Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 May, 2025

By Tom Jacobs

UnitedHealth Group Inc.'s stock continued its monthlong freefall, cratering to its lowest value in five years as the possibility of a federal investigation heightened investors' skepticism over its business practices.

The Eden Prairie, Minn.-based insurer on May 14 had already seen its share price plunge 47.4% to $273.56 from $585.04 since April 16 in the wake of weaker-than-expected first-quarter earnings caused by struggles with soaring medical costs and pricing issues with Medicaid and Medicare Advantage.

Turmoil in UnitedHealth's C-suite, which began with the assassination of UnitedHealthcare CEO Brian Thompson on Dec. 4, continued this week with Andrew Witty abruptly stepping down as UnitedHealth Group's CEO. Former CEO Stephen Hemsley returned to that role May 13, when he revealed that the company was pulling its 2025 guidance.

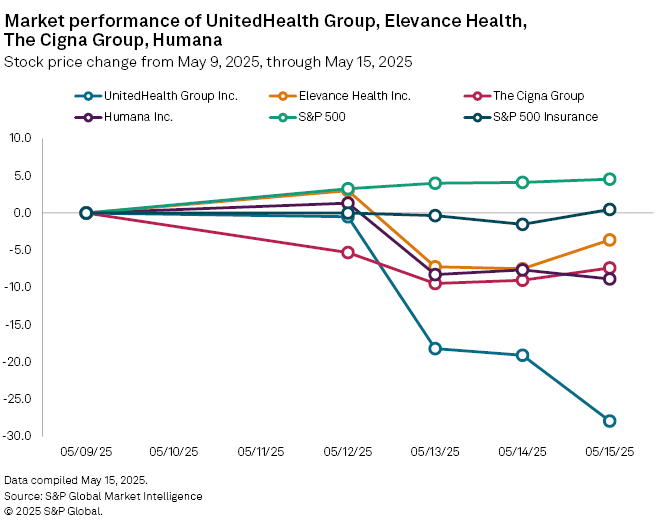

The slide deepened on May 15 after The Wall Street Journal reported UnitedHealth was facing a US Justice Department probe into possible Medicare fraud. UnitedHealth's stock was down 27.9% for the week through May 15 to $274.35, its lowest close since touching $271.78 on July 10, 2020.

The S&P 500 Insurance Index was up 0.48% for the week through May 15, while the S&P 500 gained 4.54%.

UnitedHealth's stock slide is indicative of the lack of trust in the company, according to Leerink analyst Whit Mayo.

"The investment community has ... lost faith [in UnitedHealth] and its credibility has deteriorated quite remarkably," Mayo said in an interview. "So, the valuation has gone down a lot."

UnitedHealth had no comment on the stock performance and addressed the possible probe in a press release, saying it had not been notified of a "supposed criminal investigation.

"We stand by the integrity of our Medicare Advantage program," the company said.

The DOJ did not respond to a request for comment.

Several other companies in the managed care sector also had rough weeks. Humana Inc. was down 8.8%, while The Cigna Group and Elevance Health Inc. fell 7.4% and 3.6%, respectively.

Seeds of distrust

Mayo said questions around UnitedHealth began in February 2024 after a healthcare outage caused by a data breach that struck Change Healthcare Holdings LLC, which is part of UnitedHealth and Optum Inc. Change Healthcare is a tech company that acts as a middleman in the US healthcare system, processing medical claims before they are sent to carriers for payment.

The quality of earnings last year, Mayo said, were "somewhat questionable" because UnitedHealth was adding back a number of estimated costs from suspending prior authorizations due to that breach.

"So that ... started to raise some questions and it was just a period of people starting not to believe them," Mayo said. "Then it was the way they handled fourth-quarter [2024] results and not communicating the revenue issues they were having."

UnitedHealth missed revenue expectations in the fourth quarter of 2024, logged higher medical expenses and was hit hard by the breach at Change Healthcare, as well as Thompson's shocking death.

Change at the top

Stephen Hemsley's return to the CEO role ends Andrew Witty's four years at the helm. Hemsley previously served as CEO from 2006 to 2017, then became chairman of the board.

UBS analyst A.J. Rice said in a research note that UnitedHealth enjoyed a period of growth during Hemsley's prior stint at the top and he should be a steady hand to lead the company. Jefferies analyst David Windley said Hemsley's role in designing the Optum strategy is "more valuable than most directors stepping in as CEO."

Hemsley said in a May 13 conference call with investors that he was "deeply disappointed ... in the performance setbacks" and conceded the company has wrestled with "both external and internal challenges."

"Many of the issues standing in the way of achieving our goals as well as our opportunities are largely within our control," he added.