Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 May, 2025

By Brian Scheid

Amid ongoing policy uncertainty and market volatility, Federal Reserve officials are hoping to maintain the status quo on interest rates after they meet this week.

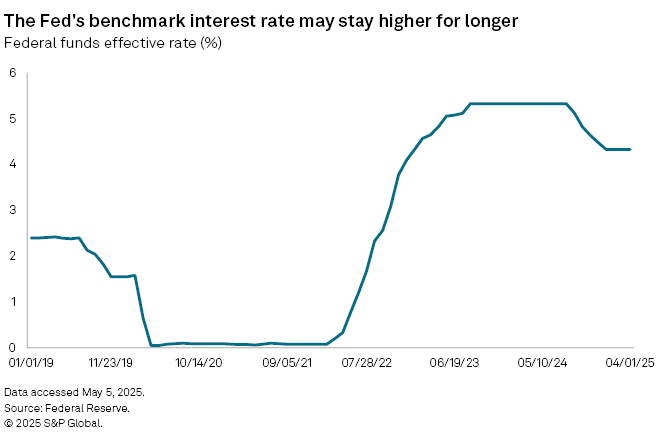

The rate-setting Federal Open Market Committee is widely expected to keep the Fed's benchmark rate unchanged in its current range of 4.25% to 4.5% at the meeting, which concludes May 7.

President Donald Trump's tariffs on nearly all US trading partners are expected to worsen inflation and upend the strength in the domestic labor market. Trump has threatened to fire Fed Chairman Jerome Powell if he does not cut rates soon. But the central bank will likely stick to its plan to keep rates higher for longer, economists said.

"We think the Fed can afford to wait a little longer since policy uncertainty will likely stay high, even if the tariffs are brought down somewhat relatively soon, and the hard data will bend, but not break, and thus dampen recession fears," said Oren Klachkin, a financial market economist at Nationwide.

As of May 5, about 97% of the futures market expected Fed officials to make no change to rates at their meeting this week, and more than 70% expected no change at their June meeting as well, according to CME FedWatch.

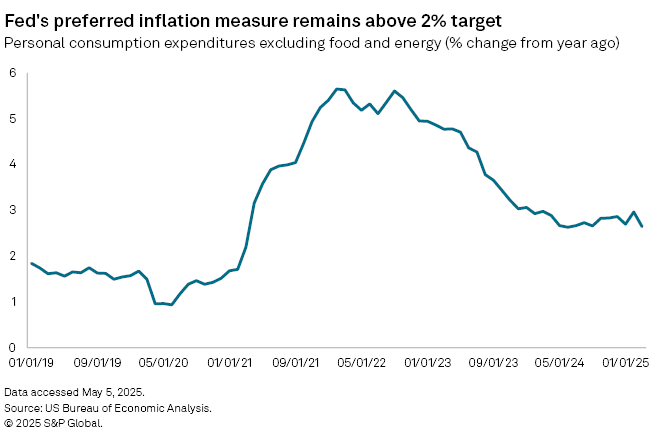

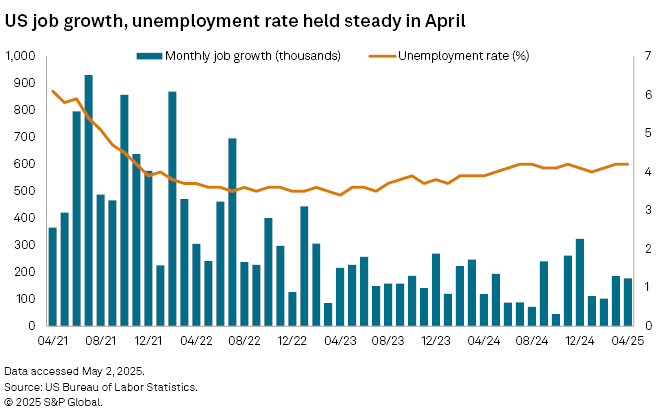

Much of this is due to relatively strong economic data — including a labor market where jobs are still being added and unemployment remains steady — and inflation, which has been moderating above the Fed's 2% target for months.

"Expectations of Fed easing keep getting pushed back because the economic data has been resilient thus far," said Michael O'Rourke, chief market strategist with JonesTrading. "That seems appropriate at the time, but I think there is potential for weak economic data this month that could potentially pull forward easing to June."

Klachkin with Nationwide expects the next rate cut may not be approved until this fall.

"The federal funds rate is going to stay as it is until the hard data show real deterioration and/or policy uncertainty is resolved, or at least diminished significantly," Klachkin said.

Fed officials are watching the impact that the uncertainty around tariffs is having on the US economy and may be hesitant to take any action with a 90-day pause on reciprocal tariffs not set to end until early July.

"If the labor market worsens rapidly and inflation expectations hold steady, then July could be in play," said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics. "We think the Fed is likelier to hold for longer, just because the inflationary shock from tariffs could be stretched out."

While the inflation data is trending in the right direction, Tang said it does not yet reflect the impacts of Trump's tariffs, including potential goods shortages and rising prices. Similarly, the jobs data has yet to show the effects of the president's tariff plans or the impact of the administration's immigration policy changes on the size of the labor force.

At his press conference this week, Powell will likely be asked about tariff expectations and threats from Trump to cut rates, but he is expected to remain measured and focused on monetary policy.

"Powell will be his usual diplomatic self, and will likely refer back to the Fed's dual mandate to explain their conduct," Tang said. "We will watch if he repeats his talking point of policymakers wanting to look at the net effect of all Trump policies, like deregulation and taxes, not just tariffs."