeps you the most comfortable in peak times and peak hold times, that is what you want to make sure you are building for. That's all going to be in the preplanning."

Once the datacenter is built and operational, technology companies can save additional energy through implementing chip efficiency measures, according to Gheewala-Dowla.

Technology company leaders also have a responsibility to push for energy-saving measures at datacenters, such as efficiency and programs that could flex datacenter demand, the experts said.

"There's also interesting dynamics here where not all of these tech companies are monolith," said Charles Hua, founder and executive director of PowerLines, an advocacy group looking to change utility regulation. "I think the Google energy team, to be very specific, is very understanding and motivated by this. The question is, is the Google C-suite motivated by this? They face a different set of incentives."