Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 May, 2025

Clean energy trade groups and developers remain optimistic that the US Senate will soften the House Republicans' aggressive phaseout approach to the Inflation Reduction Act's green energy tax incentives.

But how far Senate Republicans are willing to go to support the US clean energy industry, and whether any forthcoming changes can pass muster in both chambers, remains to seen, industry analysts noted.

The market saw a sharp sell-off in US clean energy stocks after the House's sweeping budget reconciliation bill narrowly passed, 215-214-1, on May 22. All but two Republican House members voted in favor of the bill, and one Republican voted "present." All Democrats voted against it.

Shares of NextEra Energy Inc., one of the nation's largest renewable energy and storage developers, were down nearly 6.5% on the May 22 trading day, on triple average trading volume. The stock price for leading residential solar provider Sunrun Inc. plunged 37% on about seven times average trading volume.

"The good news is there's something called the US Senate," American Clean Power Association CEO Jason Grumet remarked at the trade group's CLEANPOWER 2025 conference in Phoenix. "It is the place where generally more rational, thoughtful, deliberate policy discussions happen. We are talking to them a lot."

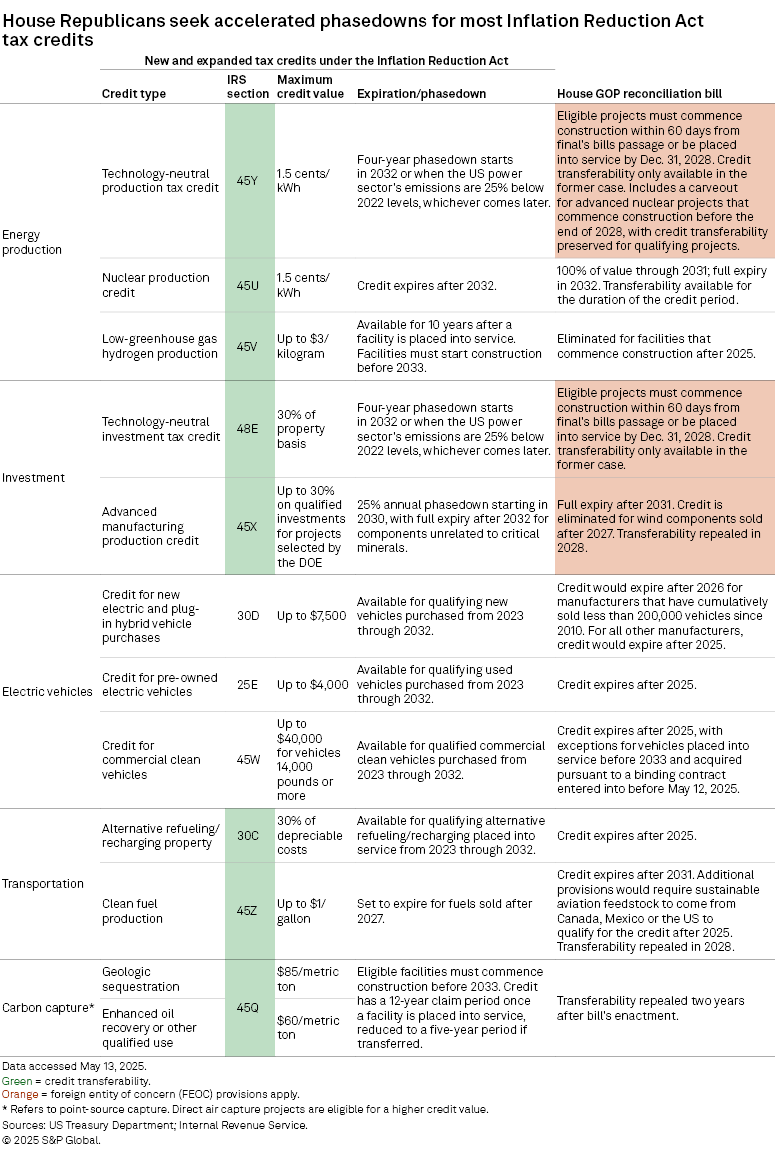

Grumet said the trade group still expects to see a more deliberate GOP phaseout approach for the 2022 climate law's tax credits. The IRA's technology-neutral 45Y and 48E clean electricity tax credits and 45X advanced manufacturing credit, for example, have already produced a major boom in US clean energy investments. A majority of announced projects and jobs are located in GOP congressional districts.

Phasedown outlook

Under the Inflation Reduction Act, a four-year phasedown for the 45Y and 48E clean electricity production and investment tax credits is set to begin either in 2032 or when CO2 emissions from the US power sector fall to 25% of their 2022 levels — whichever comes later.

The House-passed bill put in place requirements tied to credit eligibility for wind and solar projects to "commence construction" within 60 days of the legislation's passage. The bill also included requirements for projects to be placed in service by the end of 2028 to be eligible for the credits — conditions climate groups said would disqualify most energy projects. Credit transferability, or the ability to buy or sell the credits as part of project financing deals, would only be available in the former case, ClearView Energy Partners noted May 22. The two credits would be eliminated after 2028.

"We are ready for this, but we're going to make sure that I think it happens in a way that honors the investments and the commitments and the momentum that we've all had over the last few years," Grumet said May 22.

The CEO of EDP Renováveis SA, which has extensive developments in the US, offered a similar view during a sideline interview at the Aurora Spring Forum in London.

