Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 May, 2025

By John Wu and Cheska Lozano

Declining residential property prices in Hong Kong are putting pressure on major banks, which have increased their exposure to the real estate sector.

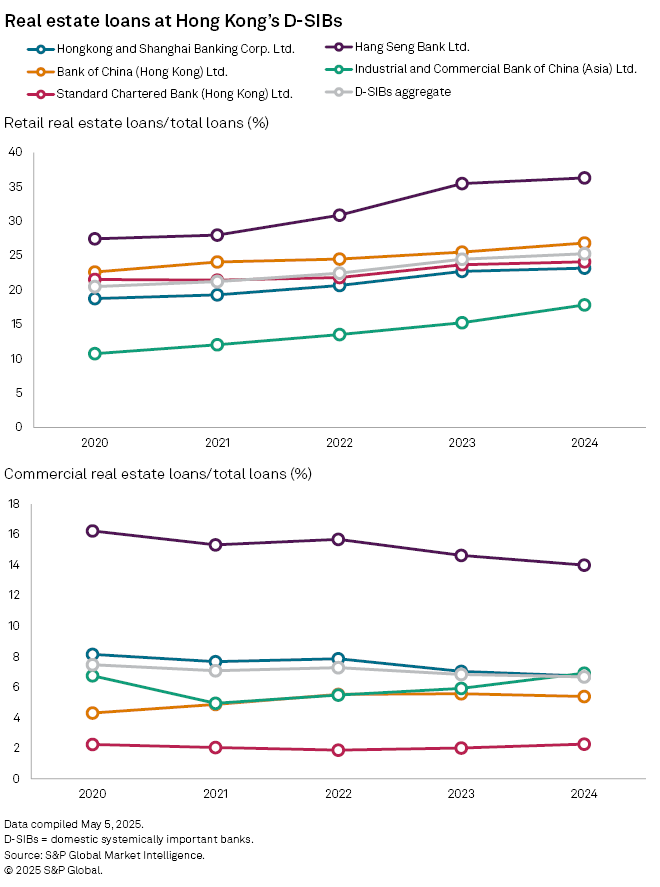

The aggregate loan exposure, covering both residential and commercial sectors, of the five domestic systemically important banks (D-SIBs) in Hong Kong rose to 25.75% by the end of 2024, up from 20.49% in 2020, according to S&P Global Market Intelligence data.

Hong Kong's leading banks "have deepened their exposure to real estate, with property loans forming a significant part of their portfolios," said Steve Alain Lawrence, chief investment officer of Balfour Capital Group, via email. "While supporting lending growth, this concentration increases risks tied to interest rates, regulatory changes, and economic conditions," Lawrence said.

Biggest banks

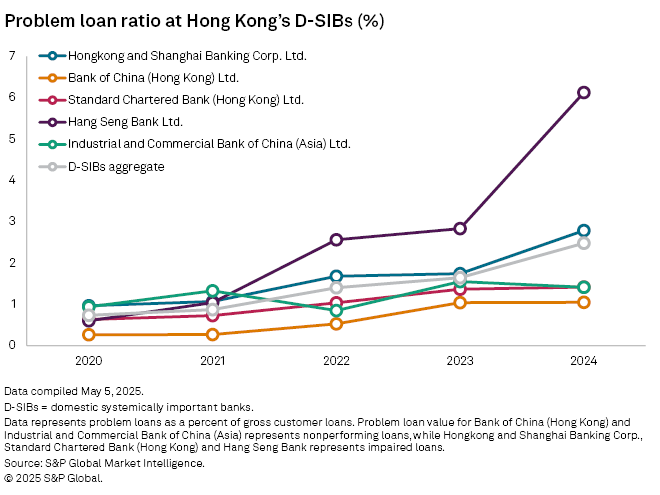

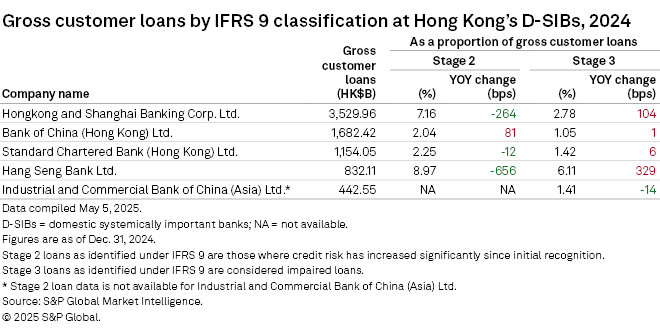

Hong Kong is home to five D-SIBs: Hang Seng Bank Ltd., Industrial and Commercial Bank of China (Asia) Ltd., The Hongkong and Shanghai Banking Corp. Ltd., Standard Chartered Bank (Hong Kong) Ltd. and Bank of China (Hong Kong) Ltd. Hang Seng Bank has the highest exposure to the property sector, with 36.34% of its total loans allocated to this market, according to Market Intelligence data. Hang Seng Bank also had the highest problem loans, at 6.12%, the data show.

