Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 May, 2025

By Taylor Kuykendall and Annie Sabater

US coal exports took a sharp turn downward in the first quarter as trade tensions escalated with China.

Coal exports have comprised an increasingly larger share of many US producers' sales books as the nation's consumption of the black rock has shrunk substantially for over a decade. While producers are growing more optimistic about domestic sales opportunities, concerns over shifting trade policies have exacerbated challenges from weak demand in the global coal market.

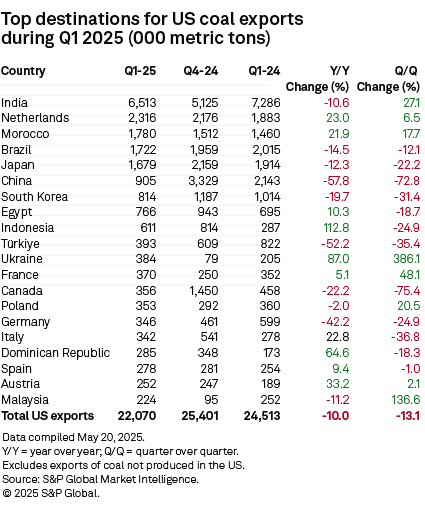

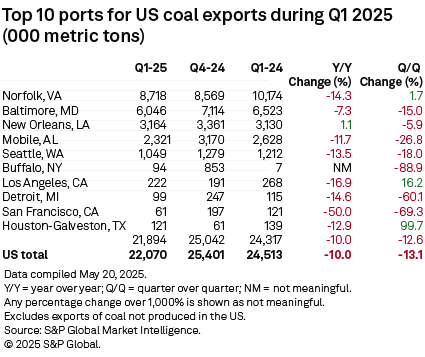

The US shipped 57.8% less coal to China in the first quarter on a year-over-year basis, dragging down overall coal exports to 22.1 million metric tons. Total coal exports declined by 10.0% year over year and by 13.1% compared to the previous quarter. US coal producers have been pivoting in response to the uncertain market.

"Our two primary lines of business, metallurgical and high-[calorific value] thermal coal, continue to encounter soft market conditions in the international arena due in part to trade-related uncertainties," Core Natural Resources Inc. CEO Paul Lang said during the company's May 8 earnings call.

"While we hope the current tariff situation proves to be transitory, we have pivoted quickly to redirect our products away from countries that have established retaliatory tariffs, and we believe we're in generally good shape for the balance of 2025 and heading into 2026."

Back-and-forth tariffs and other trade uncertainties presented hurdles for coal sales logistics in the first quarter, especially with China.

On May 12, the US and China announced a 90-day suspension of increased tariffs: The US decreased tariffs on most Chinese goods to 30% from 145%, while China reduced its tariffs on American imports to 10% from 125%. However, the pause does not affect product-specific tariffs, leaving in place policies in China that set an effective tariff rate of 18% on US coal.

China was the second-largest buyer of US seaborne coal in the fourth quarter of 2024, behind India. In the first quarter of 2025, China was the sixth-largest coal trading partner for the US, and US coal shipments to China fell to just 905,174 metric tons, dropping 72.8% quarter over quarter.

Producers hope ongoing negotiations between the two world powers could support global coal market dynamics.

|

– Check out the latest data on weekly US coal production – Explore more data on US coal exports and imports. |

"If we do see a trade deal between China and the US, I would suggest that China will be back buying US coal and not only coal, but pet coke, which will certainly tighten that market for India," Robert Braithwaite, senior vice president of marketing and sales at Core Natural, said during the company's May 8 earnings call.

Similarly, US producers faced a wave of uncertainty when the US Trade Representative proposed a new rule implementing steep fees on vessel operators from China and shippers that use Chinese-built ships in their fleet.

The fees, as originally proposed in early April, threatened to "shut down the US coal export industry by May or June," Ernie Thrasher, CEO of coal marketing and logistics firm XCoal Energy & Resources LLC, told S&P Global Commodity Insights in early March.

However, those rules were softened, the fee level was tied to cargo volume and implementation dates were added, reducing concern about the rule.

