Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Apr, 2025

|

Critical minerals, such as germanium and gallium, are essential to the production of advanced semiconductors and have been weaponized in an escalating trade war between Washington and Beijing. |

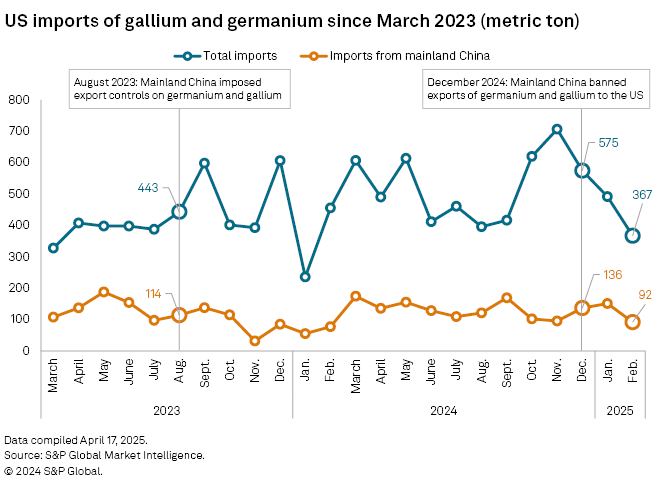

A chaotic breakdown in US-China trade relations triggered a surge in buying and stockpiling of critical minerals essential for defense and semiconductor industries, experts told Platts, part of S&P Global Commodity Insights.

Germanium and gallium are widely used in the production of advanced chips, fiber-optic cables and 5G networks critical for defense and consumer electronics sectors, but like many mined raw materials, the US largely depends on other countries' imports.

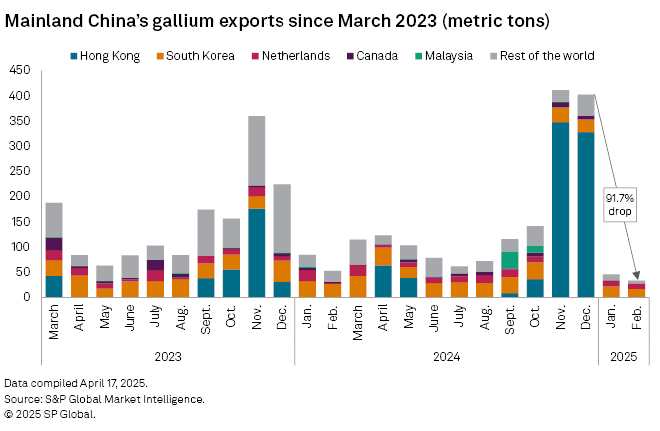

China's exports of gallium and germanium-related products dropped to 1,250.9 metric tons in February, down 28% from 1,748.8 metric tons in December 2024 when Beijing started restricting exports of the niche metals to the US, according to S&P Global Market Intelligence's Global Trade Analytics Suite (GTAS) data.

"People are buying as much as they can get their hands on, especially at the consumer level, because they want their operations to continue," Willis Thomas, Head of CRU+, told Platts. "If you cannot run your production line because of the lack of germanium or gallium, that costs you a lot, and we have seen the economic impact of the chip shortage that happened in the automobile industry. ... It shut down production and limited sales. No one wants to be in that position."

Mainland China's exports of gallium, a critical component in defense and aerospace systems, saw a particularly sharp decline over the review period, dropping 92% to just 33.3 metric tons in February from 402.4 metric tons in December 2024, according to GTAS data. China accounted for 99% of global low-purity gallium production, according to the US Geological Survey.

China flexes critical mineral muscle

China on Dec. 3, 2024, banned exports of "dual-use" materials — materials with military and civilian uses such as gallium, germanium and antimony — to the US and tightened export controls on synthetic and natural graphite. The new restrictions were expanded earlier export controls announced in August 2023.

"When China announced an export ban [on germanium and gallium] to the US, this was accompanied by an explicit ban on re-exports as well, and it was said that the re-exports to the US would be closely monitored," Piyush Goel, Commodities Consultant at CRU, told to Platts.

Despite export controls being in place since Aug. 2023, gallium and germanium exports from China continued to flow into the US through third countries, according to experts.

"China used to be quite tolerant of re-exports in the past. Hence, they mapped out which countries are re-exporting gallium and germanium to the US. It turned out to be the likes of Japan and South Korea," Sandeep Rao, analyst at Leverage Shares ETPs, told Platts.

Japan and South Korea mostly produce high-purity gallium material that is being refined from China's low-purity gallium ores.

"When the US tariff regime came into place, China, Japan, and South Korea formed a triangle of critical minerals producers to ensure they keep this ecosystem to themselves and have a better bargaining position against the United States in trade negotiations," Rao said. "Supply chains of these critical minerals are essentially being shortened in favor of these three countries."

US total imports of gallium and germanium-related materials declined to 367.1 metric tons in February, down 36% from 574.6 metric tons in December 2024, while imports from mainland China dropped 33% to 91.9 metric tons from 136.4 metric tons, according to GTAS data.

Economic impact

Economic losses to the US from decreased gallium and germanium imports would be concentrated in the semiconductor device manufacturing industry, which would account for more than 40% of the net loss, the US Geological Survey said in a November 2024 report. Additional losses would spread across multiple industries, including downstream producers dependent on semiconductors, according to the study.

"Losing access to critical minerals that make up a fraction of the value of products like semiconductors can add up to billions of dollars in losses across the economy," wrote Nedal Nassar, lead author of the study.

US manufacturers flagged "acute" shortages of critical minerals needed to sustain their production lines, particularly germanium, according to the Institute of Supply Management manufacturing survey from April 1. A representative from the transportation industry said in the survey that prices have risen significantly due Chinese restrictions on critical minerals such as germanium.

"There will be a significant supply shortage on the market," Rao said. "The US has strategic reserves of germanium but not of gallium, and for gallium, it's hard to find ex-China production."