Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 May, 2025

By Brian Scheid

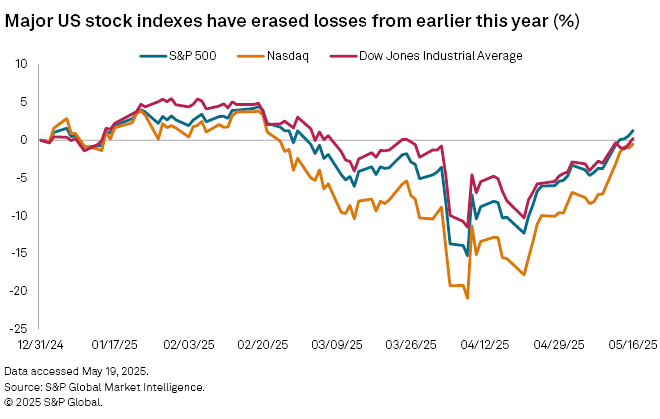

In the days after President Donald Trump announced a wave of new tariffs against nearly all US trading partners, the value of the S&P 500 plunged to the lowest level since November 2023.

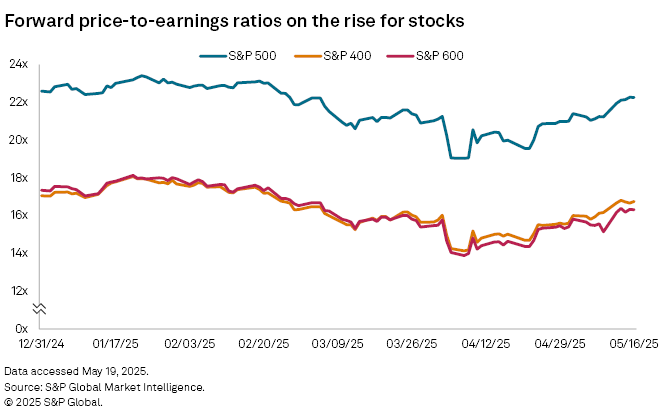

The S&P 500's daily forward price-to-earnings (P/E) ratio, a measure of share prices relative to forecast earnings per share, fell to just over 19 on April 7, reflecting a stock plunge in the aftermath of Trump's April 2 announcement of tariffs on imports from US trading partners.

The drop was a significant shift from late January, when the ratio climbed to the highest level since April 2021, setting the view that, as the large-cap index rallied to record highs, stocks had never been assessed as so expensive. While the S&P 500's forward P/E ratio has climbed at least back to levels from early March, it remains unclear if that valuation, still well above pre-pandemic levels, is warranted.

"I think there's just too much uncertainty right now, and so everyone's being cautious, perhaps cautiously optimistic given the administration has pulled back a lot from their initial tariff salvo," said Sonu Varghese, a global macro strategist with Carson Wealth.

The P/E ratio, which can help assess the relative value of a stock or collection of stocks, remains about 25% more expensive than its average over the past 20 years, said Michael O'Rourke, chief market strategist at JonesTrading.

"There is an additional risk the earnings estimates may be too high due to the trade war and related uncertainty," O'Rourke said. "I think the S&P 500 is overvalued and a risky investment in the current environment."

While it is unclear if forward P/E is useful in determining whether a stock is under- or overpriced, it can be a useful gauge of market sentiment over time, said Varghese with Carson Wealth.

Valuations of the S&P 500 and other indexes tend to be at least partly driven by the index's composition and which sectors are over- and underweight which can make comparisons over longer periods of time challenging, Varghese said.

It is difficult to determine, for example, if potential impacts or fears of a looming recession are being reflected in forward P/E data or any data on the current value of stocks.

In addition, the usefulness of these valuations remains debatable.

"I have always thought that valuation is among or the single worst timing tool in investing," said Paul Schatz, president of Heritage Capital. "Markets can stay overvalued for months, quarters and years before it matters."

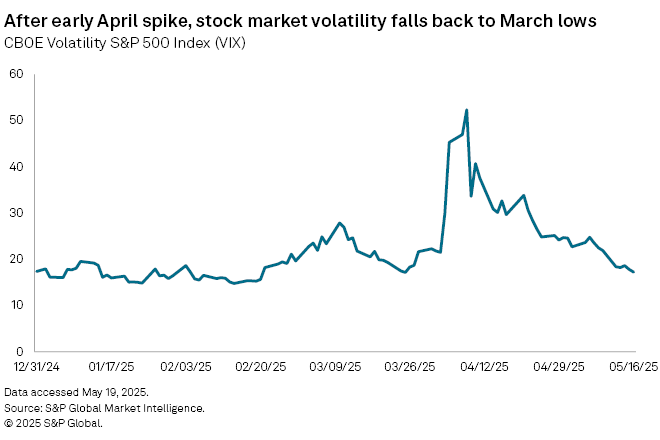

Volatility in the market remains relatively high, though it has fallen from early April levels when Trump's announced tariffs upended markets.

"I think volatility is still relatively high … which tells you that the market is also trying to figure out an equilibrium," Varghese said. "The fact that forward valuations are more or less back to where they were at the start of the year tells you that the market is looking through the tariffs."

Whether this view from the market ultimately proves correct depends largely on whether the tariffs will rise from here and if they will have a negative impact on corporate profitability.

"It's not easy to tell given the policy whipsaws," Varghese said.

The fair value of stocks will always hinge on the environment and outlook, said O'Rourke with Jones Trading.

During a recession, for example, the P/E ratio might appear expensive, but it could ultimately prove a bargain if earnings recover and beat analysts' outlooks.

"Depending upon how you anticipate the future environment to shape up, you can decide if you want or are willing to pay a lower, higher or the current multiple for a stock or the market," O'Rourke said.

While the forward P/E ratio is widely viewed as the best measure of a stock or index's fair value, the valuation is flawed by earnings per share and assumptions of fair market multiples from Wall Street analysts, portfolio managers and strategists, said Tyler Richey, a co-editor with Sevens Report Research.

"So effectively, both sets of proverbial goal posts are constantly being moved amid earnings estimate revisions and shifting geopolitical and macroeconomic landscapes impacting multiples," Richey said. "Specifically, when volatility picks up meaningfully, it is very challenging to recalculate multiples based on fluid fundamental changes impacting the markets."