Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2025

By Yuzo Yamaguchi and Marissa Ramos

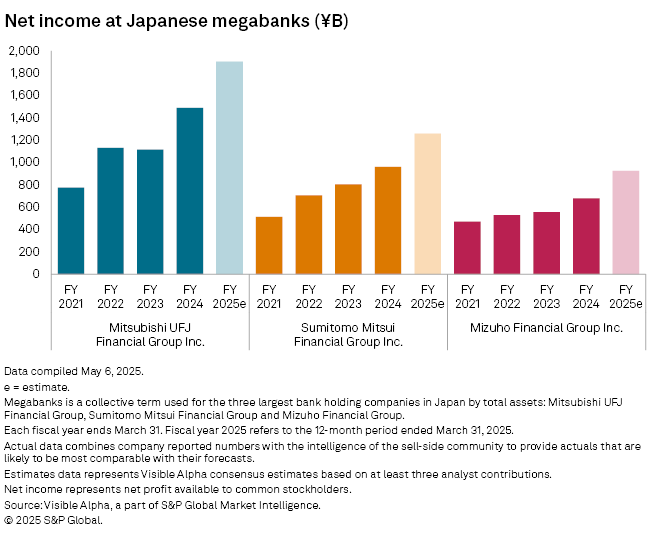

Japanese megabanks are expected to post better-than-expected earnings for the fiscal year that ended March 31, according to analyst estimates on S&P Global's Visible Alpha platform.

Mitsubishi UFJ Financial Group Inc. is expected to post annual net income of ¥1.90 trillion, according to Visible Alpha estimates based on inputs by at least three analysts. The biggest lender by assets among the three Japanese megabanks on April 30 upgraded its annual earnings outlook to ¥1.86 trillion from its prior projection of ¥1.75 trillion.

Net income at Sumitomo Mitsui Financial Group Inc. is expected to have reached ¥1.26 trillion for the fiscal year that ended in March, according to Visible Alpha estimates, surpassing its full-year target of ¥1.13 trillion. Mizuho Financial Group Inc.'s net income is likely to be ¥926 billion, versus the bank's prior projection of ¥820 billion, the data shows.

"SMFG and Mizuho should have gained upward momentum from higher rates, similar to MUFG," said Hideo Oshima, a senior economist at Japan Research Institute, a unit of SMFG. "All three banks should be moving in the same direction."

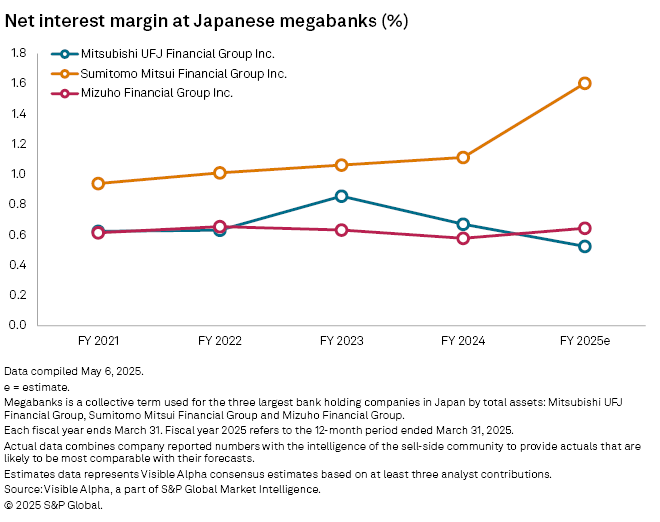

Japanese banks have gained from the country's monetary policy normalization. The Bank of Japan has raised its policy rate three times since March 2024, taking its benchmark rate to 0.50% in January 2025. The central bank abandoned its experiment with negative interest rates in 2024, starting on a hiking cycle while most of its peers were looking to cut rates. The BOJ expects to announce further rate increases, with economists predicting the benchmark rate to reach closer to 1.0%.

SMFG is set to announce its full-year earnings May 14. MUFG and Mizuho will follow on May 15. The megabanks are also expected to provide their earnings projections for the fiscal year that started in April, which may reflect the impact of US President Donald Trump's tariff policy on the global economy and the banks' lending.

"The market is paying attention to their guidance for this fiscal year," said Oshima.

SMFG had almost achieved its annual earnings target in the three quarters to December 2024, while Mizuho exceeded its earnings estimate in the same nine months. MUFG also hit 99% of its net income goal within the first three quarters of the fiscal year.

"So if they [SMFG and Mizuho] were to miss the guidance, it would imply a net loss" for the fourth quarter, said Michael Makdad, a senior analyst at Morningstar. "I don't expect that to happen."

MUFG estimated in February when it reported its earnings for the three quarters that the January rate hike would add ¥20 billion in net interest income for the fiscal year to March 2025, and ¥100 billion annually from the financial year starting April 1.

SMFG also expects the rate increase in the same month to contribute about ¥100 billion to net interest income per year, in addition to a total of ¥100 billion added from previous hikes in July and March 2024. The lender said a 25-basis-point rate increase will generate an additional ¥100 billion.

Mizuho said the three rate hikes so far will likely add ¥105 billion in net interest income for the fiscal year through March and estimates this to more than double to ¥225 billion in the next fiscal year.

SMFG's net interest margin is estimated to have increased to 1.60% in the last fiscal year, up from 1.11% the previous year, according to Visible Alpha. Mizuho's margin is forecast to have improved to 0.64% from 0.58%, while MUFG is expected to post a decline in net interest margin to 0.52% from 0.67%.

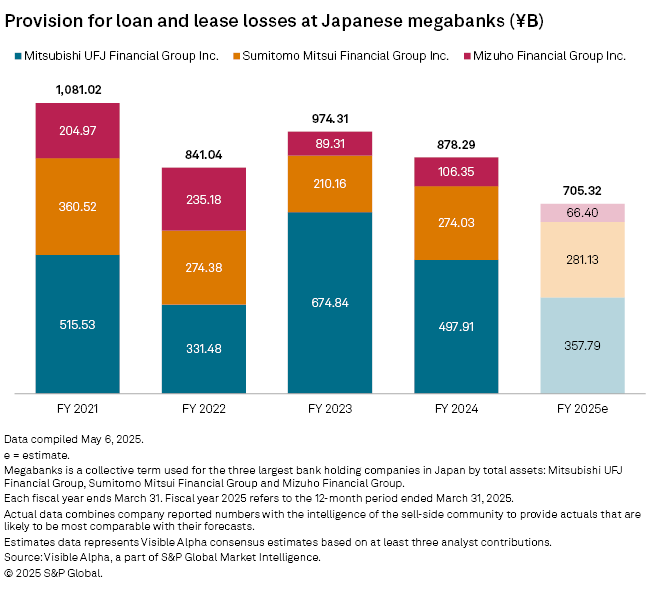

The sale of strategically held stocks has been another driver of the megabanks' solid performance.

Japanese companies often hold each other's stocks to maintain business relations. MUFG sold ¥225 billion of such shares from April to December 2024 as part of its three-year plan to dispose of ¥700 billion in total. SMFG, which divested ¥122 billion of its strategic shares over three quarters, aims to unload ¥600 billion in five years. Mizuho disposed of ¥152 billion during the same period, planning to sell off ¥300 billion in two years.