Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 May, 2025

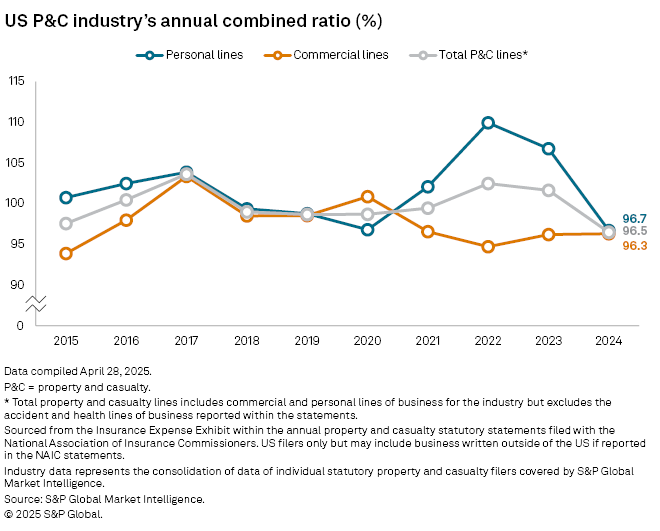

The net combined ratio for the US property and casualty industry in 2024 reached its lowest level in over a decade, according to an analysis by S&P Global Market Intelligence.

The industry's aggregated property and casualty (P&C) lines posted a net combined ratio of 96.5%, marking the best annual performance since 2013, when it was 96.2%. This figure represents a significant improvement from the previous year's net combined ratio of 101.6%.

The drastic improvement can be attributed to better underwriting results in personal lines of business, which include private auto, homeowners and farmowners insurance. The net combined ratio for personal business lines was 96.7% in 2024, reflecting a year-over-year improvement of approximately 10 percentage points.

In contrast, the aggregated commercial business lines net combined ratio was 96.3% in 2024, a slight deterioration from the 96.2% recorded in the prior year.

Personal lines

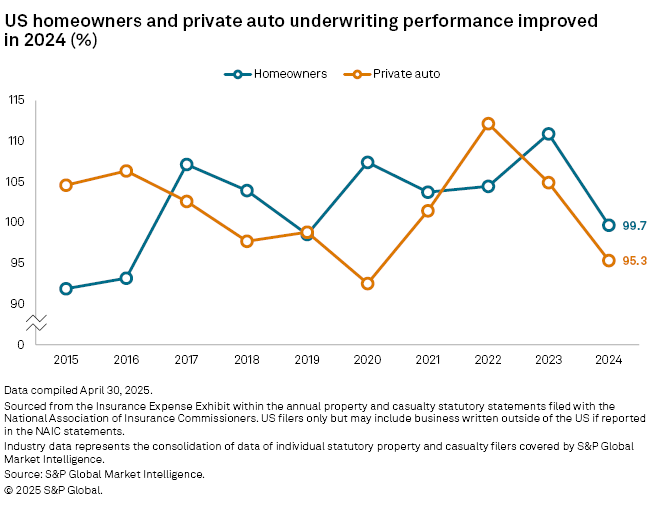

The US homeowners insurance industry achieved its first annual underwriting profit since 2019, despite facing significant catastrophe losses from convective storms and major hurricanes. The homeowners business line benefited from higher premium rates and a substantial amount of catastrophe losses being absorbed by non-US domiciled reinsurers or stemming from flooding, which is typically not covered by traditional homeowners' policies. For instance, the US industry's direct incurred losses for the federal flood business line surged to $7.71 billion in 2024, up from $1.74 billion in 2023.

Overall, the net combined ratio for the US P&C industry's homeowners business line was 99.7% in 2024, a notable improvement from 110.9% in 2023. The industry reported a 98.5% combined ratio in 2019.

Meanwhile, the US private auto insurance sector continues to demonstrate significant recovery from its historically poor underwriting performance in 2022. Substantial rate increases have helped push the net combined ratio for private auto insurance to 95.3% in 2024, marking a decrease of nearly 17 percentage points from its peak of 112.2% in 2022.

Commercial lines

The underwriting performance in major commercial lines for 2024 was mixed. Most liability lines experienced year-over-year deterioration, while property lines and commercial auto showed improvement.

Approximately a quarter of the US industry's commercial lines direct premiums written are reported under the other liability line of business. This category includes various subtypes of insurance such as general liability, commercial excess and umbrella, errors and omissions, and cyber insurance. The net combined ratio for the aggregated other liability line was 110.1% in 2024, the highest ratio since 2016 when it was 110.9%. In comparison, the net combined ratio for other liability was 100.1% in 2023.

The product liability net combined ratio stood at 107.9% in 2024, reflecting a deterioration of 8.1 percentage points from the previous year. The commercial multi-peril liability net combined ratio increased to 114.9% in 2024 from 110.1% in 2023. The last time commercial multi-peril liability reported a sub-100% combined ratio was in 2015.

Medical professional liability improved, falling to 103.0% in 2024, compared to 109.8% the prior year.

|

– Click here to read an article discussing the impact of tariffs on the US private auto industry. – Download a template to analyze the P&C insurers' historical market share across all lines of business |

The aggregated commercial auto business line achieved a combined ratio of 107.2%, representing a year-over-year improvement of 2.1 percentage points. This enhanced performance was primarily driven by improvements in physical damage coverage. The net combined ratio for commercial auto physical damage was 88.6% in 2024, a 7.6-percentage-point improvement from 2023. Commercial auto liability reported a net combined ratio of 113.0% in 2024, a slight improvement from its 113.4% combined ratio during the prior period.

All three commercial property lines reported year-over-year improvements in 2024, ranging from a 9.0-percentage-point decrease in the fire business line and a 13.8-percentage-point decrease for commercial multi-peril non-liability. The 2024 net combined ratios for fire, commercial multi-peril non-liability and allied lines were 77.2%, 91.6% and 93.2%, respectively.

Workers' compensation continues to be a profitable line for the industry, with a net combined ratio of 88.8% in 2024, nearly unchanged from the prior year's ratio of 88.1%