Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Apr, 2025

By Brian Scheid

The US dollar's decades-long status as a safe haven currency is under threat in the wake of President Donald Trump's far-reaching new tariffs.

The tariffs on US imports from nearly every country in the world are expected to spike prices for US consumers, fuel another sustained increase in inflation, weaken real yields and accelerate global cynicism of America's traditional role as an economic leader, economists said. These new tariffs could present an unprecedented risk to the dollar's standing as a reliable store of value during times of market turbulence.

"I do see these tariffs as having the potential to undermine the role of the dollar," Jesse Schreger, an economist at Columbia Business School, said in an interview. "Fundamentally, to be the world's safe haven currency, everyone around the world needs to believe that they can always convert their US dollars to buy the goods and services they actually need. The nature of this policymaking calls this into question: If people cannot be sure how the United States will behave, how can they know that their dollars will buy them what they need in times of stress?"

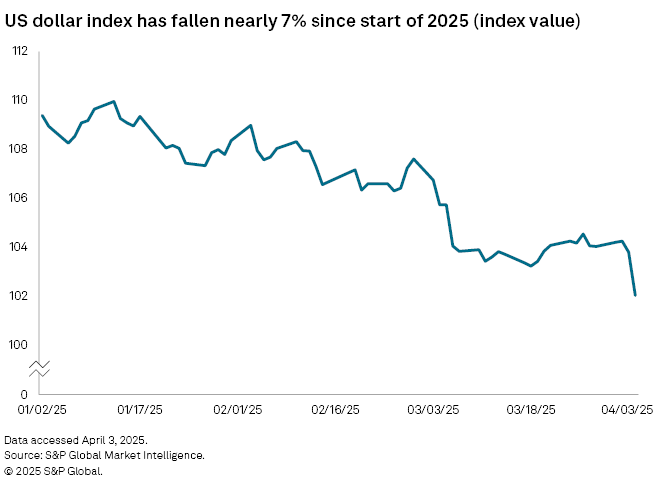

The US dollar index, a measure of the dollar against a basket of other widely traded international currencies, has fallen nearly 7% since the start of the year, but the downward move is not entirely due to tariffs, according to Francesco Pesole, a foreign exchange strategist at ING.

The initial, prevailing view in currency markets was that tariffs would prove to be positive for the US dollar, but this was based on an assumption that the US economy would remain robust and Trump would have already delivered on his deregulation and fiscal stimulus efforts to further momentum, Pesole said. Instead, Trump's tariffs were announced April 2 at a time of declining US growth expectations, deteriorating consumer sentiment and other weakness in forward-looking indicators, according to the foreign exchange strategist.

"So the decline in the dollar is mostly mirroring the markets' view that tariffs will exacerbate an already soft US outlook," Pesole said.

This rise in instability and uncertainty in US markets, Pesole said, has "clearly dented" the dollar's status as a safe haven currency as the Japanese yen, Swiss franc and euro appear to be emerging as alternative, safer investments in foreign exchange.

With growth slowing, the AI boom fading and investors bracing for a recession, the "US exceptionalism" trade that dominated global markets appears to be collapsing, said Karl Schamotta, chief market strategist at Corpay.

If the economy weakens further, so will the dollar, according to Schamotta.

"The dollar's safe haven status is fundamentally underpinned by the size of the economy, the scale of its trade linkages, the depth and liquidity of American financial markets, the stability of major institutions, and confidence in the rule of law," Schamotta said. "A future in which this changes — in which the economy grows more slowly, trade flows shrink, financial markets work less efficiently, major institutions are destabilized and the rule of law is brought into question — could weaken the dollar's dominance and prompt a reconsideration of alternative currencies."

It could be decades, however, before the dollar's role is supplanted, Schamotta said.

Safe haven reputation

For decades, the dollar has been seen as one of the world's few safe haven currencies, one that can retain and even increase in value during stretches of turbulence in global financial markets. Bolstered by America's perceived stability and economic stature, robust liquidity, relatively mild inflation and a stable political system, the dollar has long proven to be a dependable investment shield against economic turmoil.

This safe haven reputation has led the dollar to be the world's chief reserve currency, widely used in global trade and finance.

But the Trump administration's historic wave of new tariffs, and the process through which they were calculated and announced, has exposed cracks in the dollar's reputation, and the consequences may last generations.

"This rift that now exists between the US and many of its allies suggests that trust has been broken," said Jane Foley, head of foreign exchange strategy at Rabobank.

The US dollar has been the world's most widely used currency since the US emerged from World War II as protector of the free world, Foley said. The dollar's standing was bolstered as the British Empire broke down and the US established trust in its financial system throughout much of the world via its commitments to NATO and other global agencies, according to Foley.

The dollar is not at risk of losing its safe haven status in the near term since it is currently used in about half of all global invoices and Europe still relies heavily on the US for defense, Foley said. But efforts to lessen dollar reliance could soon be underway, and established norms could shift drastically if the world falls into trading blocs.

"Measures will be taken to loosen the links and this will probably also mean a move away from reliance on the [dollar] which will lessen the role of the [dollar] as a safe haven," Foley said. "This, however, will take time."