Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jun, 2025

By Zack Hale and Darren Sweeney

|

Cows graze on an allotment near the coal-fired Naughton power plant in Kemmerer, Wyoming, on Nov. 22, 2022. The plant, operated by Berkshire Hathaway Energy subsidiary PacifiCorp, is among more than 13,000 MW of coal-fired resources scheduled for decommissioning in 2025. |

An executive order signed by President Donald Trump in April could disrupt utilities' plans to retire dozens of coal-fired power plants in the coming years, according to an analysis of S&P Global Market Intelligence data.

The US Energy Department is already in the early stages of implementing the order amid skepticism about the long-term viability of federal vetoes of individual plant retirements.

The DOE itself has stepped into plant retirement decisions. Energy Secretary Chris Wright issued an emergency order May 23 requiring CMS Energy Corp.'s 1,411-MW J.H. Campbell coal-fired power plant in Michigan to stay online for at least three months beyond its planned May 31 retirement date.

Wright signed the order pursuant to Section 202(c) of the Federal Power Act, a seldom-used provision of the statute historically reserved for addressing grid disturbances and natural disasters. Section 202(c) authorizes the energy secretary to allow, or even require, power generators to operate during specific hours of a defined emergency for periods of up to 90 days.

"202(c) authorizes the secretary and the [DOE] to proceed either on its own motion or in response to a request," said David Hill, who wrote multiple 202(c) orders as DOE general counsel during the second George W. Bush administration.

Trump's executive order was one of four presidential directives issued April 8 to support US coal production and coal-fired power generation. In a news release issued the same day, the DOE said it also plans to make $200 billion in low-cost financing available "for a wide range" of coal energy investments, including to potentially restart operations at shuttered coal plants.

Wright relied on Section 202(c) on May 27 when he issued another emergency order delaying the retirement of 760 MW of natural gas- and oil-fired power capacity at Constellation Energy Corp.'s six-unit Eddystone Generation Station in Pennsylvania.

More 202(c) orders are expected to follow in the months ahead.

Orders require emergency findings

In ordering the continued operation of the J.H. Campbell plant, Wright determined that "an emergency exists" in portions of the 15-state Midcontinent ISO region due to a shortage of power supplies "and other causes." The North American Electric Reliability Corp.'s most recent summer reliability assessment found that the MISO footprint is at elevated risk of power supply shortfalls during periods of high demand, Wright's May 23 order noted.

Michigan Public Service Commission Chair Dan Scripps disagreed with the order, saying it is unnecessary.

"We currently produce more energy in Michigan than needed," Scripps said in a statement. "As a result, there is no existing energy emergency in either Michigan or MISO."

To justify the emergency order for Eddystone units 3 and 4, Wright separately pointed to a February 2023 analysis by the PJM Interconnection LLC warning that the pace of thermal generator retirements in the 13-state mid-Atlantic region could outstrip new capacity additions by the end of the decade.

In response to Trump's executive order, the DOE is crafting a plan to "streamline, systemize, and expedite" its process for issuing 202(c) orders "to the maximum extent permitted by law."

Trump's order also tasked the DOE with developing a uniform methodology for analyzing current and anticipated reserve margins across grid regions overseen by the Federal Energy Regulatory Commission. The order further directed the DOE to use that methodology — which must be publicly posted online by July 7 — to inform decisions on whether to invoke 202(c) authority to delay generator retirements or potentially override plans for fuel conversions.

"That's a different context than the 202(c) orders that were issued at least when I was at the department," Hill said in an interview. He noted that 202(c) orders are also subject to legal challenge.

Regional market outlook

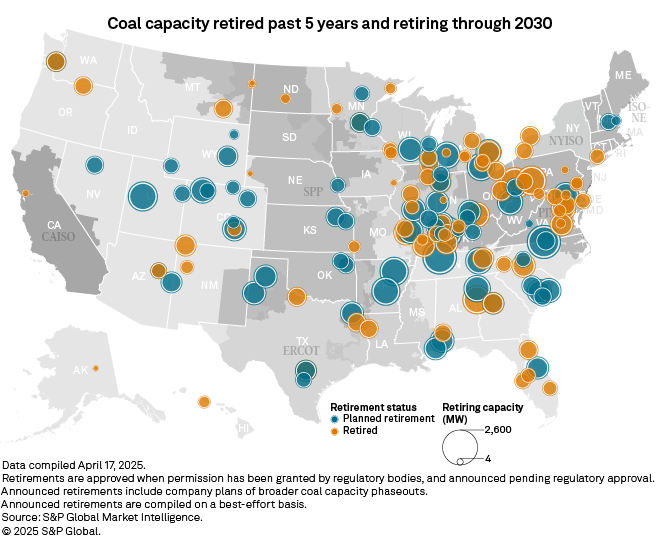

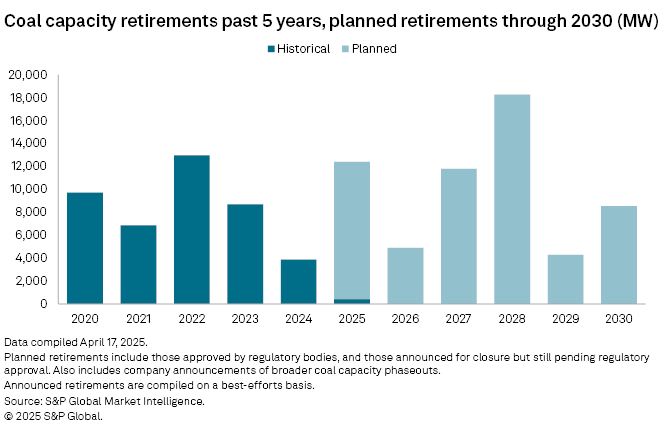

Nearly 60,000 MW of US coal-fired capacity is slated to be retired between 2025 and 2030, according to S&P Global Market Intelligence data. The largest share that capacity, almost 25,400 MW, is situated outside of FERC-jurisdictional grid regions, in the Southeast or western US.