"Though delinquency rates remain low due to prudent underwriting, prolonged high rates could strain borrower affordability, particularly for developers and investors facing refinancing challenges, heightening loan impairment risks," Lawrence said, adding that "market fundamentals suggest that real estate assets may continue to devalue, influenced by affordability constraints, interest rate trends, and shifting investor sentiment."

Downturn

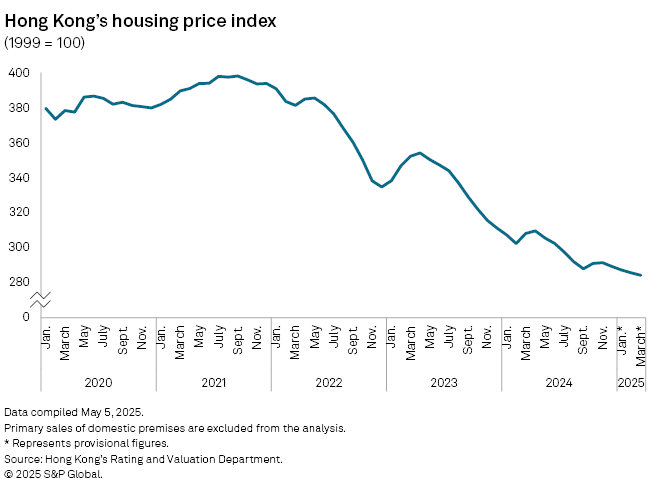

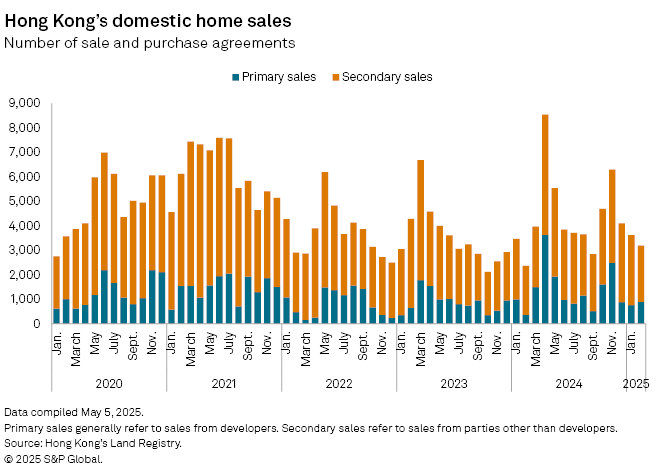

Hong Kong residential property prices entered a multiyear downturn with falling prices and shrinking transaction volume after hitting an all-time high in 2021. Slower economic growth, both in Hong Kong and in mainland China, and higher interest rates after the COVID-19 pandemic dampened sentiment.

By March 2025, the official housing price index, according to Hong Kong's Rating and Valuation Department, declined to 284.2, the lowest since August 2016. The index touched an all-time high of 398.1 in September 2021.

Property deals

The Centa-City Leading Index, compiled by local real estate consultancy Centaline Property and followed more closely by the industry, fell to 136.71 on May 2, from 191.34 in August 2021. The total value of residential property in Hong Kong stood at HK$8.99 trillion, down from HK$9.5 trillion a year ago, according to a Feb. 20 report by the agency. Hong Kong has sought to support the real estate market, including a relaxation in stamp duty for homes up to HK$4 million.

In April, Hong Kong recorded 7,229 transactions of building units, including both residential and commercial properties, representing an 8.5% increase compared to March, according to the Land Registry. Still, the number of transactions was down 26.8% year over year, and the total value at HK$50.1 billion was down 40.3%.

Hong Kong's three largest banks "have manageable exposure as they mainly lend to the largest developers and landlords, which typically own property in prime locations, and have pledged substantial collateral against their loans," S&P Global Ratings said in a March 5 note.

The aggregate exposure of the biggest banks to the commercial real estate sector, however, has declined, Market Intelligence data show. The five Hong Kong D-SIBs had, on aggregate, 6.66% of their total loans to the commercial real estate sector as on Dec. 31, 2024, compared with 7.48% in 2020.

"Our exposures to commercial real estate have been falling in absolute dollar amount and percentage of HK loans since 2021," a spokesperson for The Hong Kong and Shanghai Banking Corp said via email.

Queries to Bank of China (HK), Hang Seng Bank and Industrial and Commercial Bank of China (Asia) went unanswered. Standard Chartered Bank (Hong Kong) declined comment.

Smaller banks

However, "the picture shifts for small and midsize banks," said Phyllis Liu, a credit analyst at Ratings. "We believe such lenders are more exposed to small property firms or developers that are aggressively leveraged or heavily exposed to nonprime properties," Liu said.

The Hong Kong economy expanded by 3.1% year over year in the first quarter of 2025, picking up from the 2.5% growth in the prior quarter. Still, the government flagged caution. "The extremely high levels of trade policy uncertainty will dampen international trade flows and investment sentiment, which in turn overshadow the near-term outlook for the Hong Kong economy," the government said in its May 2 GDP press release.