Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 May, 2025

By Ben Dyson

| US Treasury Secretary Scott Bessent speaks at a May 12 press conference after a two-day negotiation with China on tariffs. |

Trade credit insurers are staying calm as the constantly shifting tariffs of the Trump administration disrupts global trade.

President Donald Trump has imposed a swathe of tariffs on goods imported from the US' trading partners since he took office, including a 30% levy on goods from China and a baseline 10% tariff on goods from most countries. Several of these tariffs have changed since they were originally announced, in particular those on China, which reached as high as 145% before being cut after negotiations between the two countries in mid-May.

Having made the mistake of rapidly pulling coverage in response to previous crises, in particular the global financial crisis of 2008, insurers have learned their lesson and are instead monitoring the situation closely, according to Richard Wulff, executive director of the International Credit Insurance & Surety Association, a trade body representing the global credit and surety insurance market.

"I think the best way to describe it is wait and see — no rash actions," Wulff said in an interview.

Disruptive force

Trade credit insurance protects sellers of goods and services against buyers' inability to pay for them, usually because of insolvency. Global trade disruptions often lead to higher insolvencies, which means more claims for trade credit insurers.

There is little doubt among trade credit insurance market participants that Trump's tariffs will disrupt global trade.

"The protectionist policies of the US and possible retaliatory reactions could lead to a reduction in global economic growth, widespread price increases, and could trigger profound changes in supply chains and trade flows," Atradius NV, one of the big three private trade credit insurers, said in emailed comments.

A key aspect of the Trump administration's trade policy has been rapid changes to tariffs. In the latest twist, the US Court of International Trade on May 28 blocked the tariffs Trump imposed using the International Emergency Economic Powers Act, including the "Liberation Day" reciprocal tariffs on a wide range of countries and those imposed on Mexico, Canada and China, which the administration said were aimed at stemming the flow of synthetic opioids and migrants entering the US without legal permission.

The White House appealed almost immediately, and the US Court of Appeals for the Federal Circuit ruled May 29 that the tariffs will stay in place for now while it considers the case.

The tariffs have already made their mark to an extent, according to Christophe Souquet, UK and Ireland underwriting director at trade credit insurer Coface SA's UK operation. "The constant uncertainty of Trump's announcements has already had an impact on global trade," Souguet said in emailed comments, noting a sharp drop in shipping container bookings from China to the US. "We're also seeing more businesses exploring 'connector countries' like Vietnam, Thailand and Brazil, which are benefiting from shifts in trade routes and lighter tariff regimes," Souquet said.

The high-speed changes to the US' trade policy in recent months has been unhelpful for both global trade and, by extension, trade credit insurers. The uncertainty means companies are holding off on investment decisions, Wulff said. "That scares me a lot because less investment means less employment, and that means a spiral going all the way down to higher interest rates, which again weakens companies to the point of insolvency, which is what we cover."

Mixed effects

Even so, trade credit insurers' response has been measured to date.

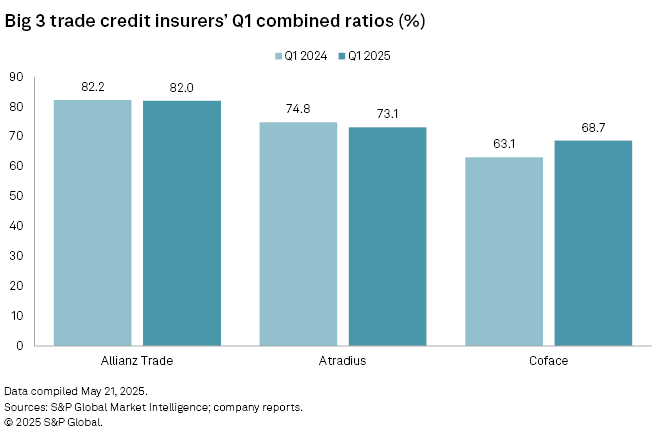

"We've seen no immediate reaction from underwriters so far, with pricing and coverage levels remaining stable and all the major global trade credit insurers maintaining healthy [combined ratios]," Steven Stennett, CEO of trade credit insurance broker Xenia Broking Group Ltd., said in an email.

An increasing number of insolvencies does not necessarily translate directly into higher losses and tougher times for trade credit insurers. There was a high level of insolvencies in the UK after the COVID-19 crisis, but many were small and medium-sized companies, meaning that the average size of claims was small, according to Ian Leslie, head of UK trade credit at insurance broker Marsh LLC. "If that trend continues, then I don't see it impacting pricing," Leslie said in an interview.

