Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Apr, 2025

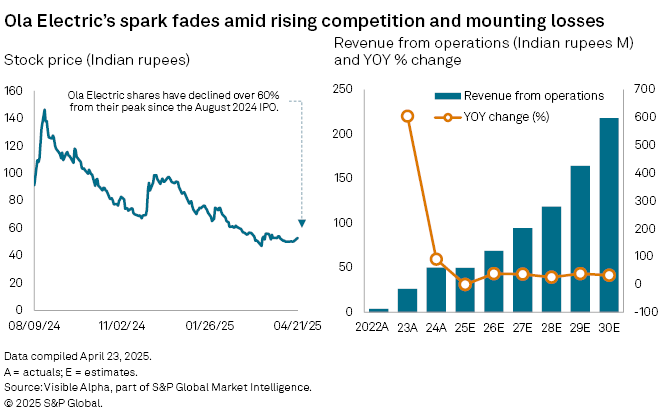

Ola Electric Mobility Ltd. (NSE: OLAELEC), India’s leading electric two-wheeler maker, is struggling to maintain its early lead in a fast-growing but increasingly competitive market. Shares have plunged more than 60% since their August 2024 peak, as investors grow wary of intensifying rivalry from established players like Bajaj Auto Ltd. (NSE: BAJAJ-AUTO) and TVS Motor Company Ltd. (NSE: TVSMOTOR), alongside nimble challenger Ather Energy.

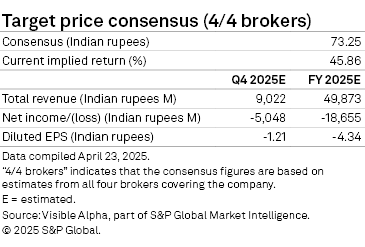

Once buoyed by ambitious expansion plans, Ola Electric now faces operational headwinds. A surge in customer complaints over product quality has weighed on brand perception, denting sales momentum. Analysts expect the company’s revenue from operations to edge down 0.45% in 2025 to ₹50 billion—marking a sharp reversal from the 90% growth recorded last year, according to Visible Alpha consensus estimates.

Losses are also set to deepen. Net losses are forecast to widen to ₹18.7 billion in 2025 from ₹15.8 billion the previous year, as the company continues to burn cash in a bid to shore up market share. With margins under pressure, consumer trust in flux, and intensifying Ola’s share of the electric scooter market is projected to drop from 34.6% in 2024 to 31% in 2025—and could decline further to just 21% by the end of the decade.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for S&P Capital IQ Pro.

– Access Visible Alpha estimates on Ola Electric Mobility.