Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 May, 2025

By Rica Dela Cruz and Zain Tariq

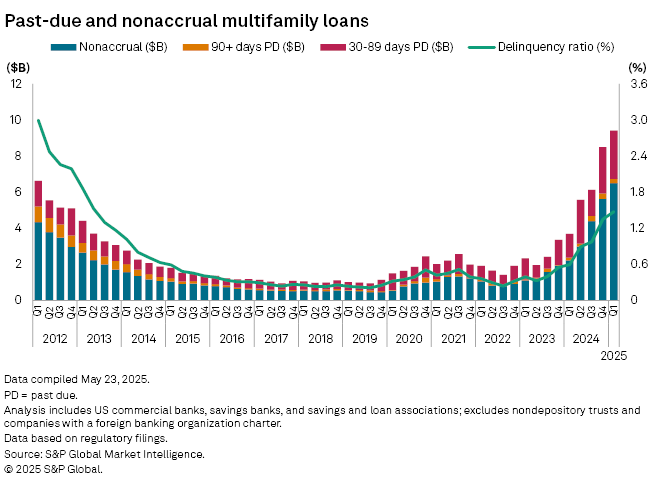

US banks' multifamily delinquency ratio ticked up for the seventh consecutive quarter in the first three months of 2025.

The multifamily delinquency ratio at US banks was 1.47% as of March 31, compared with 1.35% a quarter ago and 0.59% a year ago, according to S&P Global Market Intelligence data. The ratio is the highest since the second quarter of 2013, when it was 1.53%.

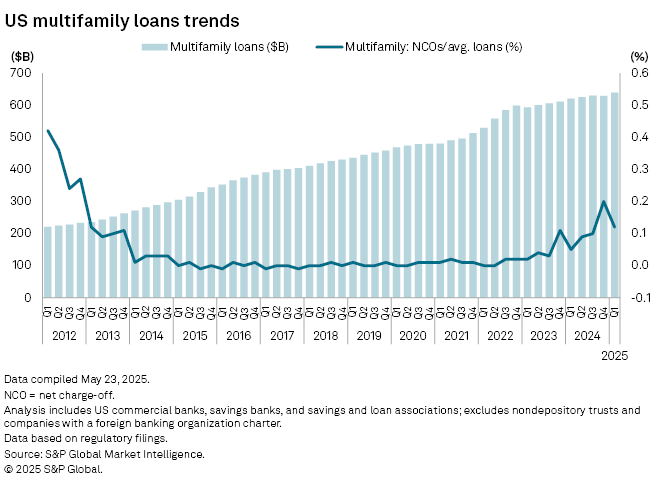

Banks' ratio of net charge-offs (NCOs) on multifamily loans to average loans climbed to 0.12% from 0.05% a year ago. Multifamily loans increased 3.0% year over year to $638.94 billion.

Of the 63 respondents in the Federal Reserve's April senior loan officer survey, 73% said they didn't change standards for approving applications for loans secured by multifamily residential properties during the first quarter. For 69.8% of the respondents, multifamily loan demand remained about the same during the period.

Positive signs emerged in the commercial real estate (CRE) space as transaction volumes rose and property valuations stabilized, according to Wells Fargo economists. The decline in multifamily vacancy rate for the first time in four years was another positive, "as new deliveries downshifted and net absorption strengthened alongside ongoing homeownership affordability challenges," the economists wrote in a May 14 report.

Uncertainties related to the economy and consumer behavior remain the key factor influencing Wedbush Securities analyst Richard Anderson's view on the multifamily sector. However, the sector may "see a collective run" if it avoids a significant disruption, Anderson wrote in a May 5 research note.

