Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 May, 2025

By Tim Siccion and Shambhavi Gupta

Global private equity and venture capital-backed rounds of funding in April fell from the monthly high recorded in March.

Total transaction value in April amounted to $24.75 billion, less than half the $66.49 billion reported in March, according to S&P Global Market Intelligence data. The number of rounds was down to 1,139, from 1,316 the previous month.

In the first four months of 2025, 4,989 rounds amounted to $129.53 billion, an increase from the $100.52 billion amassed across 5,627 rounds for the same period in 2024.

Year-over-year deal value showed growth. April's total value was up from $21.83 billion a year earlier.

– Read up on private equity trends in elite university endowments.

– Read our latest In Play reports featuring rumored deals.

– Explore more private equity coverage.

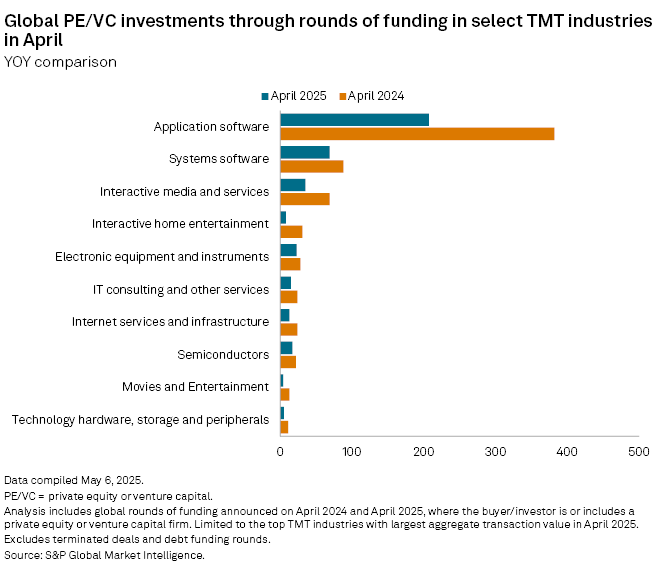

Technology, media and telecommunications (TMT) had the highest transaction value in April, accounting for 40% of total investments. TMT raised $9.90 billion across 416 rounds of funding, followed by the healthcare sector, which pulled in $4.41 billion.

Application software remained the most favored subsector within TMT, recording 207 deals, followed by system software with 69 deals. Deal volume across all TMT subsectors was down compared with April 2024.

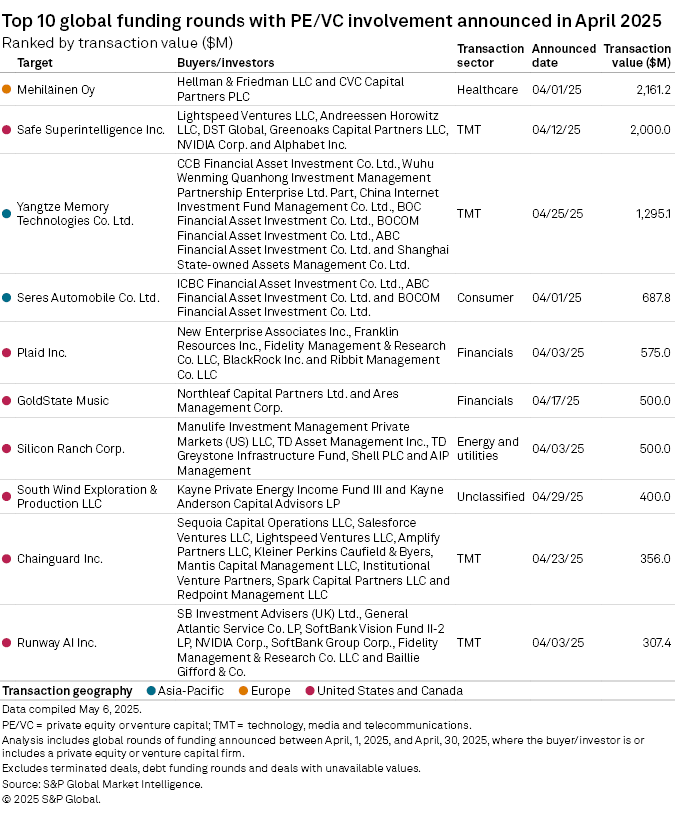

Largest rounds of funding

The largest funding round in April was the CVC Capital Partners PLC-led $2.16 billion investment in Finnish healthcare services provider Mehiläinen Oy. Hellman & Friedman LLC also joined the round. Mehiläinen will use the proceeds to expand its operations in Finland and international markets, among other initiatives.

The second-largest round was a Greenoaks Capital Partners LLC-led $2 billion series B round for US-based AI developer Safe Superintelligence Inc.

The third-largest was a $1.30 billion investment in Chinese electronic components manufacturer Yangtze Memory Technologies Co. Ltd., with participation from China Internet Investment Fund Management Co. Ltd.