Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 May, 2025

The House Ways and Means Committee's budget reconciliation bill puts tax credits and other key benefits for nuclear power into question at a pivotal moment for the industry, nuclear advocates, developers and operators said.

Nuclear generation is poised to play a vital role as the US confronts an "unprecedented" surge in electricity demand driven largely by artificial intelligence operations, domestic manufacturing and economic expansion. Federal incentives are essential, however, including those in the 2022 Inflation Reduction Act, according to an April 30 letter to Congress from the Nuclear Energy Institute (NEI).

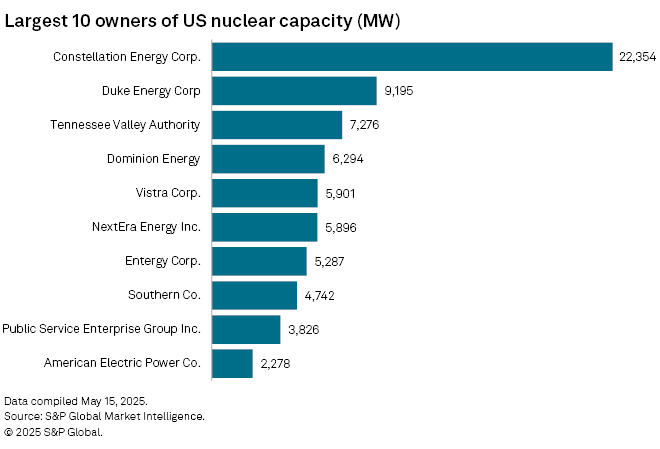

That letter was signed by more than 120 member companies, including electric utilities American Electric Power Co. Inc., Dominion Energy Inc., Duke Energy Corp., NextEra Energy Inc. and Southern Co.

The House Ways and Means Committee’s proposal to phase out tax credits for renewables and nuclear, as well as credit transferability, could still have significant pushback from the Senate. A full House vote is expected the week of May 19.

Until markets change, the nuclear industry needs policies such as "tax credits, transferability and elective payment to power our economy, keep our grid reliable and win the AI race," Flannigan added.

Duke Energy's nuclear plants earned more than $500 million in tax credits that went "directly to reducing our customers' bills" in 2024, Harry Sideris, the utility's president and CEO, said May 6 during the company's first-quarter earnings call.

"The savings our customers receive from these energy credits fall right in line [with] what the president wants to do, which is delivering on his promise to reduce power bills across the country," Sideris said, referencing President Donald Trump's energy policies. "The nuclear tax credits are most important to us."

Analysts see downside for nuclear operators from a valuation standpoint if nuclear production tax credits end, citing Duke, Southern and independent power producers Constellation Energy Corp., Talen Energy Corp. and Vistra Corp.

"Nuclear has been bipartisan and was expected to be intact so the phaseout is one of the most adverse surprises from the draft [legislation]," Jeffries analysts said in a May 13 report.

Guggenheim analysts said in a May 13 report that nuclear might be "the net loser here with IPPs potentially losing [production tax credit] floor benefits alongside regulated operators harvesting the benefit on credit metrics."

Credits are critical, NEI says

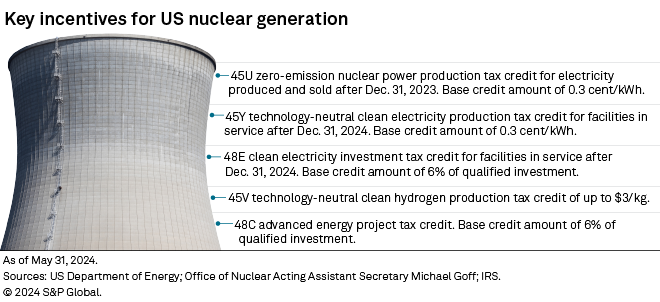

Those nuclear energy tax credits — sections 45U, 45Y, 48E and 48C of the Inflation Reduction Act — are "essential tools" to retain and grow US nuclear capacity, according to the NEI letter.

"Preserving these credits is critical to strengthening US energy security, fostering economic growth and bolstering our economic competitiveness," the letter said.

The 45U credit helps by reducing the cost of nuclear power and has helped reverse a "trend of prematurely closing nuclear plants," NEI said. The 48C credit is prompting nuclear suppliers to site more manufacturing facilities in the US.

