Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2025

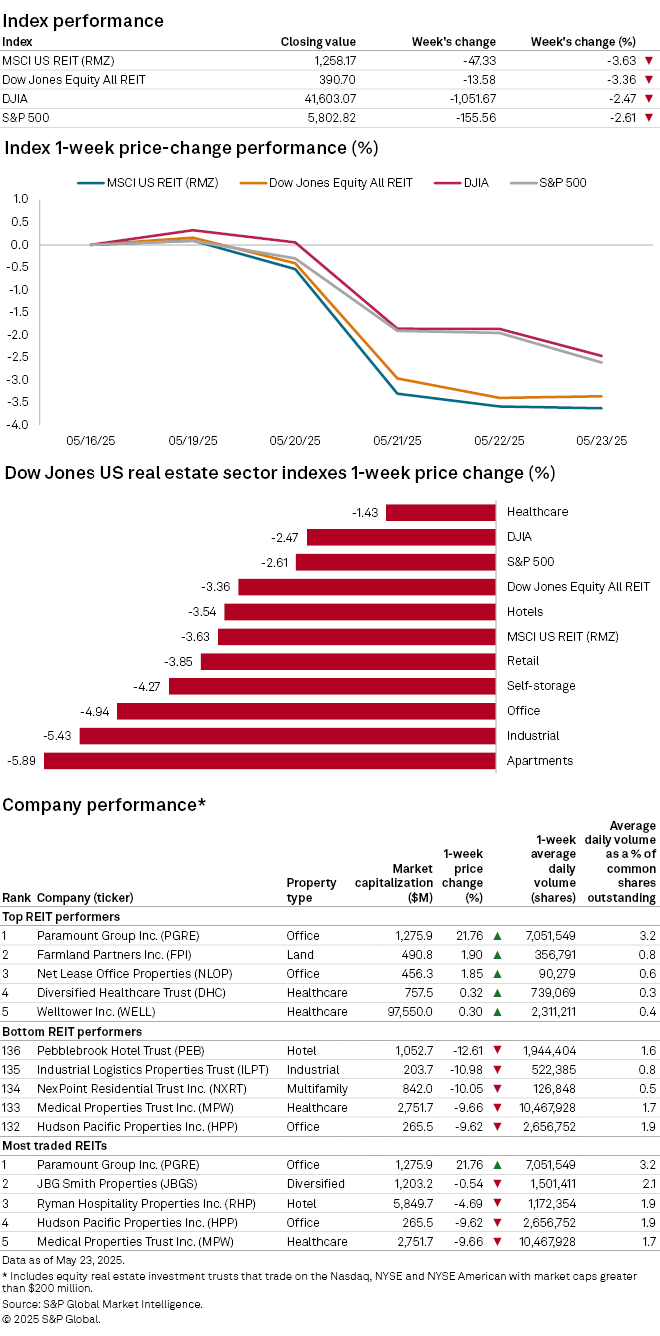

Share prices for US real estate investment trusts dropped alongside the broader market during the week prior to the US Memorial Day holiday.

The Dow Jones Equity All REIT index closed the week ended May 23 down 3.36%, while the S&P 500 and Dow Jones Industrial Average also dropped 2.61% and 2.47%, respectively.

All Dow Jones US real estate property sector indexes closed the recent week in the red. The apartment REIT index logged the largest decline during the week, down 5.89%. The industrial and office indexes followed next, down 5.43% and 4.94%, respectively.

Hotel REIT Pebblebrook Hotel Trust logged the largest drop in share price among all US REITs with at least $200 million in market capitalization, down 12.61%. Industrial REIT Industrial Logistics Properties Trust and multifamily REIT NexPoint Residential Trust Inc. followed next with share-price drops of 10.98% and 10.05%, respectively.

On the other end, office REIT Paramount Group Inc.'s share price jumped 21.76% over the past week, the largest increase of the REIT sector. On May 19, the REIT announced that its board of directors has initiated a review and evaluation of strategic alternatives in an effort to maximize shareholder value.

In the press release on the matter, the REIT's CEO Albert Behler stated "As Paramount continues to build on the strong leasing momentum from the first quarter, the Board and management team remain focused on closing the persistent gap between the Company's public market valuation and our assessment of its intrinsic value. We are committed to acting in the best interests of our shareholders as we evaluate a comprehensive range of strategic alternatives to maximize shareholder value."

Farmland REIT Farmland Partners Inc. logged the second-largest share-price increase during the week, up 1.90%, followed by office REIT Net Lease Office Properties with an increase of 1.85%.