The MISO region accounts for nearly 30% of coal capacity scheduled to retire within that time frame, followed by PJM with 13% and the 14-state Southwest Power Pool at 9%.

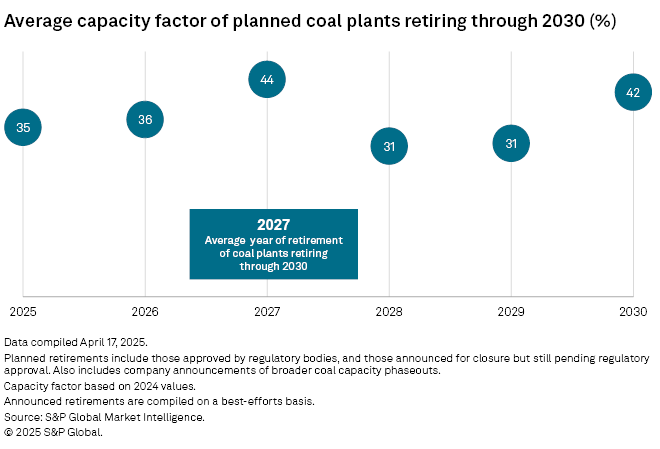

On average, the identified coal capacity slated for retirement runs for less than half the operating year, although that could change as demand from datacenters continues to grow. Coal plants scheduled for retirement in 2027 operated with a 44% average capacity factor in 2024, according to Market Intelligence data.

Coal has also been taking back some of natural gas's share of the power generation market as rising gas prices have reduced the competitiveness of gas plants against coal this year.

As of mid-May, annual coal-fired generation output in the Lower 48 was up 21% compared to 2024, according to data from the US Energy Information Administration. The PJM and MISO regions experienced 30% and 25% increases, respectively, in the output of their coal-fired power plants.

'A fool's errand'

Electric Power Supply Association President and CEO Todd Snitchler, who was previously chairman of the Public Utilities Commission of Ohio, disagreed with the notion that aging power plants can continue to operate on 90-day cycles. The trade group advocates for competitive power producers in wholesale power markets across the US.

"I understand the direction that the administration may be trying to go in, but this is an emergency relief valve that you can't run a business on," Snitchler said in an interview. "If you're an asset owner, you don't make investment decisions to run a unit because you've got 90-day periods where they say we need you to run some more."

In addition, the Institute for Energy Economics and Financial Analysis (IEEFA) released a report in early April that called efforts to reopen closed coal plants to help meet surging electricity demand "a fool's errand."

IEEFA analyzed 102 coal-fired units in the US that were closed between 2021 and 2025, representing about 36.6 GW of capacity.

"Looking at these 102 units really made us realize just how impossible it is to go back and restart units that have already been closed," IEEFA analyst Seth Feaster said during a May 7 webinar on the report. "These closures are nearly all part of long-term plans by states, by utilities, extensively negotiating what their power generation portfolio is going to be."

"They have made tremendous investments into the billions and billions of dollars for replacement resources," Feaster added. "So, it is unlikely that you would be restarting a coal plant if you have a brand-new and far more efficient gas plant next door that you have already sunk a tremendous amount of money in."

The analysis also showed that at least 24 of the 102 units reviewed have already been demolished, with another 14 units converted to run on a different fuel source. The 102 units had a median age of 56 years at the time of their closure, with some beginning operations in the 1960s.

"These are not units that are likely to be economic or necessarily even viable to restart because they are so old," Feaster said.

Commenting on his April 8 executive orders, Trump cited the coal-fired Cholla plant in Arizona, whose last two units, one of which had been operating since 1962, were shut down in March. The plant's operator, Pinnacle West Capital Corp. subsidiary Arizona Public Service Co., retired the first of the four Cholla units in 2015 following the US Environmental Protection Agency's 2012 final rule on regional haze.

Arizona Corporation Commission Chair Kevin Thompson said in a May 30 statement that the commission determined it would cost $1.9 billion to bring the plant into compliance with existing regulations, which would be the responsibility of the utility's ratepayers. Arizona Public Service has produced thousands of megawatts of new capacity in recent years, mostly renewables and storage, and has added gas-fired resources.

While IEEFA acknowledged that operators of some coal-fired units have delayed their retirement, the analysts said this does not mean these plants will operate at a high capacity factor.

"That means they'll be online. ... They may be around for one day in the wintertime," IEEFA analyst Dennis Wamstead said. "The fact that you've delayed your retirement doesn't mean you're all of a sudden an economic resource ready to be used."