Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 May, 2025

Strains in commercial real estate lending are one of banking's longest hangovers from the COVID-19 pandemic, though a pullback in construction has helped stabilize property prices and rents and given lenders some room to maneuver.

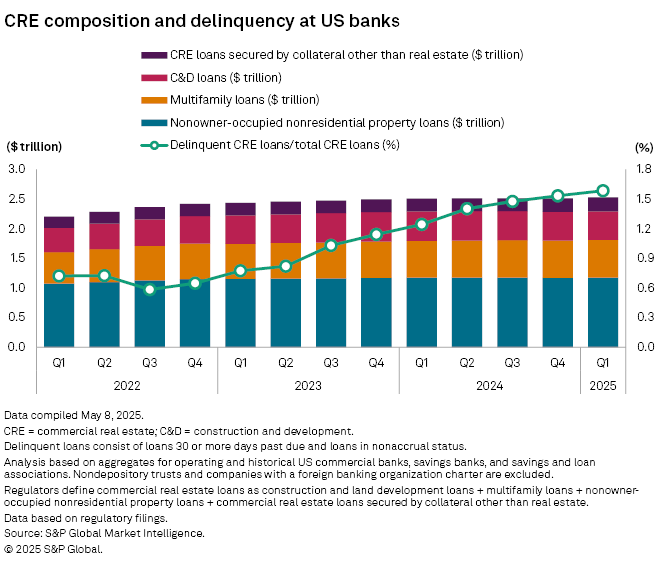

The commercial real estate (CRE) loan delinquency rate across US banks climbed just five basis points sequentially in the first quarter to 1.58%, according to S&P Global Market Intelligence data. The last several quarters have seen the CRE loan delinquency rate's year-over-year rise decelerate, slowing from a recent peak of a 58 basis-point increase in the second quarter of 2024 to a 34 basis-point increase in the first three months of this year.

Recent relative stability in CRE can be attributed to a thinned-out pipeline of commercial and multifamily projects, according to Wells Fargo economists.

"Supply should continue to downshift for the foreseeable future and help the CRE market maintain balance as changing economic policies and market volatility generate substantial uncertainty," a May 14 report said.

In office, an acute area of stress after COVID-19 scrambled work-from-home patterns, more new space was taken up by tenants than was delivered in the first quarter, the first instance of positive net absorption since 2021, according to the Wells Fargo economists. In fact, the delinquency rate across nonowner-occupied, nonresidential property loans — the largest component of bank CRE portfolios — fell for the second consecutive quarter to 2.01%. Multifamily delinquencies continued to mount, by contrast, up 12 basis points to 1.47%.

|

|

|

— Click here for a spreadsheet with data in this article. — Set email alerts for future data dispatch articles. — Download a template to generate a bank's regulatory profile. |

Cutting exposure

CRE loan volumes across banks continued to move sideways in the first quarter, up just 0.9% year over year to $2.53 billion, a major downshift from several periods of double-digit percentage growth in 2022 and 2023.

Banks have reported tightening CRE loan standards for about three years through the first quarter, along with weaker borrower demand reflecting higher interest rates, according to a Federal Reserve survey.

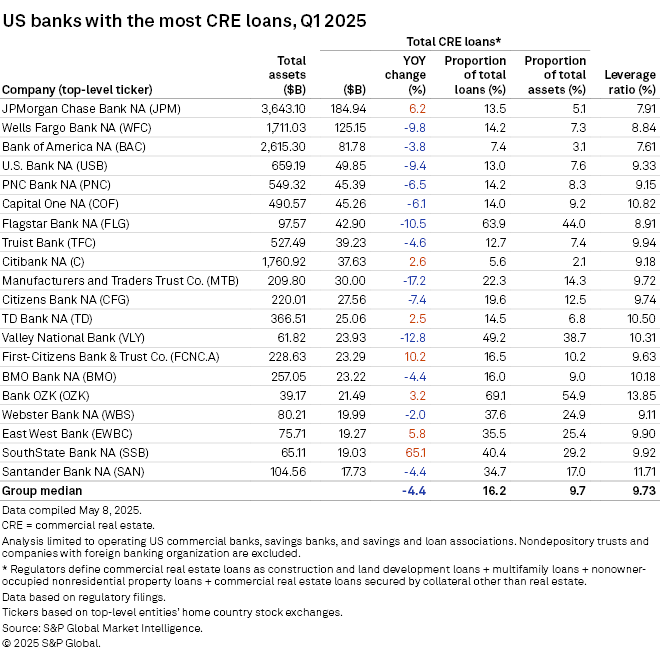

Among the 20 banks with the biggest CRE portfolios, such loans were down by a median 4.4% from the year prior. That includes a 17.2% decline at M&T Bank Corp., which has undertaken a years-long effort to reduce its exposure, and a 10.5% decline at Flagstar Financial Inc., which is building up in commercial and industrial lending after credit problems prompted a major capital infusion and an executive overhaul.

