Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Apr, 2025

US life insurers are expected to discuss strategies for navigating macroeconomic uncertainties, particularly those stemming from tariff-related market volatility, during first-quarter earnings calls.

Global markets have been turbulent in the weeks since US President Donald Trump announced sweeping international tariffs. Life insurance stocks suffered alongside the broader market, though industry analysts anticipate insurers will emerge from the volatility in a good position.

Market instability could lead to growth in areas like annuities and pension risk transfers for life insurers, Jeffries analyst Suneet Kamath said.

"The recent pullback has created some attractive investment opportunities, and we stay constructive on US life," Kamath said in a client note.

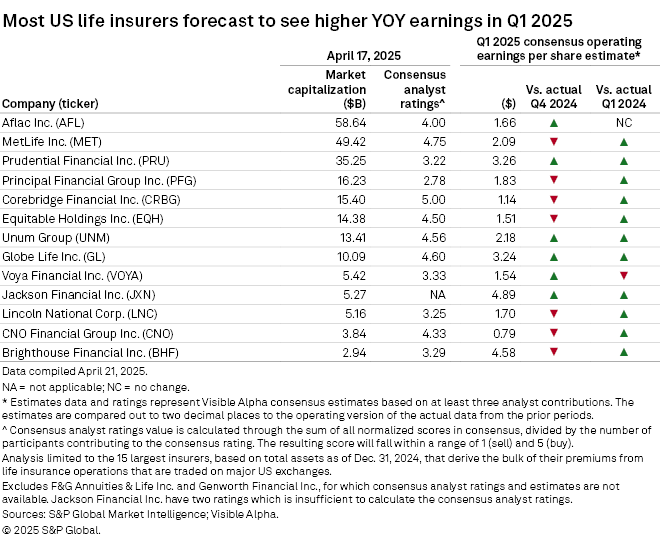

Earnings up YOY

Among the largest US insurers, all but Voya Financial Inc. and Aflac Inc. are projected to report higher year-over-year first-quarter earnings, S&P Global's Visible Alpha data shows.

Voya pre-announced first-quarter variable investment income, including alternative and pre-payment fee investment income, of between $24 million and $34 million pretax. That was between $15 million and $25 million below long-term expectations, according to Piper Sandler analyst John Barnidge, who said the early announcement was an "incremental negative" for Voya.

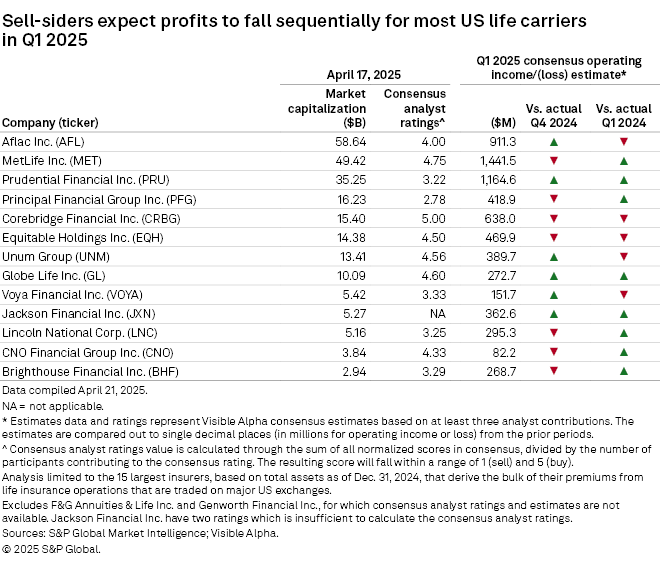

Seven of the largest US life underwriters are expected to report lower first-quarter earnings on a sequential basis. First-quarter results will be "pressured" by adverse alternative returns and mortality claims, TD Cowen analyst Andrew Kligerman anticipates.

"Aside from earnings, we expect a focus on management commentary on macro conditions and the outlook for buybacks," Kligerman said in a note to clients. "We have a balanced view of US life given macro risks and feel investors should remain selective."

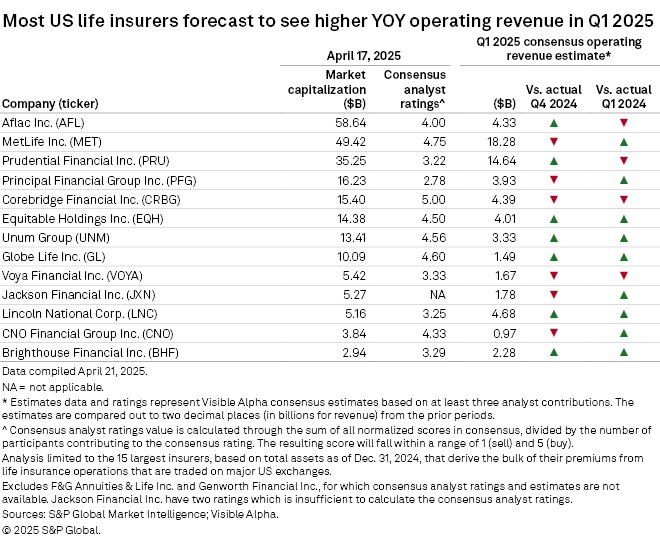

Revenue growth

Most of the largest US life insurers are expected to report higher first-quarter operating revenue than a year ago. MetLife, Inc. has the highest revenue estimate for the period at $18.28 billion. Aflac, Prudential Financial Inc., Corebridge Financial Inc. and Voya are all projected to book lower operating revenue.

Mixed profit picture

Most life insurers are expected to see profits fall sequentially but rise year over year. None of the analysed companies should book a loss.

Prudential pre-announced some first-quarter financial metrics April 14, including assets under management for its principal asset management business, PGIM. The $1.39 trillion figure was close to Barnidge's estimate and about the same as a quarter earlier, showing that market volatility had a real impact on results, the analyst said in a note.

Prudential also pre-announced other related revenue of $20 million, down from $65 million in the fourth quarter of 2024, Barnidge said. Variable investment income for the first quarter was also below his expectations.