Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 May, 2025

By Cathal McElroy and Cheska Lozano

| The European Commission's Valdis Dombrovskis talks about the effect of US tariffs on the EU in Brussels, Belgium, on May 19, Source: Thierry Monasse/Getty Images News via Getty Images. |

Banks in Southern European markets face larger-than-expected falls in lending income in the coming quarters as the European Central Bank cuts rates to combat the threat of an economic slowdown caused by US tariffs.

Expectations of a faster easing of eurozone monetary policy rose following US President Donald Trump's April 2 announcement of tariffs on all US imports.

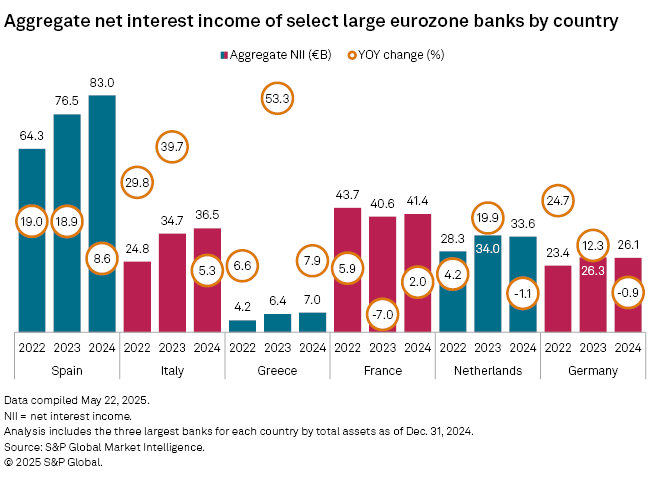

Lenders in Southern Europe — Italy, Spain, Portugal, Greece and Cyprus — are particularly sensitive to swings in interest rates due to the relatively large proportion of variable-rate loans on their balance sheets and their greater reliance on lending income to generate revenues. Many of the

"Banks operating in Southern European economies have generally benefited most from the increase in interest rates in recent years," Andrea Costanzo, vice president of financial institutions at Morningstar DBRS, said in an interview. "These are also the banks that will probably suffer more when rates go down."

Losing interest

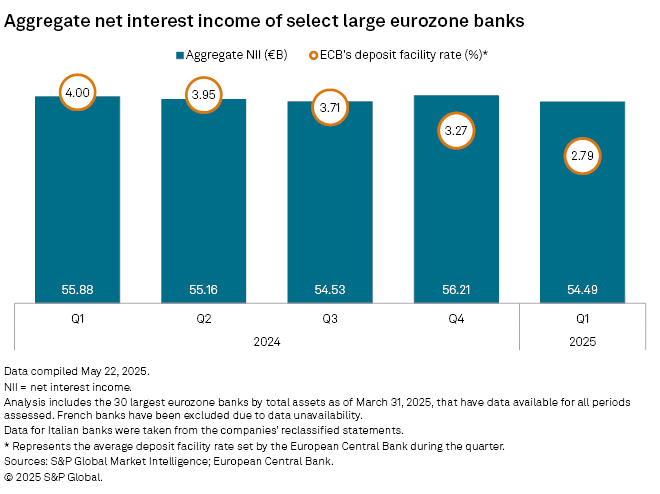

Net interest income (NII) — the difference between what banks earn from interest on loans and other assets and what they pay for deposits — is already falling at most eurozone banks.

