Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Apr, 2025

By Zack Hale and Susan Dlin

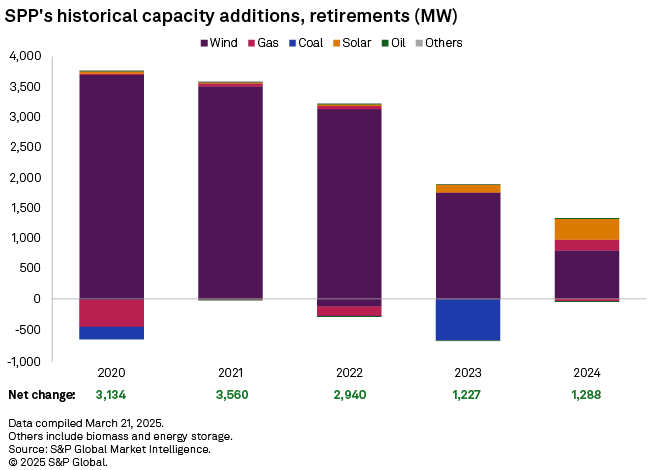

The Southwest Power Pool region is poised to add record amounts of solar, energy storage and natural gas-fired capacity this year as the 14-state grid operator braces for a potential 75% increase in peak electricity demand by 2035.

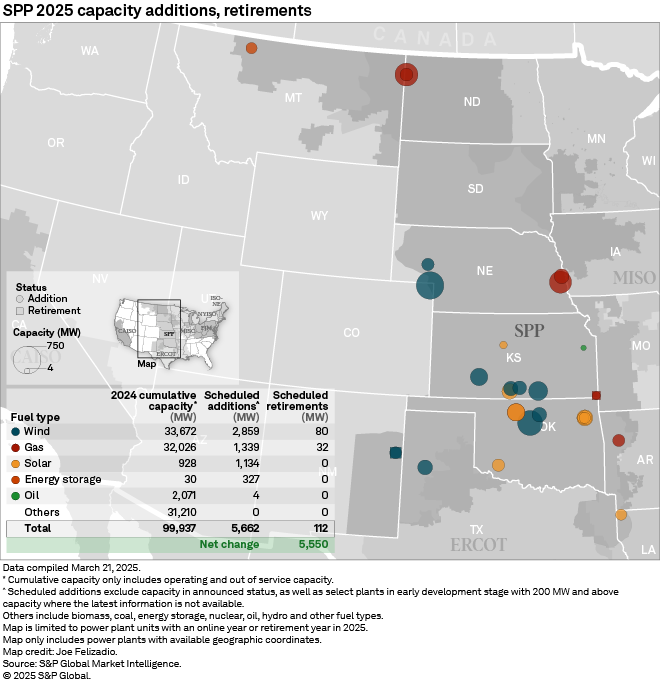

SPP's scheduled capacity additions for 2025 include 2,859 MW of wind, 1,339 MW of gas, 1,134 MW of solar and 327 MW of energy storage, according to an analysis of S&P Global Market Intelligence data.

For the second straight year, the grid operator does not anticipate any significant retirements of baseload generation, with just 80 MW of wind and 32 MW of gas-fired capacity scheduled for closure in 2025.

Overall, the SPP system is scheduled to add 5,550 MW of net generating capacity in 2025, although actual additions are expected to be lower at year-end, given historical project completion rates.

A significant number of projects with 2025 in-service dates are already under construction. That includes 886 MW of wind, 1,312 MW of gas-fired capacity, 682 MW of solar and 75 MW of energy storage capacity, according to Market Intelligence data.

For context, SPP added 802 MW of wind, 179 MW of new gas-fired capacity, 343 MW of solar and 30 MW of energy storage in 2024, the data shows.

Generator additions

Invenergy LLC's 598-MW Wagon Wheel Wind Project in Logan County, Oklahoma, and NextEra Energy Inc.'s 250-MW Skeleton Creek Solar Project in Alfalfa County, Oklahoma, are under construction with target in-service dates in December.

In Kansas, Invenergy's 153-MW Flat Ridge V Wind Project in Barber County and 135-MW Flat Ridge IV Wind Project in Kingman County have broken ground and are expected online before the end of the year.

Two gas-fired units at Basin Electric Power Cooperative's existing Pioneer Generating Station in North Dakota — totaling 491 MW of new capacity — are under construction with in-service dates in June and September. Another 450 MW of new gas-fired capacity at the Omaha Public Power District's planned 675-MW Turtle Creek Station in Sarpy County, Nebraska, is expected online this spring.

In September 2024, Berkshire Hathaway Energy subsidiary BHE Montana LLC broke ground on its 75-MW Glacier Battery System in Toole County, Montana. With a target in-service date in December, the stand-alone facility will be used to support real-time scheduling of electricity from BHE Montana's wind and solar projects.

Grid studies, transmission planning

Lanny Nickell, SPP's new president and CEO, said his top near-term goal is connecting more new generation and transmission to the SPP system.

"We need to be able to do so quicker than we've ever done before," Nickell told Platts, part of S&P Global Commodity Insights, in an April interview days after officially stepping into the CEO role.