"We are grateful that the most recent guidance details are, in our opinion, much improved and include exemptions for empty vessels coming into American ports," Daniel Horn, executive vice president and chief commercial officer of Alpha Metallurgical Resources Inc., said during a May 9 earnings call. "If the projected action moves forward based on the revised proposal, we no longer believe Alpha will experience any related material adverse impacts."

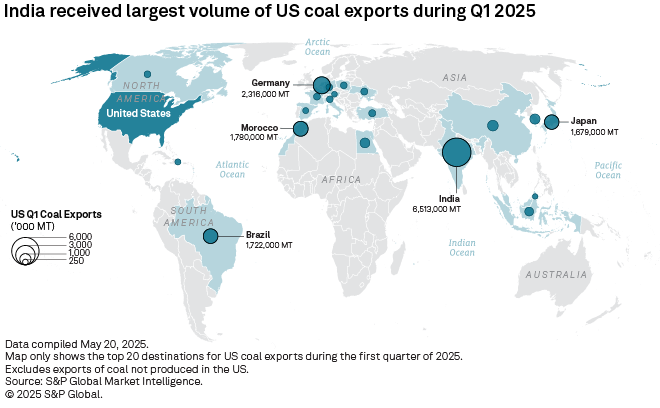

India remained the largest destination for US coal, importing 6.5 million metric tons in the first quarter, a 27.1% increase compared to the prior quarter. The Netherlands and Morocco followed with 2.3 million metric tons and 1.8 million metric tons, respectively.

The US Energy Information Administration has forecast that US coal exports will fall to 93.7 million short tons in 2025, from 107.6 million short tons in 2024, according to the agency's latest Short-Term Energy Outlook.

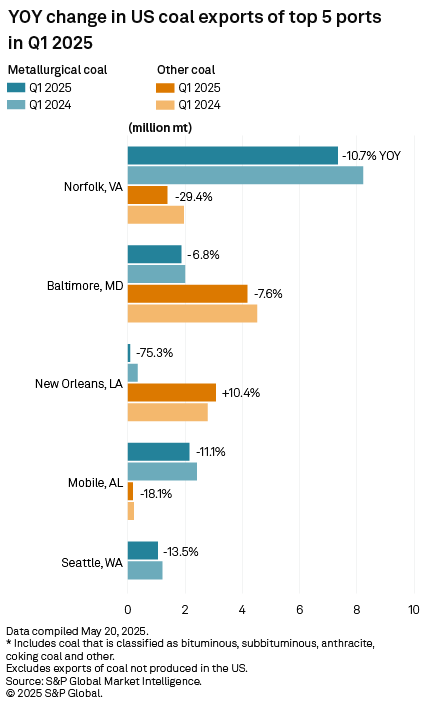

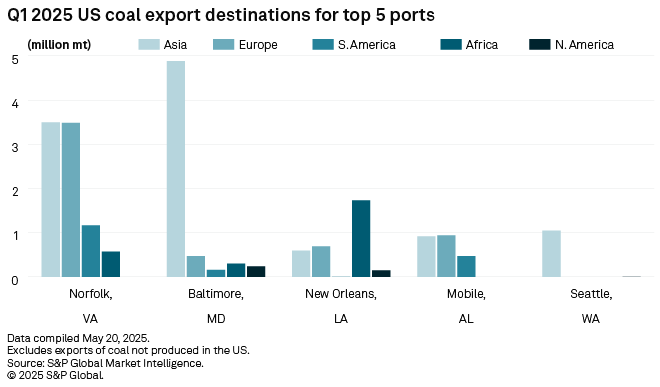

Asia was the top destination for coal exported from the US out of Norfolk and Baltimore ports. Africa was a top destination for US coal exported through New Orleans in the first quarter. Europe was just behind Asia as a destination for coal shipped out of Norfolk. In contrast, European destinations edged out Asia as the destination of choice for coal moving through Mobile, Alabama.

The majority of coal exported from Norfolk and Mobile is metallurgical-grade coal, primarily used in the steelmaking industry. However, other grades of coal, including thermal coal used to generate electrical power, dominate shipments out of the other top ports, including Baltimore, New Orleans and Seattle.