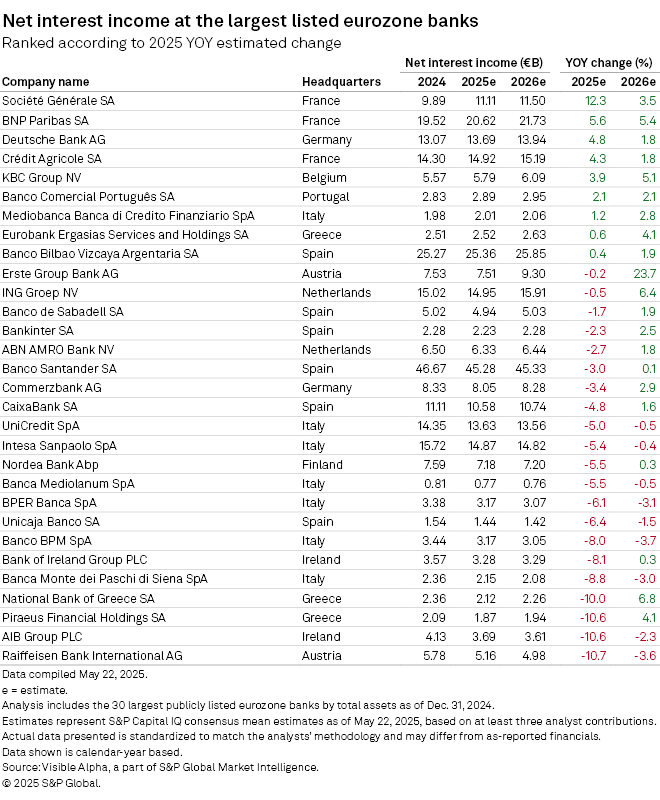

Analysts expect further falls throughout 2025, with some Southern European lenders predicted to suffer further declines in 2026, data from Visible Alpha, part of Market Intelligence, shows. NII is expected to decrease annually in 2025 by an average of almost 5.7% among the large eurozone banks predicted to suffer drops this year.

Southern European banks make up 13 of the 21 large eurozone banks predicted to suffer NII declines in 2025. Only four Southern European lenders are forecast to enjoy increases to lending income.

Eurozone banks maintained their guidance for NII for 2025 when announcing first-quarter results even as their expectations for terminal eurozone interest rates fell to about 1.5% from 2% in the previous quarter, Amal Shah, EY global banking senior analyst, said in an interview.

Still, further downward revisions to interest rate expectations could change that guidance. "Anything below 1.5%, potentially some impacts on NII do start to appear," Shah said.

A terminal rate of 1%, as some analysts are predicting,

"Below 1% for whatever reason — recession, worse tariff outcome than expected, if we go to maybe 0.75% — then it becomes really tough," said Alloatti.

Trade tensions

The ECB cut rates by 25 basis points on April 23,

While ECB President Christine Lagarde reaffirmed its commitment to stabilize inflation sustainably at its 2% medium-term target when announcing the move, she warned of an economic outlook "clouded by exceptional uncertainty" that has "deteriorated owing to rising trade tensions."

The European Commission, the executive arm of the European Union, downgraded the eurozone economy's 2025 growth forecast to 0.9% on May 19, down 40 basis points from its last projection in November. The revision was largely due to the weaker and more uncertain global trade outlook caused by US tariffs, it said.

"The downside risks to growth suggest the ECB's policy path is relatively straightforward," Seema Shah, chief global strategist at Principal Asset Management, said via email. "If a recession becomes more probable, multiple additional cuts could follow."

Southern European banks should be able to offset some of the damage lower rates would cause. Some of the region's banks, particularly Spanish lenders, have bolstered their long-term NII prospects in recent quarters by investing heavily in sovereign bonds at attractive rates.

Still favorable, albeit deteriorating, liquidity conditions are also allowing the banks to cut deposit costs as interest rates fall, further slowing the tightening of margins.

Lower interest rates should also boost demand for loans. Most Southern European economies have performed relatively well in recent quarters and should be largely insulated from the more direct negative impacts of US tariffs.

Italy exposed

Italy could be an exception, said Alloatti. Italy was the eurozone's third-largest exporter to the US in 2024, after Germany and Ireland, with outbound trade in goods worth almost €65 billion.

"It will be interesting to see whether those tariffs really push the eurozone as a whole into recession or just some economies," said Alloatti. "I think Italy, for sure, will slow down."

The eurozone currently faces a 10% tariff on most exports to the US following President Trump's decision to pause, for 90 days, the 20% tariffs originally announced on April 2. A 25% tariff on automotives, steel and aluminum remains. Trump last week threatened to impose a 50% tariff on EU goods from June 1, but subsequently delayed this to July 9.

A 10% tariff on most EU exports to the US would probably reduce eurozone GDP by about 0.2%, according to UK-based consultancy Capital Economics. But the damage could be greater due to the US administration's "flip-flopping," which is adding to the already high level of uncertainty, it added.