Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 May, 2025

By Tim Siccion and Shambhavi Gupta

Global private equity and venture capital investments in pharmaceutical companies lag 2024 figures, and regulatory headwinds are tempering further activity.

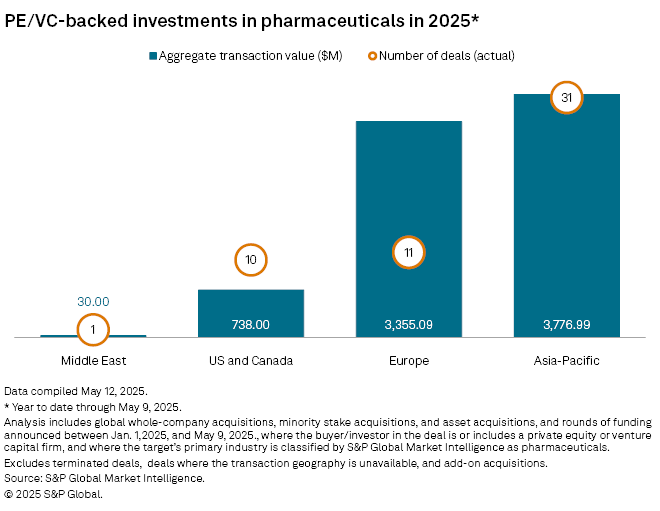

Private equity deal value in the pharmaceutical sector reached $7.9 billion across 53 deals from Jan. 1 to May 9, less than half the $20.44 billion from 101 deals in the first five months of 2024, according to S&P Global Market Intelligence data.

US tariffs have become a major obstacle for private equity investments in pharmaceuticals worldwide, according to Arthur D. Little Ltd. principal Rebecka Wadman.

"The US is the largest drug market. If you can't access it, that's tricky," Wadman told Market Intelligence, adding that tariffs make it more difficult for foreign firms to sell to US consumers.

The US government's recent executive order to slash drug prices poses another major challenge to private equity investments in the industry.

"[Prices] drive valuation to a very large extent for a pharmaceutical company," Wadman said. "When you have uncertainty on what that is going to look like, then you need to model different scenarios, and one thing you don't like in a private equity acquisition is to have scenarios that are wildly different from each other."

Limited partners and general partners still find the pharmaceutical industry attractive, with its underlying fundamentals as well as rapid scientific developments that can magnify profits, Wadman said. "But the problem right now is there's a lot of uncertainty in the market."

– Download a spreadsheet with data featured in this story.

– Learn more about private equity trends in commercial services.

– Read up on how tariffs weigh on the Big Four's sentiment.

Asia-Pacific leads in deal value and volume, totaling approximately $3.78 billion across 31 deals so far this year through May 9. Europe follows closely with about $3.36 billion from 11 deals. The US and Canada rank third, with $738 million from 10 deals.

Amid regulatory uncertainty, UK private equity firm Heligan Investments LLP partner Ramesh Jassal believes that the US remains favorable for private equity investment in pharmaceutical companies.

"The US remains a leading destination for pharmaceutical investment, especially in terms of consumption," Jassal told Market Intelligence, citing the robust regulatory framework, strong intellectual property protection and innovation-driven market as advantages over other regions.

However, Jassal expects the weak IPO market to slow private equity exits in the sector, which may restrain deal activity.

"There's IPO hesitancy with companies opting to stay private longer and raise larger private rounds instead of going public, which can limit exit opportunities and slow recycling capital into new deals," Jassal said.

Largest private equity deals

The largest private equity-backed deal in pharmaceuticals so far this year is Bain Capital Pvt. Equity LP's planned $3.36 billion acquisition of Japanese drug manufacturer Mitsubishi Tanabe Pharma Corp. from Mitsubishi Chemical Group Corp.

The second-largest is KKR & Co. Inc.'s proposed $2.73 billion purchase of Swedish consumer healthcare company Karo Healthcare AB from EQT AB (publ).