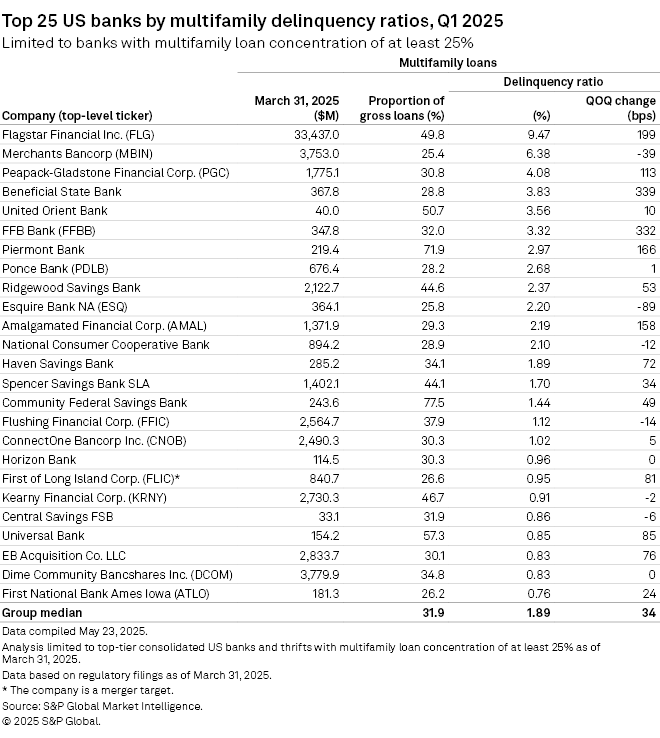

Top banks by delinquency ratios

Among banks with a multifamily loan concentration of at least 25%, Flagstar Financial Inc.'s multifamily delinquency ratio was the highest in the first quarter at 9.47%, up 199 basis points quarter over quarter. The company's diversification strategy includes reducing its multifamily portfolio, CFO Lee Smith said during an earnings call.

"We will continue to explore all options as it relates to reducing our multifamily and commercial real estate portfolios and nonperforming loans, and we'll execute on what is in the best economic interest of the bank," Smith said.

Merchants Bancorp had the second-highest multifamily delinquency ratio at 6.38%, followed by Peapack-Gladstone Financial Corp. at 4.08%. Most of Peapack-Gladstone's multifamily credit issues involve a small number of special borrowers and sponsors, President and CEO Douglas Kennedy said in an earnings release.

"We continue to work through each credit individually, while building appropriate reserve coverage. All of the multifamily loans that repriced in 2024 have continued to make their scheduled payments despite the higher rate environment," Kennedy said.

– View asset quality by loan type for all US banks.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top news and insights from S&P Global Market Intelligence.

Esquire Bank NA, which tempered multifamily growth in 2024 due to the economic environment, logged a multifamily delinquency ratio of 2.20%. Flushing Financial Corp., which expects limited risk and loss content in its multifamily book, posted a delinquency ratio of 1.12%.

ConnectOne Bancorp Inc. and First of Long Island Corp., which are set to merge, were part of the list with multifamily delinquency ratios of 1.02% and 0.95%, respectively. The deal should close on or about June 1.

Top lenders

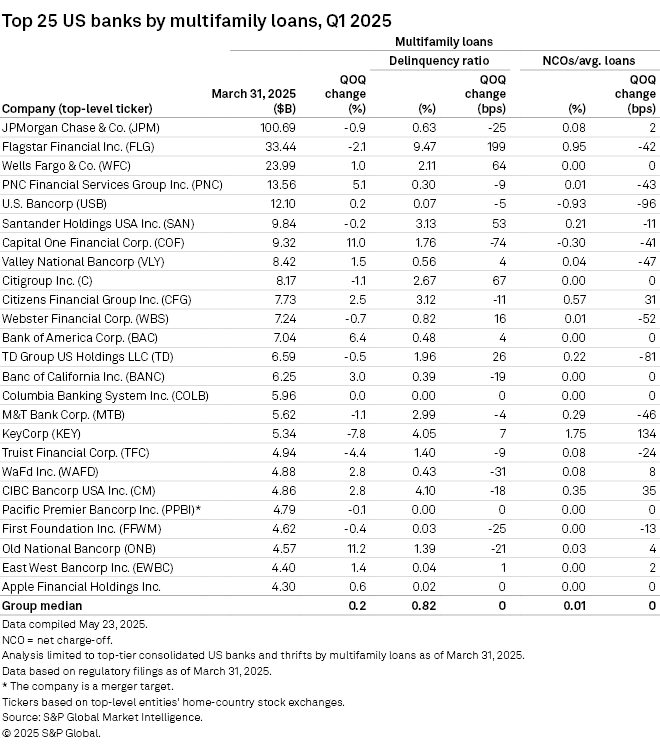

JPMorgan Chase & Co. once again led the industry in terms of multifamily loan levels, which was $100.69 billion as of March 31. Flagstar ranked second with $33.44 billion in multifamily loans, down 2.1% from the previous quarter. These loans made up nearly 50% of Flagstar's gross loans.

Columbia Banking System Inc. and Pacific Premier Bancorp Inc., which are in a pending deal, were among the top multifamily lenders as of March 31. Columbia Banking reported $5.96 billion in multifamily loans as of March 31, unchanged from the previous quarter, and Pacific Premier booked $4.79 billion in multifamily loans, down 0.1%.

Within the group, KeyCorp posted the largest quarter-over-quarter decrease in multifamily loans at 7.8% to $5.34 billion in the first quarter, while Old National Bancorp posted the largest increase at 11.2% to $4.57 billion. Old National completed its acquisition of Bremer Financial Corp. on May 1.