Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Apr, 2025

By Zoe Sagalow and Gaby Villaluz

Several swift US bank deal regulatory approvals so far this year have the industry hopeful deals can get done faster than in the previous four years.

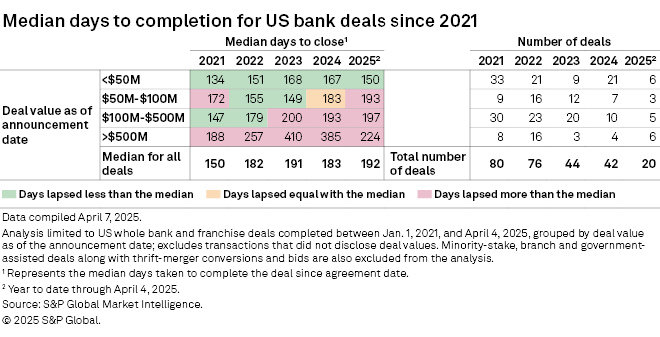

So far this year, completed deals with a value below $50 million and above $500 million at announcement have seen faster closing timelines than they have since 2021. The six deals with values below $50 million completed this year have taken a median of 150 days to close, an improvement from 151 days in 2022, 168 in 2023 and 167 in 2024, an analysis by S&P Global Market Intelligence showed. Larger deals with a value over $500 million are also at their lowest median days to close since 2021.

"All government agencies that interact with banks seem less combative and more collaborative," Brian Martin, director of equity research at Janney Montgomery Scott LLC, wrote in an email. "This does not mean lax or easy, [but] it really implies that well-run institutions with completed merger applications are getting less delays and run-around than we saw in prior years." Martin compared the current environment to 2017-2019, during President Donald Trump's first term.

"What they're trying to demonstrate, perhaps, is that they are trying to get faster with approvals, and whether it's a plain vanilla simple transaction or not, the desire is to demonstrate that they are doing this quickly," Joseph Silvia, a Duane Morris LLP partner who advises financial institutions on M&A and other topics, said in an interview.

While the overall median for deals completed so far this year is the longest in at least the past five years, industry observers expect that to decline. Several recent speedy regulatory approvals that led to quicker expected closing time frames support that outlook.

Cadence Bank's $105.8 million acquisition of FCB Financial Corp., which was announced on Jan. 22, was approved in only 61 days. The swift approval pushed Cadence's estimated closing time for the deal to May 1, from a third-quarter estimate when the deal was announced.

While deals with a value between $100 million and $500 million have yet to see a meaningful decline in days to close, Glacier Bancorp Inc.'s recent swift approval of its acquisition of Bank of Idaho Holding Co. in 86 days could bring that median down. The Glacier-Bank of Idaho deal is the second-largest US bank deal announced this year with a $246.2 million value at announcement.

"In addition to the moderate improvement in the actual data, anecdotal evidence certainly feels constructive," Brendan Nosal, a director focused on US bank equity research at the Hovde Group LLC, wrote in an April 2 report. "Plus, [regulatory] approvals feel like they're coming in large batches, at times, which gives the feeling of moving through the backlog."

The analyst pointed to several examples, like Old National Bancorp's $1.40 billion purchase of Bremer Financial Corp., which was announced on Nov. 25, 2024, and originally expected to close in mid-2025, but now expected to close on May 1 after receiving all regulatory approvals by March 19.

Those examples could be harbingers of a change in attitude at the federal regulators, partly thanks to new regulatory heads with more M&A-friendly outlooks. Federal Reserve Governor Michelle Bowman, whom Trump nominated for the Fed in 2018 and nominated for the role of vice chair for supervision in March 2025, has pushed for faster approvals, and so has FDIC acting Chairman Travis Hill, who recently led a proposed withdrawal of the 2024 merger statement of policy.

"This is something those two particular people specifically have been advocating for," James Stevens, partner and co-leader of Troutman Pepper Hamilton Sanders LLP's Financial Services Industry Group, said in an interview. "It is safe to say that we are going to see faster approval times. And I think that maybe that will reveal itself when we get some more complicated transactions."

Transaction tests

However, it remains to be seen if most deals will get a brisk green light. Transactions involving banks with regulatory issues, large deal values or similarly sized institutions could still see prolonged timelines.

"When we see a transaction that potentially has a little hair on it, whether it's the target has some kind of compliance issue or an enforcement action that needs to get taken care of, or we have a small questionable, competitive issue, that's when we'll really see what the administration's policy is going to be," Silvia said.

A major test for the new administration's outlook on bank M&A will be a sizable transaction. So far, it has only approved smaller, more vanilla community bank deals. But given recent stock price volatility and economic uncertainty following the president's tariff news, it might be a while before there is a bigger or more complex deal that can show banks and industry observers how rapidly the new administration will handle these types of transactions, experts said.

Nonetheless, the administration is already showing signs of being good for banks and businesses more broadly.

"The appetite for the new administration is to, again, be pro-business, ensure that banks can operate in a way that ensures their profitability, supporting mergers when it makes sense and the institutions, the resulting institution will be safe and sound and will be operating in a way that ensures its success," Marina Olman-Pal, co-chair of the financial regulatory and compliance practice at Greenberg Traurig PA, said in an interview.