Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Apr, 2025

By Darren Sweeney and Gaurang Dholakia

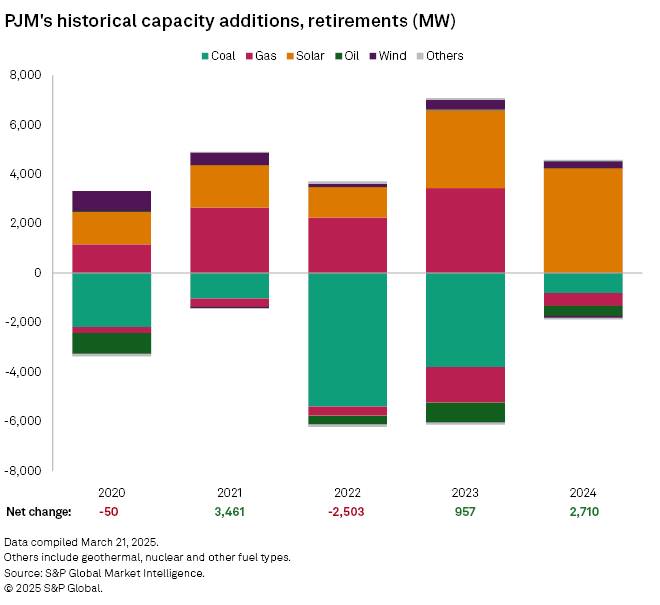

The PJM Interconnection LLC market will continue to see an abundance of intermittent resources added to its grid in 2025 but will lose about 3 GW of fossil fuel resources, all while calls to add and preserve dispatchable generation grow louder.

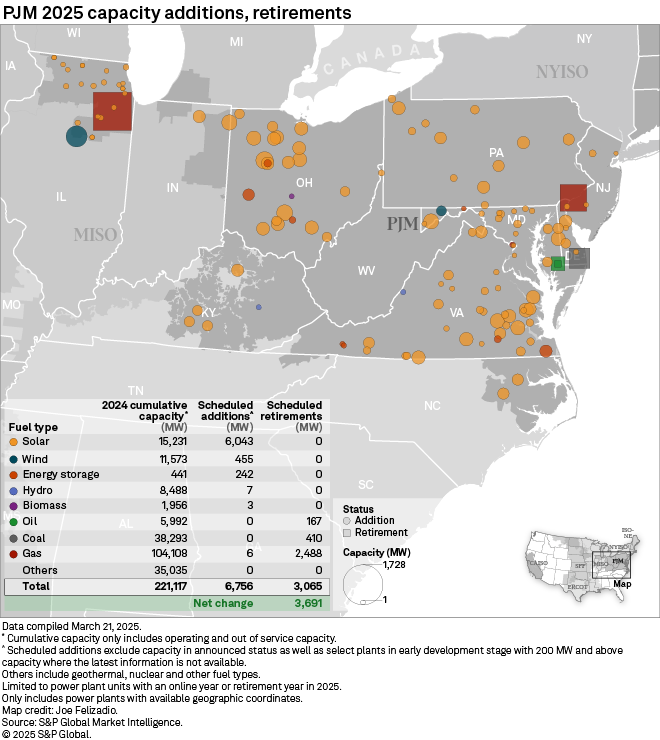

Developers are scheduled to add about 7 GW of capacity across PJM's mid-Atlantic footprint in 2025, including more than 6 GW of solar, according to an analysis of S&P Global Market Intelligence data.

PJM, which serves all or parts of 13 states and Washington, DC, also could add 455 MW of wind generation and 242 MW of energy storage in 2025, the analysis shows. There is one, 6-MW natural gas-fired unit scheduled to be added to the grid, but 2,488 MW of gas-fired resources are set to come offline.

In addition, 410 MW of coal-fired generation and 167 MW of oil-fired resources are scheduled for retirement in 2025. This represents a net change in capacity of about 3.7 GW.

Meanwhile, the operator of the nation's largest electricity grid added about 4.5 GW of primarily solar capacity in 2024, short of the 10 GW forecast for the year. The analysis shows 1,868 MW of capacity was retired in 2024.

"It is clear that we need more supply," Joe Bowring, president of Monitoring Analytics, PJM's independent market monitor, said during a March 13 conference call with reporters. "And part of the question is why haven't we been getting it?"

Bowring, during the call to discuss Monitoring Analytics' 2024 "State of the Market" report for PJM, said one of the issues the grid operator is facing is processing its interconnection queue.

"PJM significantly reformed its queue process," Bowring said. "But if you look at the details, there is more than 200,000 MW of supply in the queue. Most of it is renewables, and we expect a very small part of that to ultimately become capacity, something on the order of 10,000 MW out of the 200,000 actually become capacity."

Preserving, building reliability

To help address this backlog, the Federal Energy Regulatory Commission in February approved PJM's proposal to enable 50 "shovel-ready, high-reliability" generation projects to move ahead in the interconnection queue. The Reliability Resource Initiative has received 94 applications representing 26.6 GW of nameplate capacity, evenly split between uprates of existing generation and proposed new builds, PJM said in a March 21 news release.

"We think PJM needs to do that on a more permanent basis," Bowring said. "PJM needs to be allowed to make it possible for any new generation resources that believe they can be online to help solve that [resource adequacy] problem to not go through a lengthy multiyear queue process, but to move ahead."

As another part of the queue reform process, FERC in late 2022 approved PJM's move to a "first-ready, first-served" approach to clear a backlog of more than 250,000 MW in proposed generating capacity. More than 95% of those projects represent renewable energy, battery storage or a hybrid of both.