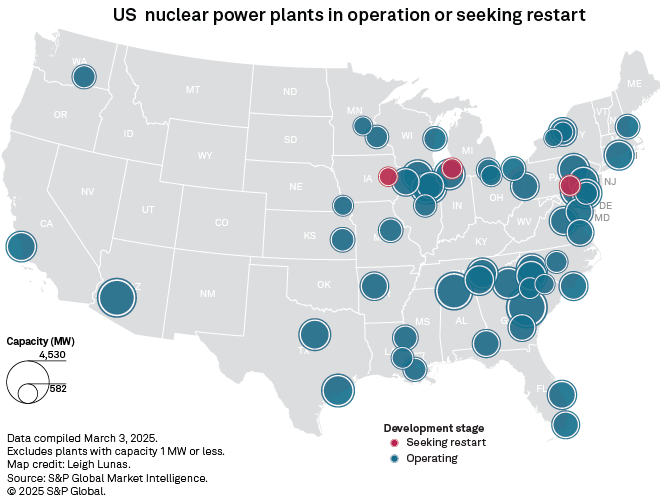

The four credits are "driving unprecedented private investment in nuclear expansion," according to the letter, including a possible restart of the Palisades plant in Michigan, Three Mile Island unit 1 in Pennsylvania and others. The credits are also enabling plant uprates expected to add more than 3 GW to the grid.

Sections 45Y and 48E, which are technology-neutral, also incentivize development of new nuclear capacity.

"Without major new capacity additions, the US grid faces serious constraints that threaten to undercut economic growth and innovation," according to the NEI letter.

While a utility such as Duke may not see operational changes as a result of losing the credits, customers will lose the cost-savings benefit, Kelvin Henderson, Duke's chief nuclear officer, said during an interview with Platts, part of S&P Global Commodity Insights. Duke operates the largest investor-owned regulated nuclear fleet in the US.

Henderson estimated that the impact of the credits for Duke's customers in 2025 will equal or exceed the $500 million earned last year.

"There's where I see the challenge," Henderson said. "Especially as we're a company looking to invest in infrastructure, transmission, distribution. ... These tax credits have just been huge."

Nuclear advocates also urged lawmakers to preserve transferability and elective payment provisions in the law to lower costs and drive new investment.

Unlike other technologies, nuclear projects cannot easily use traditional tax equity structures due to strict licensing rules under the Atomic Energy Act. Any entity with an ownership stake must obtain a Nuclear Regulatory Commission (NRC) license — a process that can take six months to two years. Those hurdles have made tax equity financing largely unworkable for nuclear, advocates said.

Transferability allows projects to monetize credits without requiring changes in ownership, and elective payment allows public power utilities and rural electric cooperatives that collectively own about 20% of the nation's nuclear capacity to claim credits intended to preserve existing generation and encourage new investments.

"For our industry, these are necessary tools to attract capital, support supply chains and keep nuclear projects moving forward," the NEI letter said.

Using the credits is an uphill battle for regulated utilities, Henderson said.

"For us, we need them together," Henderson said of the credits and transferability.

The draft House Ways and Means legislation also would make further cuts to the US Energy Department's Loan Programs Office, which provided funding in April to help restart Palisades and helped fund Southern's two-unit Vogtle Nuclear Plant expansion completed last year.

"Congress should preserve the ability of the office to partner with private industry to meet the administration's goals of energy dominance to develop a secure, reliable electric grid," NEI's Flannigan said.

Future generation

Some utilities, including Duke, have built advanced nuclear into future resource plans.

"We have 11 GW of new nuclear by 2050" in the Carolinas resource plan, Henderson said.

Duke aims to have two small modular nuclear reactors (SMRs) online in 2033 and 2034, and the company has already started work at its Belews Creek site — currently the site of a 50-year-old gas-fired plant — which could accommodate up to six units.

Duke has not selected an SMR technology for the project yet, but has plans to submit an early site permit to the NRC by the end of 2025, Henderson said.

Henderson said Duke is having internal discussions about the possibility of both smaller-scale advanced nuclear generation and larger-scale reactors.

Duke told North Carolina regulators it had selected three existing power plant sites as potential locations for a new large reactor in the Carolinas. The utility has combined licenses from the NRC to construct two AP1000 reactors totaling up to 2,234 MW at its preferred site. That license, awarded in 2016, expires in 2056. (NRC Docket Nos. 52-018 and 52-019)

Duke is also seeking license extensions for all of its existing units, and is considering potential uprates. Any loss of tax credits and other federal incentives will not necessarily change Duke's plans for new generation, Henderson said.

"It's not slowing any new nuclear down," he said. "The biggest loss would be the flow back to our customers."