Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 May, 2025

By Vanya Damyanova and Marissa Ramos

Tariff-induced volatility is expected to dampen second-quarter advisory and underwriting revenue at most of Europe's largest investment banks.

Barclays PLC, BNP Paribas SA, Société Générale SA, HSBC Holdings PLC and UBS Group AG will post weaker revenue in the segment for the second quarter compared to the previous three-month period, according to consensus estimates from Visible Alpha, a part of S&P Global Market Intelligence.

Deutsche Bank AG is the only one among the continent's six leading players forecast to book a revenue increase, thanks to stronger debt origination, which accounted for over 60% of its advisory and underwriting activities in the first quarter.

Uncertainty related to US tariffs and their impact on markets, monetary policy and economic growth has dimmed the prospects for a recovery in dealmaking and IPO activity this year. Equity underwriting and advisory estimates have been trending downward since the beginning of 2025, Visible Alpha analysts said in a May 9 note.

"The outlook has become more difficult for senior leaders to predict, likely putting deals and transactions on hold," the analysts said.

Debt underwriting, on the other hand, has been relatively steady, which could be a sign of underlying stability in market conditions and borrowers' creditworthiness, according to the analysts.

Soon after the tariff announcements in early April, analyst consensus estimates for advisory and equity underwriting fees at the largest five US investment banks — Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley — were also downgraded, Visible Alpha data compiled by Market Intelligence shows. In contrast, debt underwriting projections were upgraded.

Banks hopeful

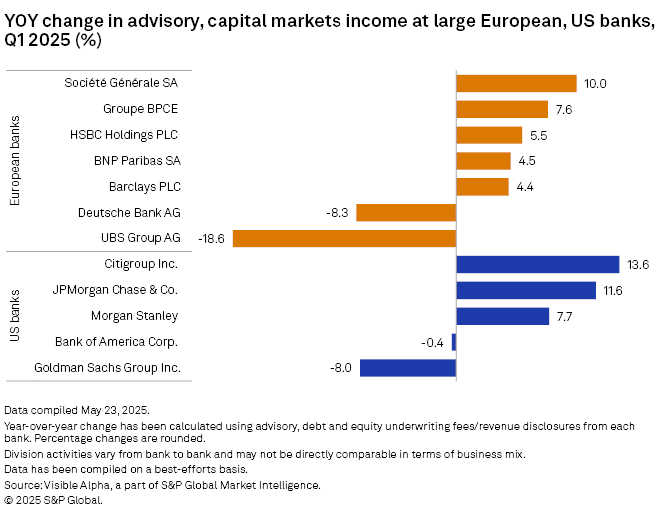

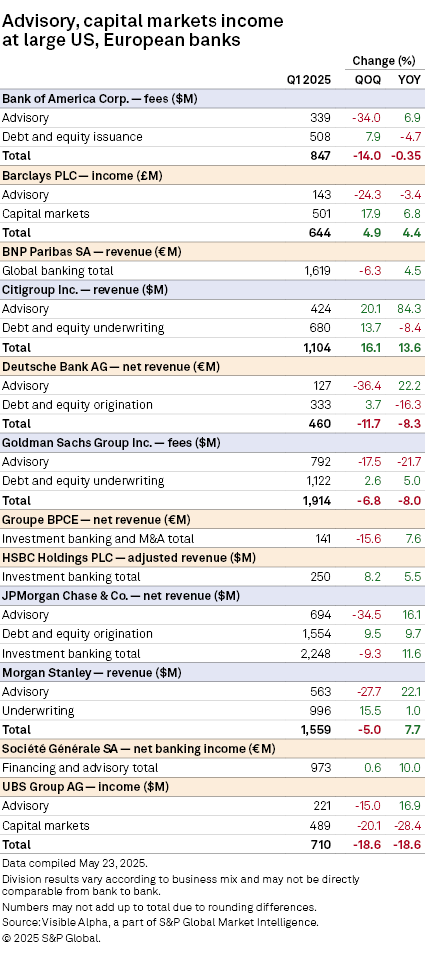

In the first quarter, advisory and underwriting revenue increased across most major European and US investment banks compared to a year ago, data compiled by Market Intelligence shows.

Based on filings of banks that report revenue by business separately, advisory and debt underwriting largely increased year over year, while equity underwriting revenue fell at most banks.

Deutsche Bank and UBS, which booked the largest year-over-year declines, are both hopeful of an improvement later in the year.

"While the market environment weighed on our [investment] banking results across products and regions, and despite growing economic uncertainty, our pipeline continues to build," UBS CFO Todd Tuckner said during the group's first-quarter earnings call on April 30.

UBS was dragged down by a drop in underwriting revenue, largely driven by weaker leverage finance business. Equity underwriting was also weaker, but the bank is focused on boosting its pipeline, which should "yield meaningful returns over the medium term," Tuckner said.

Deutsche Bank CEO Christian Sewing also spoke of a "robust pipeline" in the group's advisory and origination (O&A) business during its latest earnings call, projecting "healthy numbers" for the second and third quarter.

"We see some delayed deals, but no deal is canceled," Sewing said.

Deutsche Bank's first-quarter O&A revenue decline was due to a weaker debt underwriting result related to "a loss on the partial sale and markdown of a specific loan" in the group's leveraged finance business, CFO James von Moltke said.

Advisory slowdown

Compared to the previous quarter, overall revenue at most banks was lower in the first three months of 2025, primarily due to weaker advisory. Bank of America, Barclays, Deutsche Bank, Goldman Sachs, JP Morgan, Morgan Stanley and UBS all posted quarter-over-quarter revenue drops in that line of business, the data shows.

Earlier hopes for a dealmaking boom were quashed by "the reality of tariff-driven uncertainty, still-elevated interest rates and choppy equity markets," JP Morgan said in its 2025 midyear outlook report. Public market activity, notably the IPO space, has been very quiet, and projections for M&A activity growth have been cut in recent months, the bank said.

While there were some green shoots with global M&A activity rising 17% year over year in the first quarter, "the prospect of prolonged uncertainty has created a cloudier outlook on the pace for dealmaking, at least over the near term," JP Morgan said.