Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Apr, 2025

By Darren Sweeney and Allison Good

Most investor-owned electric and multi-utilities are expected to report strong first-quarter results, but datacenter demand forecasts, economic uncertainty and a bumpy federal policy environment are critical issues around which investors and analysts will be seeking clarity for the rest of the year.

Shortly after the end of the first quarter, US President Donald Trump implemented sweeping tariffs on major trading partners, sending markets reeling. On April 9, the administration announced a 90-day pause on the reciprocal tariffs, but escalated trade tensions with China.

"Utilities are spending capital daily, so we'll be very interested to hear how companies are financing those cash outflows," Scotia Capital (USA) analyst Andrew Weisel wrote in an April 22 report. "While some may be hesitant to issue equity when their stock prices are declining, this can be a dangerous game given high and rising equity needs."

NextEra Energy Inc. competitive generation unit NextEra Energy Resources LLC has "less than $150 million in tariff exposure through 2028 on over $75 billion in expected capital spend," based on discussions with suppliers, NextEra Chairman, President and CEO John Ketchum said April 23 on the company's first-quarter earnings call.

"Once we work with our customers, we expect our $150 million tariff exposure to be significantly reduced, potentially down to zero," Ketchum said, noting the company has "contractual trade measure protections" in its contracts.

NextEra on April 23 reported first-quarter adjusted earnings of $2.04 billion, or 99 cents per share, compared with $1.87 billion, 91 cents per share, in the first quarter of 2024. Those results topped the S&P Capital IQ consensus normalized EPS estimate of 97 cents for the first quarter of 2025.

"I don't think tariffs are going to move the needle in terms of long-term growth or near-term earnings," Morningstar analyst Travis Miller told Platts, a part of S&P Global Commodity Insights.

Analysts, however, are keeping an eye on how tariffs and potential supply chain issues could impact capital investment plans and the sourcing of large equipment, such as gas turbines.

"Depending on where utilities are sourcing their equipment and turbines in particular, tariffs could raise costs or exclude some sources of supply from getting to the US," Miller said in an April 21 interview.

Dominion Energy Inc. is developing the 2,587-MW Coastal Virginia Offshore Wind project and has already increased the overall cost to $10.7 billion from $9.8 billion.

"We expect tariffs to be front and center for both Dominion and Eversource Energy since they have mechanisms in place whereby shareholders are responsible for at least some of the overruns, not ratepayers," CreditSights analyst Andrew DeVries wrote in an April 21 email. "Outside of those two names, any increase in steel, aluminum and/or transformer costs are easily manageable for the group as management teams can work with regulators to delay or defer any sharp increase in costs."

The Dominion offshore wind project could also be affected by a Trump administration review of existing and pending federal permits, but management has remained steadfast that it will come online by the end of 2026.

Datacenter demand

Macroeconomic uncertainty also could affect electricity demand forecasts and spending plans.

"A potential recession may weigh on demand for electricity, particularly hurting sentiment for utilities benefiting from [datacenter] and domestic manufacturing growth," Weisel wrote.

"Should tech companies scale back their own [capital expenditure] plans, we could see downside to utility capex plans, and the highly anticipated acceleration of utility earnings growth could potentially fail to materialize, or at least might underwhelm," Weisel wrote. "Encouragingly, however, we believe that the majority of what's included in utilities' recently updated, multiyear capex plans is highly conservative and primarily backed by firm commitments from tech customers, limiting the downside risk."

China-based DeepSeek's launch of a cheaper and more energy-efficient open-source reasoning foundation AI model, along with reports of datacenter lease cancellations, are adding to some skepticism around load forecasts.

"The bigger issue is growth estimates for end-of-decade datacenter demand have started to come down and one could argue this is owing to DeepSeek efficiency gains or the original estimates were simply too high to begin with," DeVries said.

Morningstar expects to "see some rationalization" around demand forecasts and "datacenter upside" over the next few quarters, Miller said.

"We always thought that some of these demand numbers were aggressive," the analyst told Platts.

In the meantime, companies are also looking to add generation to serve anticipated demand, with gas generation seen as a dominant fuel source.

Independent power producers (IPPs) outperformed the S&P 500 utility sector index in 2024, reflecting investors' enthusiasm for projected datacenter load growth. But the index outperformed individual IPPs Vistra Corp. and Constellation Energy Corp. during the first quarter as concerns about tech companies' electricity demand prompted stock price selloffs.

"It is apparent that [datacenter] sector growth data points are slowing," Jefferies analysts said in an April 22 note to clients. "Technology and generalist investors we speak to are increasingly skeptical about the quantum of [datacenter] demand."