Broadly, banks have been trimming CRE exposure after years during which the sector has been the focus of credit concerns, in particular after the issues at Flagstar became clear.

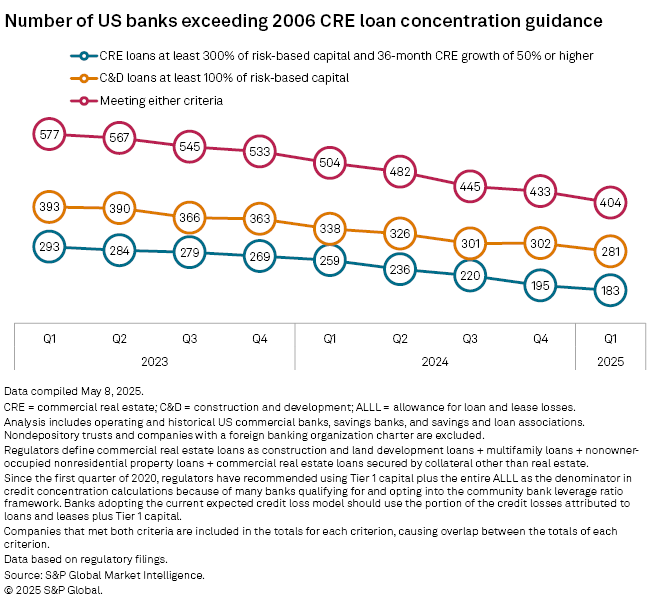

The number of banks exceeding regulatory guidance for CRE concentration fell for the eighth-consecutive quarter in the first three months of 2025, with a sequential drop of 29 banks to 404.

In office, many of the biggest lenders have slashed their portfolios by a fifth or more over the past two years as they built up substantial credit reserves to absorb losses.

The pace of declines in CRE loan demand has been diminishing, according to the Fed survey, and some banks started this year saying there were "green shoots" in terms of emerging lending opportunities in the sector.

However, President Donald Trump's tariff policies have pressured loan growth expectations; M&T pushed back its forecast for a bottom in the size of its CRE portfolio to the fourth quarter, citing aggressive pricing and terms from competitors.

|

Ongoing fallout

While big banks are working to stabilize their CRE portfolios, the industry is still feeling some pressure points.

For instance, softer travel spending has weighed on the share prices of hotel real estate investment trusts. Hotels had been at the center of early pandemic CRE concerns.

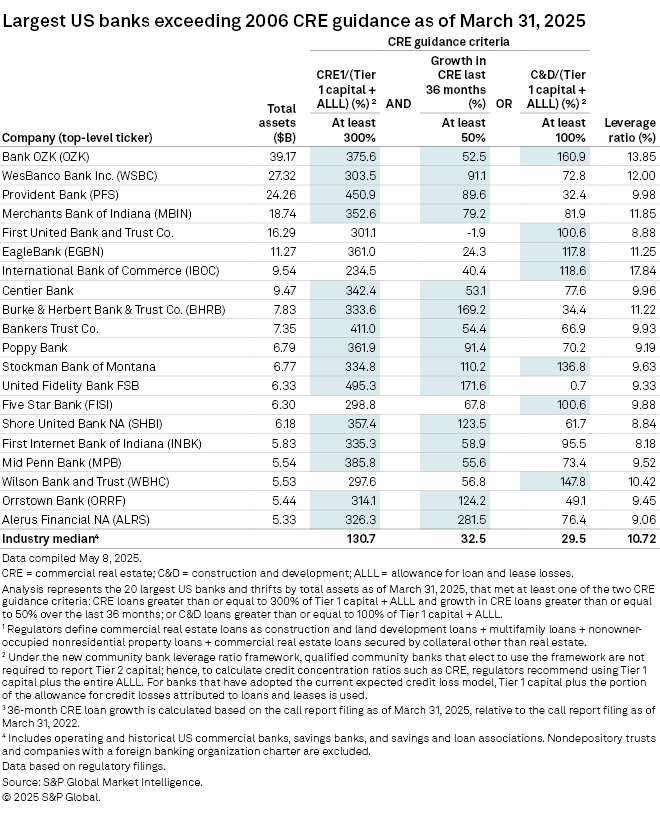

Among the largest banks exceeding regulators guidance on CRE concentration, Eagle Bancorp Inc. reported office loan downgrades and reserve builds for the first quarter, driving its shares lower. Cost-cutting efforts by the federal government played a role in Eagle's first-quarter CRE actions. While the bank's direct exposure to government-related office space is fairly low, potential "second and third derivative impacts" are hard to quantify, CFO Eric Newell said during an earnings call.

Also, Bank OZK suspended guidance for originations in its large real estate lending segment, citing macroeconomic uncertainty. The bank does expect real estate originations to continue, but "it's difficult to say what that volume is going to be over the remainder of the year," President Paschall Brannon Hamblen said on an earnings call. Real estate lending made up 62% of the company's total loans as of March 31.

|