"I think the most important thing for us is, first, there's no retroactivity," EDP CEO Miguel Stilwell d'Andrade said.

He noted that the Madrid-based renewables developer already has about 1.5 GW of mostly solar and battery capacity safe-harbored in the US, meaning the projects have already begun construction for tax reporting purposes.

"We've already started construction or done a certain amount of investment on them so — independently of whatever comes out — those projects have access to the framework that has existed," Stilwell d'Andrade said.

Foreign entity requirements

Bank of America analysts highlighted concerns that foreign entity of concern (FEOC) provisions in the House-passed bill "are extremely complicated to comply with, and are likely unworkable particularly for the storage industry, which is highly dependent on China." The FEOC provisions would apply to the 45Y and 48E credits, as well as the 45X credit for advanced clean energy technology manufacturing.

Starting in 2026, the House bill would broadly prohibit projects from receiving "material assistance" from "foreign-controlled" and "foreign-influenced" entities with ties to the governments of China, Iran, North Korea or Russia.

Material assistance would be defined in terms of components, subcomponents or critical minerals extracted, processed, recycled, manufactured or assembled by a prohibited foreign entity. The bill would also prohibit credit eligibility for any property designs that were based on a copyright or patent held by a prohibited foreign entity.

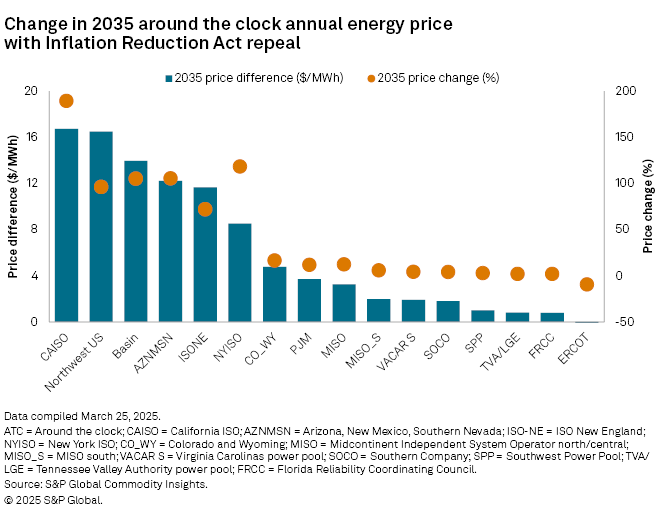

Full IRA tax credit repeal, seen as more of an extreme bookend case, would lead to significant declines in wind, solar and battery storage across the US by 2035, according to recent modeling from S&P Global Commodity Insights.

Latest bill brings new challenges

Analysts also noted the changes to 45Y and 48E from prior drafts.

"This is a drastic incremental negative compared with prior language introduced last week," analysts at J.P. Morgan said.

"If enacted, we believe this would create a surge of orders for equipment manufacturers ... as project developers look to complete construction by [year-end 2028]. Given the longer construction timelines, we believe utility-scale projects would be relatively better positioned to capture tax credits relative to residential solar projects," the J.P. Morgan analysts added.

Both the FEOC provisions and changes to the 45Y and 48E credits would present additional hurdles for the industry to maneuver.

"FEOC limitations were considered perhaps the most restrictive provision in the markup, but newly added termination dates on 48E/45Y credits serve as yet another obstacle on an already blocked pathway to claiming the credits," analysts at Jefferies said. "Even with safe harbor still an available avenue, we see it as largely limited given the shorter timelines proposed, nuances on placed in service [versus] in construction language, and extreme supply chain requirements."

Amendments to 48E would also disqualify residential solar and storage leasing companies, of which Sunrun is by far the largest, from using investment tax credits.

"This comes as a surprise especially considering how favorable the initial markup was" for companies offering leases and power purchase agreements with third-party originators, Jefferies analysts said.

The original draft proposed repealing the Section 25D residential clean energy credit at the end of this year, affecting customer-owned projects. But it allowed third-party leasing companies to continue to qualify residential installations for investment tax credits.

The draft language initially boosted Sunrun's share price.

"This short-lived advantage to [residential third-party originators] was seemingly corrected, with new text now 'leveling the playing field' by targeting all future residential solar originations, whether leased or owned," Jefferies analysts said.

Nuclear carveouts

The House-passed reconciliation bill includes carveouts for some nuclear incentives.

The bill would preserve the full value of the 45U nuclear production tax credit through the end of 2031, rather than a gradual phasedown beginning in 2029 proposed in an earlier version of the bill.

Transferability for the 45U nuclear credit would also remain in place until the credit expires. The 45U credit is currently set to sunset at the end of 2032.

And although the bill would generally eliminate the 45Y production tax credit, an advanced nuclear facility would remain eligible if construction begins before the end of 2028. The bill would also allow new advanced nuclear facilities or expansion projects that begin construction before the end of 2028 to qualify for the 48E investment tax credit.

Transferability for the other nuclear credits would sunset in 2028.

"The changes reflected in the final package will continue to advance the administration's goal of abundant energy by supporting plant restarts, power uprates and life extensions for existing nuclear reactors," said Michael Flannigan, the Nuclear Energy Institute's vice president for government affairs.

Nuclear advocates still are looking to protect federal programs such as the US Energy Department's Loan Programs Office "to usher in the next generation of nuclear technologies," Flannigan said.