While the imposition of tariffs is a "blanket measure," the effect on trade will not be felt equally because of differences in contractual terms between importers and exporters, according to Edward Nicholson, managing partner, credit and political risk at insurance broker Specialist Risk Group Ltd. "Thus, whilst it is reasonable to foresee a potential uptick in insolvencies that could impact the trade credit insurance market, this is far from certain," Nicholson said in emailed comments.

The effects of the tariffs will also not be felt immediately. Much depends on whether, and for how long, the tariffs remain in force. While tariff announcements can create uncertainty, "the real implications for credit risk will depend on how these tariffs affect trade flows, costs, and profitability over time," Atradius said.

Starting strong

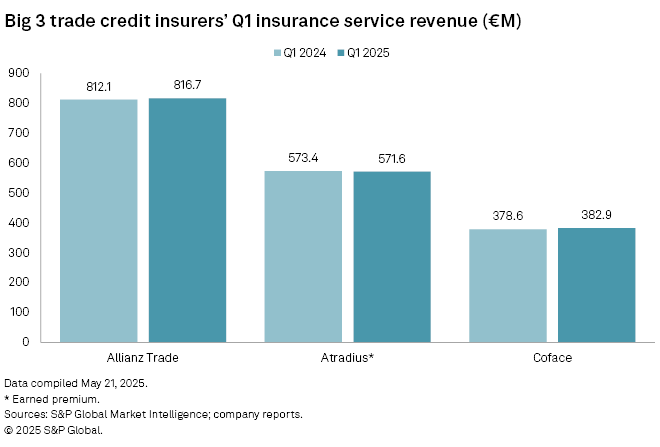

The trade credit insurance market is well prepared for the changes caused by tariffs. The big three private trade credit insurers — Atradius, Coface and Allianz SE-owned Euler Hermes Group SAS, which operates as Allianz Trade — all reported relatively stable revenues and combined ratios in the first quarter of 2025 compared with the same quarter in 2024. Coface's combined ratio increased to 68.7% from 63.1%, according to an earnings release. The company attributed this to a normalization of claims experience, as well as cost inflation and continued investment.

The market is emerging from a period of low claims following the COVID-19 pandemic. Claims for public and private short-term trade credit business written by members of the Berne Union, a trade body representing the global export credit and investment insurance industry, were up 10% year over year in 2024 to $2.65 billion, according to the association's annual report.

While claims for the public and private markets have been rising, they "still aren't back at pre-COVID levels fully for the trade credit insurance market," Paul Heaney, secretary general of the Berne Union, said in an interview.

Rapid growth in the trade turnover covered by the market has kept the relative claims level in check. The claims ratio calculated by the Berne Union — claims paid as a percentage of exposure — remained nearly unchanged year over year at 0.11%.

The market is currently very competitive, meaning that prices for cover have been falling. "The market is still relatively well balanced because although there is pressure on pricing, the claims aren't yet at a level that impacts too much the profitability or the stability for the private market," Heaney said.

Given the soft pricing and low loss frequency in recent years, "[Specialist Risk Group] believes that substantial losses for the trade credit insurance market [from the tariffs] are unlikely to materialize," Nicholson said.

Lessons learned

Previous crises have prepared trade credit insurers to deal with shocks. The amount and quality of data they collect means that they can make decisions on individual risks where needed, rather than pulling capacity for entire sectors when there is trouble. Marsh's Leslie is not expecting a "big bang moment" where coverage limits are cut universally.

Having recently dealt with the trade disruption caused by the COVID-19 pandemic, trade credit insurers should be able to handle any tariff-related turmoil. The market was "very strong and stable" during COVID, Leslie said, "And obviously, that was a far bigger impact than anything that we're seeing with the tariffs."

There is now a wider variety of capacity in the trade credit market, according to Stuart Lawson, global specialty product leader in Aon PLC's credit solutions business. This allows the larger, more established players to be more resilient because "they're able to syndicate with other insurers rather than having to take big positions on their own," Lawson said in an interview.

The tariff situation could also have some benefits for trade credit insurers, boosting demand for cover as companies realize the risks they face. Against a backdrop of rising challenges for the most affected sectors, "demand for trade credit insurance is expected to grow as businesses look to safeguard themselves against both commercial and political nonpayment risks," Stennett at Xenia Broking Group said.

This does not mean trade credit insurers are complacent about tariff-related threats, and they are keeping a close eye out for signs of claims increasing. The level of overdue payments "is certainly an area I know insurers look at more closely and also start to see if there's patterns in that," Lawson said.