Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Apr, 2025

By Iuri Struta

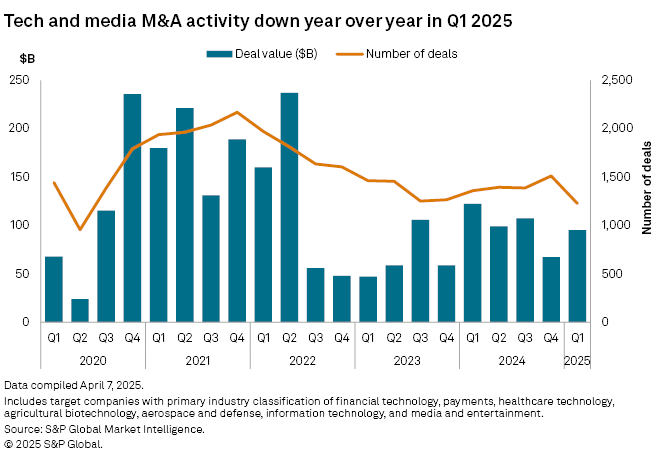

The first three months of 2025 did not bring the recovery in tech M&A that many investment bankers had expected, and the outlook for the rest of the year remains mixed amid various moves from the Trump administration.

Across US tech deal activity, deal value declined about 22% year over year in the first quarter, according to data from S&P Global Market Intelligence. The fall would have been higher absent a single large deal: Alphabet Inc.'s acquisition of cybersecurity company Wiz Inc. for $32 billion. Deal volume reached a low not seen since the depths of the COVID-19 panic in second quarter 2020.

The decline stands in contrast to what tech M&A advisers had expected directly after US President Donald Trump's election in late 2024. At that time, advisers were looking to a more lenient antitrust environment, lower taxes and less regulation. Now, some of those expectations have shifted as the Federal Reserve stopped its interest rate-cutting cycle and the Trump administration prioritized federal spending cuts and tariffs on imports. But there is still a sense that the regulatory pressures felt under former President Joe Biden have eased, allowing for more tech M&A.

"Sentiment in the corporate and M&A world was extremely positive coming into the year, so with a muted start to the year, the gap between sentiment and reality is bigger than usual," Greg Bedrosian, the CEO of tech-focused investment bank Drake Star Partners, said in an interview with S&P Global Market Intelligence. "And then the tariffs came in heavier and more complex than expected, causing market uncertainty."

Good news, bad news

On one hand, concerns about tariffs have inserted additional uncertainty into the tech M&A market. On April 2, Trump announced a 10% "baseline" tariff on imports to the US and what the White House called reciprocal tariffs on imports from individual countries. The highest tariffs were set for several Asian markets that have large trading deficits with the US, such as Mainland China, India, Taiwan, South Korea and Vietnam. Notably, these markets are also key hubs in tech supply chains.

On April 9, Trump posted on social media that most tariffs would be limited to 10% amid a 90-day pause, although tariffs on goods from China would be raised to 125%.

Dan Ives, a famously bullish tech analyst at Wedbush Securities, in a recent note called the "tech investing landscape the most difficult I have seen in 25 years covering tech stocks on the Street."

At the same time, however, there are signs that the regulatory environment is becoming more conducive to tech M&A, at least judged by deal announcements. The Alphabet-Wiz deal is the first large transaction announced by Big Tech since 2022 when Microsoft Corp. acquired Activision Blizzard Inc. for $66 billion.

In the two years through 2024, a few transactions announced by Big Tech — including Amazon.com Inc.'s acquisition of iRobot Corp. and Adobe Inc.'s buyout of Figma Inc. — did not pass muster with regulators, leading to a chilled M&A environment for large deals.

"The regulatory environment is opening up. You had a 100% shutdown by Biden, but that is opening up," Ben Howe, CEO of tech-focused investment bank AGC Partners, told S&P Global Market Intelligence in an interview.

Middle market

Midsize M&A, where most activity has been concentrated in the past few years led by buyout shops, could also stay healthy.

"There are longer-term structural dynamics that persist and are supportive of middle-market M&A — like record dry powder with private equity firms, continued sponsor interest in monetizing long-held assets, and high-quality companies already in market seeing real buyer engagement," Bedrosian said.

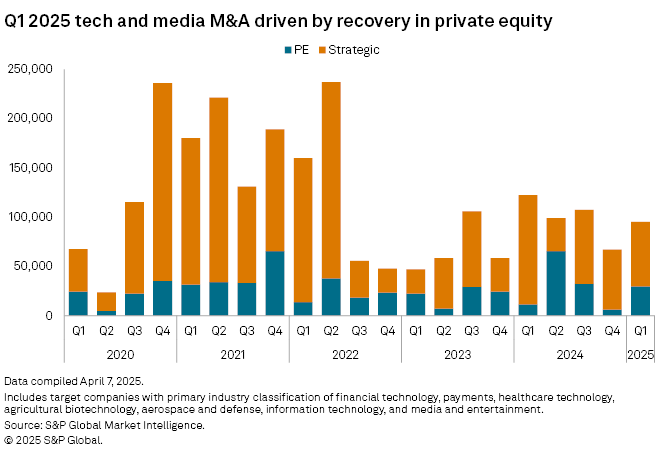

Just like in previous quarters, a substantial portion of tech M&A activity has been driven by private equity firms. In the first quarter, about 31% of deal value represented private equity deals, outpacing the average for the past 21 quarters of 27%. Strategic buyers have not been as active as expected.

Looking forward, the stock sell-offs triggered by tariff jitters could actually boost M&A, as the spread between the bid-ask gap gets smaller as stock prices drop.

"Public stocks are cheaper and potential sellers, along with just about everybody, has received some shock treatment over the last few days that valuations do not just always go well," Howe said. "Depending on their situation, now may be the best time to sell your business."

Fintech and AI

Substantial deals are happening in areas like financial technology, where valuations are not what they were a few years ago. Among the largest 30 deals of the first quarter, more than a quarter were in fintech.

"Investors are being more selective than ever, and only the most compelling fintechs will secure funding. Meanwhile, big players will continue acquiring instead of investing, making consolidation the name of the game," said John Clark, an investment banker at fintech-focused investment bank Royal Park Partners, to S&P Global Market Intelligence.

Additionally, AI is attracting strategic bidders willing to pay higher prices. ServiceNow Inc. paid $2.85 billion for agentic AI company Moveworks Inc., which in September 2024 had surpassed a $100 million annual revenue run rate. SoftBank Group Corp. acquired AI chip inferencing company Ampere Computing LLC for $6.5 billion. Ampere ended 2024 with just $16 million in revenue.