"Currently, approximately 50 GW of generation is through the queue with completed studies, approximately 18 GW is being processed to move to the final study phase for completion this year, and an additional [approximately] 50 GW will be through the queue by late 2026," PJM President and CEO Manu Asthana said in testimony presented March 25 to members of the US House Energy and Commerce Committee's energy subcommittee.

Asthana also told lawmakers that the nation's wholesale markets are sending the appropriate signals to incent the generation needed to meet skyrocketing demand and maintain reliability.

The auction for PJM's 2025/2026 delivery year cleared at $269.92/MW-day for much of the grid operator's footprint, a nearly tenfold increase from $28.92/MW-day for the 2024/2025 auction.

S&P Global Commodity Insights energy analyst Tanya Peevey said there is unlikely to be a near-term shift in the capacity picture for PJM.

"It takes time. And right now, a lot of the queue is still heavy on the renewables side of things," Peevey said. "And so, I think there is going to be a lag between the price signal and what actually is able to come online."

The price signals, however, will help existing resources stay online longer and postpone retirements, Peevey added.

PJM and Talen Energy Corp. earlier this year entered into a "reliability-must-run" arrangement that will keep the power producer's Brandon Shores and Herbert A Wagner power plants online another four years until system upgrades are complete.

Under the agreement that also involves the Maryland Public Service Commission, the Sierra Club and other stakeholders, Talen will operate the units through May 31, 2029.

Talen will receive fixed payments of $312/MW-day to operate Brandon Shores and $137/MW-day to operate Wagner as part of the agreement, which must be approved by FERC and has been contested by Monitoring Analytics.

Datacenters and demand

When it comes to meeting the insatiable electricity needs of datacenters and other energy-intensive industries, PJM market observers say it is important not to exclude any valuable resource.

"To be clear, PJM needs everything," Peevey said. "There's nothing that they're not considering."

PJM predicts a load increase of about 5 GW from 2025 to 2026, the analyst noted.

"There is no way you can do it all with renewables," Peevey said, adding that other flexible resources will be needed especially during times of peak demand.

In addition, this intense demand and an electrification push are expected to dramatically shift the long-term generation picture.

"I wouldn't be surprised if the resource mix in the queue is quite different in a few years than it is now, because all that datacenter demand is definitely not a fairytale," Peevey said.

Capacity additions

The 250-MW Hardin Solar III Energy Center in Hardin County, Ohio, is the largest renewable project expected to come online in PJM this year, according to the analysis.

WEC Energy Group Inc. in February acquired a 90% interest in the project, which is being developed by Invenergy LLC. Ohio regulators approved the project in September 2021 and its output is set to be sold through a 15-year power purchase agreement with Dominion Energy Inc., according to Market Intelligence data.

Dominion, meanwhile, is expected to bring online the 200-MW Atlanta Farms Solar Project in Pickaway County, Ohio, in 2025. The merchant project's output will be sold under a 15-year power purchase agreement with American Electric Power Co. Inc.

The 175-MW CPV Backbone Solar Project in Garrett County, Maryland, owned by Competitive Power Ventures Inc., has an estimated completion date of August. Its output is under contract with Amazon.com Inc.

Clearway Energy Group LLC's 55-MW Dan's Mountain Wind Farm in Allegany County, Maryland, is expected to come online this spring. The project has been under development for more than a decade. Power produced by the wind farm will be sold to Constellation Energy Corp. under a 12-year contract.

Retirements

The 1,728-MW Elwood Energy gas-fired power plant in Will County, Illinois, is expected to shut down in June, and Constellation plans to retire the 760-MW Eddystone 3-4 units in Delaware County, Pennsylvania, the same month.

Meanwhile, the private owner of the 483-MW Elgin Energy Center in Illinois decided it will no longer retire the four-unit, gas-fired power plant in mid-2025.

NRG Energy Inc. in February retired the 410-MW Indian River coal-fired unit 4 in Sussex County, Delaware, after PJM ended its must-run agreement following transmission upgrades.

NRG also will shut down its 153-MW Vienna and 14-MW Vienna CT oil-fired units in Dorchester County, Maryland, in June.

Power prices

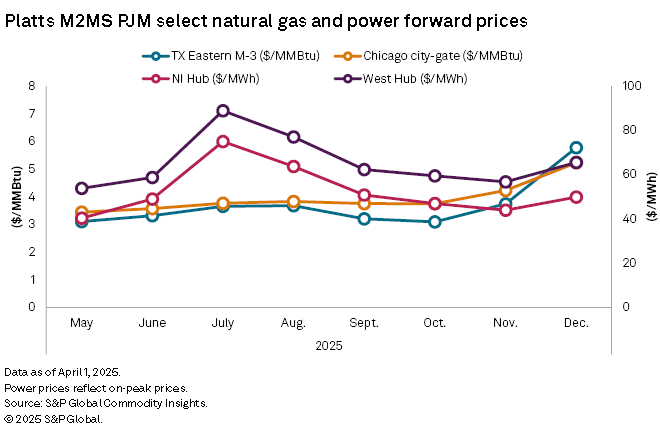

PJM forward power prices in the PJM NI hub are expected to peak at $75.00/MWh in July for the summer and $49.90/MWh in December for the winter, according to Platts M2MS data. PJM West Hub power prices peak at $88.85/MWh in July for the summer and $65.55/MWh in the winter.

Texas Eastern M-3 gas prices peak at $3.68/MMBtu in August and $5.78/MMBtu in December, according to Platts data. Chicago city-gate gas prices peak at $3.83/MMBtu in August and $5.23/MMBtu in December.