Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 May, 2025

By Zoe Sagalow and Hussain Shah

The Federal Deposit Insurance Corp.'s plan to slash its workforce threatens the safety and soundness of the bank industry and stands to hurt community banks' growth and innovation.

The agency's intention to reduce its workforce by 1,250 employees could be detrimental for supervision as exams could become less comprehensive and frequent, experts told S&P Global Market Intelligence.

Rulings on applications for growth initiatives such as M&A or branch expansions could also see delays if there is less staff to review them in a timely manner, they added. This could have the biggest impact on community banks, as the FDIC is primarily responsible for overseeing those institutions. The agency has 2,855 banks under its supervision for a total of $4.193 trillion in assets among those institutions, according to Market Intelligence data.

"If they're going to be cutting large amounts of staff without regard to production and work product, but rather just to get to certain numbers or thresholds, then there's definitely a concern that the supervisory or examination function could open up the possibility for fractures in the system," Joseph Silvia, a Duane Morris LLP partner who advises financial institutions on M&A and other topics, said in an interview.

An FDIC spokesperson declined to comment.

The layoffs are set to come after the agency has already made other steps to curtail head count recently. In January, the agency rescinded offers for more than 200 examiners following a governmentwide hiring freeze, The Washington Post reported. Then in February, the FDIC fired probationary employees, Bloomberg reported, though those employees have since been reinstated and placed on administrative leave following a lawsuit.

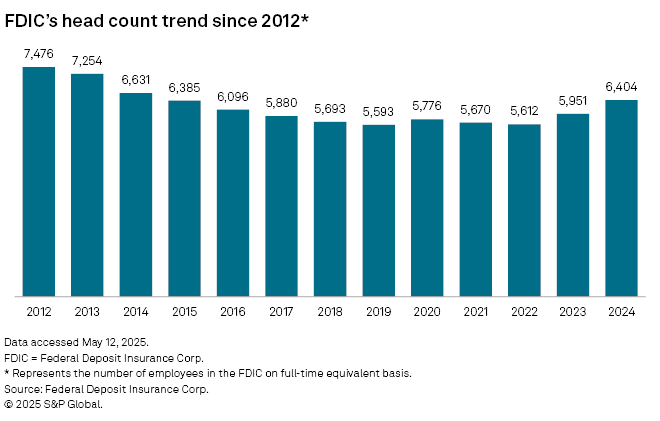

It is unclear if the 1,250 cuts will only affect full-time equivalent employees (FTEs) or include temporary or contract workers. At year-end 2024, the FDIC reported having 6,404 FTEs, the highest number in a decade.

Since 2022, the agency's head count has climbed each year, reversing a trend of near consecutive year-over-year declines since at least 2012, except in 2020 when it rose slightly.

The FDIC's head count rose 6.0% between 2022 and 2023 and then another 7.6% between 2023 and 2024. Those increases came after the failure of several large banks in 2023, in which the FDIC identified staffing constraints as one of its shortfalls in a report examining the failure of Signature Bank. In December 2023, the FDIC reported in its 2024 budget plans to hire 189 new staffers, partly because of lessons learned from the failures.

However, industry experts are not concerned that the layoffs will lead to an uptick in bank failures.

"If you look at most of the communication, they've actually deprioritized a reduction in force on those individuals who would be the subject matter experts responsible for either bank failures or liquidation authority," Peter Dugas, executive director and head of the Center for Regulatory Intelligence at Capco, said in an interview.

However, banks' exams will be affected, which could increase safety and soundness concerns. If the agency is strapped for resources, exams could become less frequent, allowing more issues to crop up, Erin Bryan, partner and co-chair of Dorsey & Whitney LLP's Consumer Financial Services Group, said in an interview.

"If we end up in a situation where, because of a reduction in the number of examination staff, exams are getting pushed off longer and longer, not happening with the same frequency or intensity — regardless of whether the exam staff themselves are finding issues, there is some risk that by not going through the regular exercise of preparing for exams that banks may not be as well positioned to respond to problems as they come up or may not be identifying them quite as quickly," Bryan said.

Moreover, this comes at a time when the federal agencies are already struggling with an aging and retiring workforce among their examiners.

"The agencies were having difficulty staffing up, replacing the aging workforce with new examiners. And so it will be a challenge if all of the workforce reductions take place amongst the newest, youngest hires because there may be a situation where as the older ones retire, there's not enough new ones to take their place," said Matthew Bornfreund, partner at Troutman Pepper Locke LLP and former attorney at the Federal Reserve Board. "It will present just a basic demographic and staffing problem."

Having fewer individuals on staff could also potentially delay approvals for banks' growth initiatives like M&A and branching, Scott Coleman, a partner at Ballard Spahr LLP who represents banks and bank holding companies, said in an interview.

"Part and parcel of getting your regulatory approval process completed in a timely fashion is the applications examination staff being able to address your application, ask questions, receive additional information to the extent it's requested," Coleman said. If this is impacted, "that would actually undercut any increases in speed and processing."

In addition to the failures, the agency has ramped up its staff in recent years to keep up with new developments in banks' activities, primarily related to technology. Undercutting the industry's innovation could also become a problem if the agency diminishes the staff it took on to keep up with those new developments.

"We have new types of products and services," Silvia said. "The landscape, the involvement of fintechs and other third-party providers has evolved."

If banks need to get in touch with a regulator to seek feedback on plans related to innovation, it could be harder to get in touch with someone. "Getting that clarity from the regulator when needed is or may become more of a challenge," said Marina Olman-Pal, co-chair of the financial regulatory and compliance practice at Greenberg Traurig PA.