To that end, SPP is working to cut the average wait time to one year for the grid studies it must perform before offering project developers a generator interconnection agreement (GIA).

"The fact that it used to take four years to do a generator interconnection study, or at least to provide a GIA — that's not sustainable, and we can't do that anymore," Nickell said earlier this month during a presentation for WIRES, a pro-transmission trade group. "Our goal is, by the end of this year, to be able to provide a GIA in one year from the time the study began."

Nickell said the use of AI in SPP's grid study process could further reduce wait times to less than 12 months.

Meanwhile, SPP is advancing a $7.68 billion portfolio of regional transmission projects approved by SPP stakeholders in October 2024. The portfolio, estimated to deliver $8 to $9 in net benefits for every dollar invested, is five times larger than any package previously approved for SPP.

As part of the plan, in February SPP selected Xcel Energy Inc. to build the region's first 765-kV transmission line. With an expected cost of nearly $1.7 billion, the 293-mile Phantom-Crossroads-Potter line will run from Amarillo, Texas, to south of Portales, New Mexico. The high-voltage line, designated as a short-term reliability project, will terminate in Lea County in the southeastern corner of New Mexico, part of the oil-rich Permian Basin.

In addition, SPP is pursuing a portfolio of seams projects identified through its joint targeted interconnection queue (JTIQ) planning process with the neighboring Midcontinent ISO.

In 2023, the Biden administration announced $464 million in bipartisan infrastructure law funding to support five JTIQ projects across seven Upper Midwest states. The Federal Energy Regulatory Commission subsequently approved a joint cost allocation framework for the JTIQ portfolio in November 2024.

Upon taking office, however, President Donald Trump paused the disbursement of loans and grants funded by the 2021 infrastructure law. That prompted Nickell and MISO President and CEO John Bear to write to the Energy Department to express a continued need for the JTIQ projects for grid resilience and affordability reasons.

Nickell said the grid operators are waiting on receipt of the federal funding to help pay for grid upgrades that have already been assigned to transmission owners.

"Will the projects not move forward without the funding? It's hard to say," Nickell told Platts. "With the funding, they'll absolutely move forward."

Future resource adequacy

SPP's most recent long-term demand forecast anticipates the region's peak load to grow from 56 GW in 2024 to 97 GW by 2035. Datacenter demand, the electrification of heating and transportation, and a resurgence in US manufacturing are driving the growth projections, Nickell said.

As part of its strategic planning efforts, in 2024 SPP commissioned The Brattle Group to study what the most cost-effective future resource mix might look like for the SPP footprint through 2050.

The Boston-based consulting firm released the study results in March, with a topline finding that between $88 billion and $263 billion in new generation could be needed to support SPP's load growth by midcentury. SPP could need up to 48 GW of new wind, 130 GW of new solar and 59 GW of new battery storage by 2050 assuming high load growth and 90% annual carbon-free generation, the study found.

Moreover, the Brattle researchers concluded that the cost of SPP's modeled generation mix would not have a material impact on customer bills. In fact, the portfolio's estimated cost would slightly lag the expected rate of inflation if federal clean energy tax credits remain intact, said Johannes Pfeifenberger, a principal at Brattle and one of the study's co-authors.

"Our results show that there are pathways over the next 25 years under which SPP can meet its load growth and do so reliably but also do so cost-effectively, particularly if the tax credits remain available," Pfeifenberger said in an interview.

Of particular note was the study's finding that thermal generation is still expected to account for 41% to 62% of SPP's rated resource adequacy capacity by 2050, even under scenarios that assume 90% annual clean energy generation, Nickell said.

"Based on an assumption that the industry will continue to trend toward cleaner sources of energy, I think that's probably a safe bet," Nickell said.

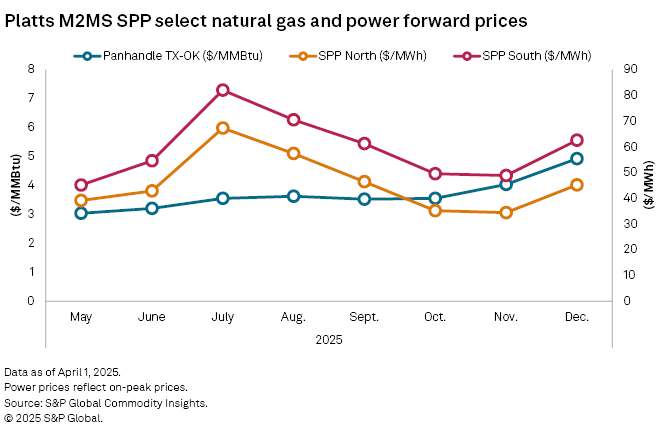

Forward prices

Power prices at the SPP North hub are forecast to peak in July at $67.25/MWh, according to Platts M2MS data, and to hit $45.15/MWh in December. At the SPP South hub, are forecast to hit $82.00/MWh in July and $62.55/MWh in December.

For natural gas, prices are forecast to peak at $3.63/MMBtu in August at the Panhandle TX-OK hub, according to Platts M2MS data, and to hit $4.92/MMBtu in December.