Evercore expects regulated utilities' outperformance relative to IPPs to continue given broader market volatility driven by sweeping US tariffs.

"While we remain constructive on the group given its limited direct tariff exposure, improving fundamentals and favorable valuation setup, the macro and political uncertainty likely results in a flight to safety, which supports our view of a heavier allocation skew towards regulated utilities in the near term," Evercore analysts wrote April 20.

At the same time, however, "companies that indicate larger tariff exposure, potential for more equity, and other headwinds will likely be sold more than in a typical quarter," according to Jefferies.

Utility companies developing renewable energy projects will face heightened scrutiny, Morgan Stanley analysts added in an April 22 note.

Companies with "near-term battery and solar plans," such as Alliant Energy Corp., Idacorp Inc., Portland General Electric Co. and WEC Energy Group Inc., also face more potential risk.

Estimates

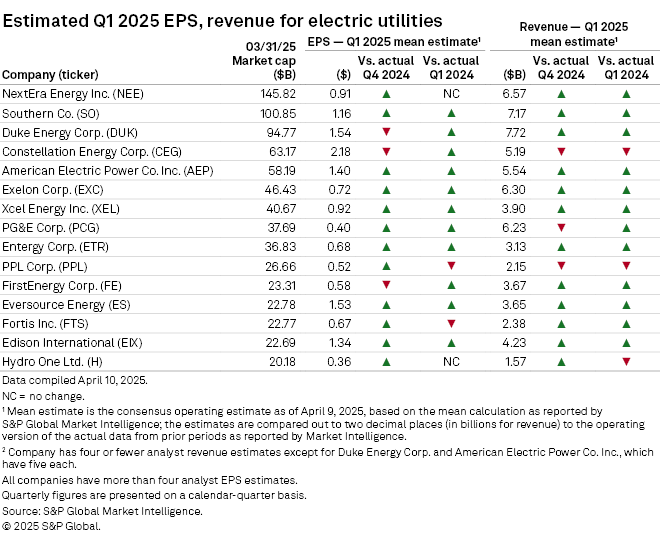

Eleven of the 15 largest North American electric companies by market capitalization are expected to post year-over-year earnings beats, according to an S&P Global Market Intelligence analysis of S&P Capital IQ consensus estimates.

Southern Co., Duke Energy Corp., Constellation, American Electric Power Co. Inc., Exelon Corp., Xcel Energy Inc., PG&E Corp., Entergy Corp., FirstEnergy Corp., Eversource and Edison International are all forecast to report higher year-over-year earnings per share in the first quarter, the analysis shows.

PPL Corp. and Fortis Inc. are expected to report an earnings miss compared to first-quarter 2024 results.

Hydro One Ltd. is expected to report earnings in line with the previous year's results.

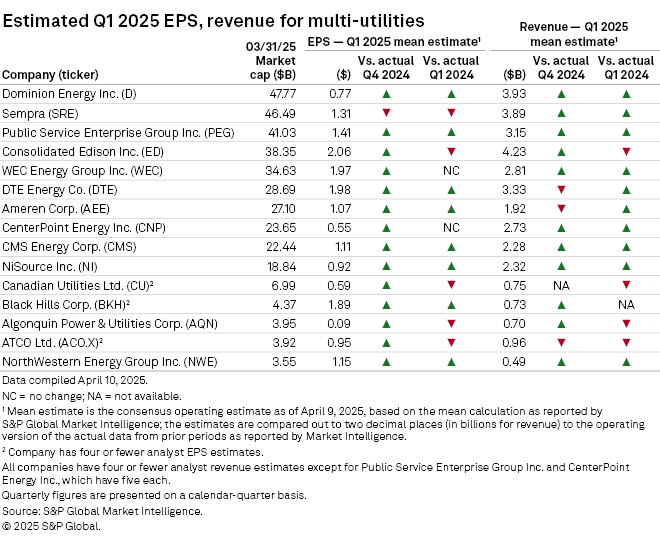

Of the North American multi-utilities, Dominion, Public Service Enterprise Group Inc., DTE Energy Co., Ameren Corp., CMS Energy Corp., NiSource Inc., Black Hills Corp. and NorthWestern Energy Group Inc. are forecast to report higher year-over-year EPS in the first quarter.

Sempra, Consolidated Edison Inc., Canadian Utilities Ltd., Algonquin Power & Utilities Corp. and ATCO Ltd. are projected to report lower earnings results, the analysis shows.

There is no change in the estimated year-over-year EPS for WEC Energy and CenterPoint Energy Inc.

|

– Access – Follow the latest news – Access more details |