Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 May, 2025

By Zia Khan and Cheska Lozano

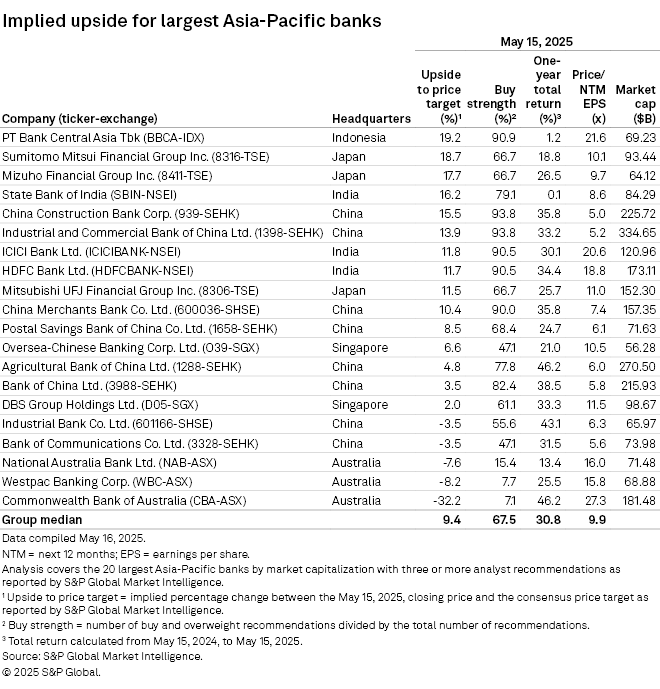

PT Bank Central Asia Tbk had the highest potential stock price upside among major Asia-Pacific banks as of May 15, an S&P Global Market Intelligence analysis shows.

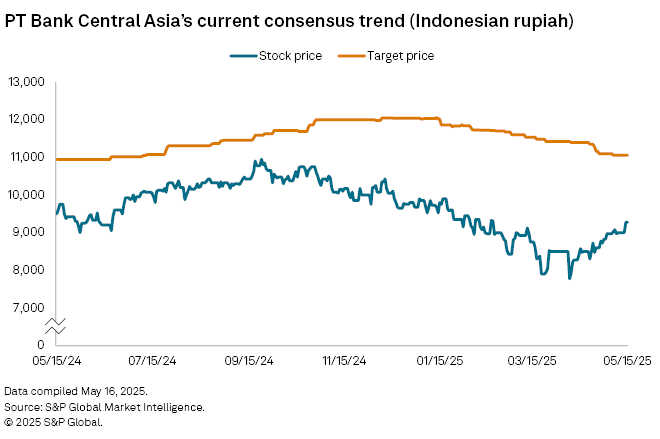

The Indonesian bank's potential share price upside, which is the percentage difference between the stock price and analysts' consensus targets, was 19.2% over 12 months. This compares to a median of 9.4% for the region's 20 biggest banks. The bank's implied upside was 12.9% as of Sept. 30, 2024.

A higher upside indicates that analysts believe a stock has more value than its market price, but there is no guarantee that stocks will reach analysts' price targets.

Buy strength

Bank Central Asia's buy strength, representing the proportion of buy and overweight analyst recommendations to total recommendations, was 90.9% as of May 15, significantly higher than the 67.5% median for the region's largest banks. Its total return was 1.2%, compared to a median of 30.8%.

The lender saw a higher potential upside despite its stock price rising more than 6% between April 23, when it posted first-quarter results, and May 15. The bank's net income grew nearly 10% to 14.146 trillion rupiah from 12.879 trillion rupiah in the same quarter last year, driven by higher interest income and an improved net interest margin.

Bank Central Asia and other major Indonesian lenders are expected to be less affected by tariff-related disruptions to economic conditions in Asia-Pacific compared to some of their regional peers, according to a May 14 S&P Global Ratings note. Indonesian banks should be resilient to such disruptions because the country's economy is not heavily reliant on exports, and the banks maintain some of the strongest regulatory capital levels in the region, Ratings said.

Following closely behind

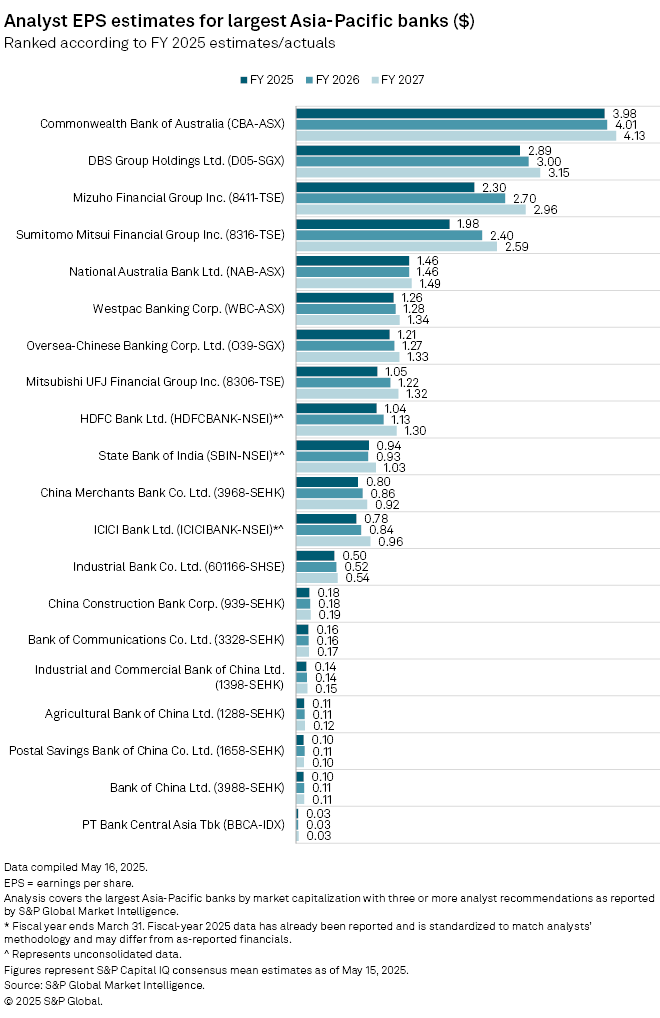

Japanese megabanks Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. closely followed Bank Central Asia in potential upside as of May 15, with 18.7% and 17.7%, respectively, according to Market Intelligence data.

Both megabanks had a buy strength of 66.7%, just under the 67.5% median for the region's biggest banks. But their one-year total returns significantly surpassed Bank Central Asia's: Sumitomo Mitsui Financial Group logged 18.8%, and Mizuho Financial saw 26.5%.

Mitsubishi UFJ Financial Group Inc., the largest of the three Japanese megabanks, had an implied upside of 11.5% as of May 15, a buy strength of 66.7% and a one-year total return of 25.7%, the data showed.

Possibly overvalued

Commonwealth Bank of Australia, Westpac Banking Corp. and National Australia Bank Ltd. had the steepest implied downsides in the sample, suggesting that the Australian lenders' stocks may be overvalued.

Commonwealth Bank's potential downside was 32.2%, with a buy strength of 7.1%. Westpac followed with a potential downside of 8.2% and a buy strength of 7.7%. National Australia Bank's implied downside was 7.6%, and its buy strength was 15.4%.

China's Industrial Bank Co. Ltd. and Bank of Communications Co. Ltd. were the two other banks in the sample that showed potential downsides to their share prices, both at 3.5%.

As of May 20, US$1 was equivalent to 16,415 Indonesian rupiah.