Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 May, 2025

| The coal from Peabody Energy's North Antelope Rochelle mine in the Powder River Basin is delivered to numerous power plants across the US. The company says it is locking in long-term commitments with customers as coal demand rises. Source: Alan J. Nash. |

US coal producers are increasingly optimistic about future sales to power generators thanks to rising electricity demand, higher natural gas prices and a supportive presidential administration taking actions to bolster the industry.

Executives with the major, publicly traded US coal producers expressed hope during first-quarter earnings calls about the prospects for domestic thermal sales. They pointed to several factors hinting at a rise in coal production, from supportive government policy to improving market conditions for a fuel whose share of US electricity generation dropped from more than half in 1990 to just 16% in 2024, according to the US Energy Information Administration.

"We believe that all coal-powered generators need to defer US coal plant retirements as the situation on the ground has clearly changed. We believe generators should unretire coal plants that have recently been mothballed, and we believe the existing fleet can and should run at much higher utilization levels than it has," Jim Grech, Peabody Energy Corp. president and CEO, said during a May 6 earnings call.

"For those who continue to predict the demise of coal, we continue to see substantial US coal demand many years into the future," Grech said.

|

Hopes for coal improving alongside market

Natural gas prices have been higher, improving coal's economic competitiveness in electricity generation markets, Steve Piper, director of energy research for S&P Global Commodity Insights, wrote in a May 6 analysis.

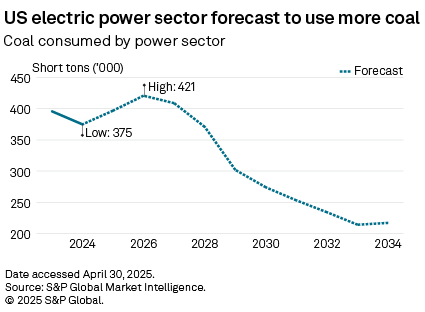

Utilities will consume about 397,000 short tons of coal in 2025, about 5.9% more than in 2024, according to the S&P Global Market Intelligence Coal Forecast. The forecast suggests the US will burn about 12.3% more coal in 2026 than it consumed in 2024.

Improved prospects for coal burning have allowed US miners to lock in longer-term business, giving them clarity for the future. On April 15, Peabody announced a seven-year contract to provide Associated Electric Cooperative Inc. with 7 million to 8 million short tons of coal annually.

Joseph Craft, chairman, president and CEO of Alliance Resource Partners LP, said during an April 28 call that his company has also been successfully locking in coal deals with domestic partners. Craft said Alliance would prioritize its long-term domestic customers over export opportunities, as a result of improving domestic demand prospects thanks to electricity demand growth and higher gas prices.

One customer had recently locked in an arrangement with Alliance for essentially all of their coal needs through 2028, Craft said.

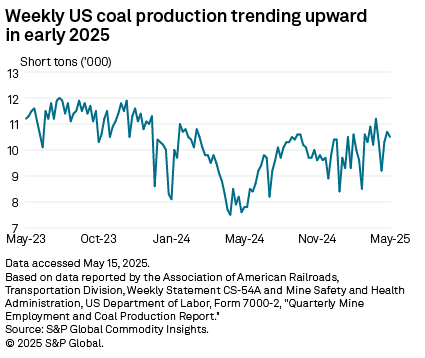

Coal production is rising in response, with weekly shipments increasing in early 2025. For the week ended May 10, year-to-date US coal production was up 5.8% compared to the same period of 2024, according to the EIA.

The mining sector has long said that the retirement of US coal-fired power plants will harm grid reliability due to the intermittency of renewable energy resources such as wind and solar. However, they say the risks have been intensified by a rapid increase in electricity demand, thanks to new datacenters for applications such as artificial intelligence.

Trump orders offer relief

On April 8, President Donald Trump signed four executive orders aimed at revitalizing the struggling US coal industry by designating coal as a critical mineral and promoting its use in powering artificial intelligence datacenters. The orders also direct federal agencies to remove barriers to coal mining, prioritize coal leasing on federal lands, and rescind policies that discourage coal production, with Trump emphasizing a commitment to "bring back an industry that was abandoned."

"I think, first and foremost, it's nice to have an administration that recognizes the industry and the importance that it has on the US economy, and really what it means relative to power prices in the US," Paul Lang, CEO of Core Natural Resources Inc., said during a May 8 earnings call. "They believe coal should be in the mix and should stay in the mix."

|

During Trump's first term, his administration took similar steps, including repealing regulations and lifting coal leasing moratoriums, but coal production and jobs continued to decline significantly in the US. Many experts suggested it would take significant subsidies to see a wholesale turnaround in the coal sector's fate. However, the latest round of executive orders benefiting coal comes at a time of rising electricity demand and higher gas prices favorable to dispatching more coal power.

The Federal Energy Regulatory Commission released a May 15 report concluding that a combination of higher-than-usual electricity demand, generator retirements and periods of low wind and solar output could lead to generation shortages.

"The administration's recent actions regarding the coal industry and grid reliability directly address the realities we have warned about for years that overdependence on intermittent renewable energy sources while simultaneously disadvantaging coal puts the reliability of our country's energy backbone at risk," Alliance Resource's Craft said April 28. "We welcome these policy actions as a recognition of coal's essential role in energy security."

The tide may also be turning beyond the federal level, Grech suggested on Peabody's earnings call.

"We are also seeing multiple states pass legislation this year that bolsters coal-fueled electricity," Grech said. "These laws often require that any existing power generation replacements be online before coal plants potentially retire, and they also mandate that these energy forms be reliably dispatchable."

Hallador Energy Co., an Indiana-based coal miner that has been transforming into a vertically integrated miner and power producer, said it is actively negotiating with a global datacenter development to provide power from its Merom Generating facility.

The company has an exclusive agreement with the unnamed party lasting through June. Hallador has also received multiple unsolicited third-party inquiries about the availability of its future energy and capacity in the last several months, Brent Bilsland, chairman, president and CEO, said during a May 12 earnings call.

"With renewed support at both the federal and state levels for coal mining and coal-fired power generation, as well as improving market dynamics, we believe that we are well positioned to pursue growth and/or expansion opportunities, including the potential to increase our coal production in the back half of 2025 or 2026 if the market supports doing so," Bilsland said.

Focus on boosting burn at existing plants

Despite the optimism, most US coal executives are leaning more on the prospect of increasing coal burn at existing facilities that are not operating at full capacity, rather than waiting for regulatory shifts to drive new builds.

"Specifically as to whether there's going to be increased investments for bringing on more coal, I don't think that's going to happen," Craft said during Alliance Resource's call. "There's going to be strong encouragement for the utilities to invest in the existing coal fleet so that they can, in fact, operate at higher capacity factors."

The average capacity factor, a measure of how much power a plant can produce versus its actual output, for US coal-fired power plants has not exceeded 50% since 2018, according to a 2024 analysis by Commodity Insights. That gives a lot of room for additional coal burn with relatively little capital investment.

Core Natural's Lang also said there would likely need to be something seen beyond the executive orders before utilities would consider building any new coal infrastructure. That is because utilities are afraid the policy tides could shift again in the next election cycle.

"I think it's headed in the right direction, and I think there are some actions that the administration would like to do legislatively that could instill some of these things a little more solidly," Lang said. "That's really what we'd like to see, is that [the pro-coal policy actions will] be a little more durable and something people could plan [around]."