Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Apr, 2025

By Marissa Ramos and Ben Meggeson

Listen to a discussion of this ranking on Market Intelligence's Spanish-language Horizontes de Latinoamérica podcast on S&P Global, Spotify or Apple Podcasts.

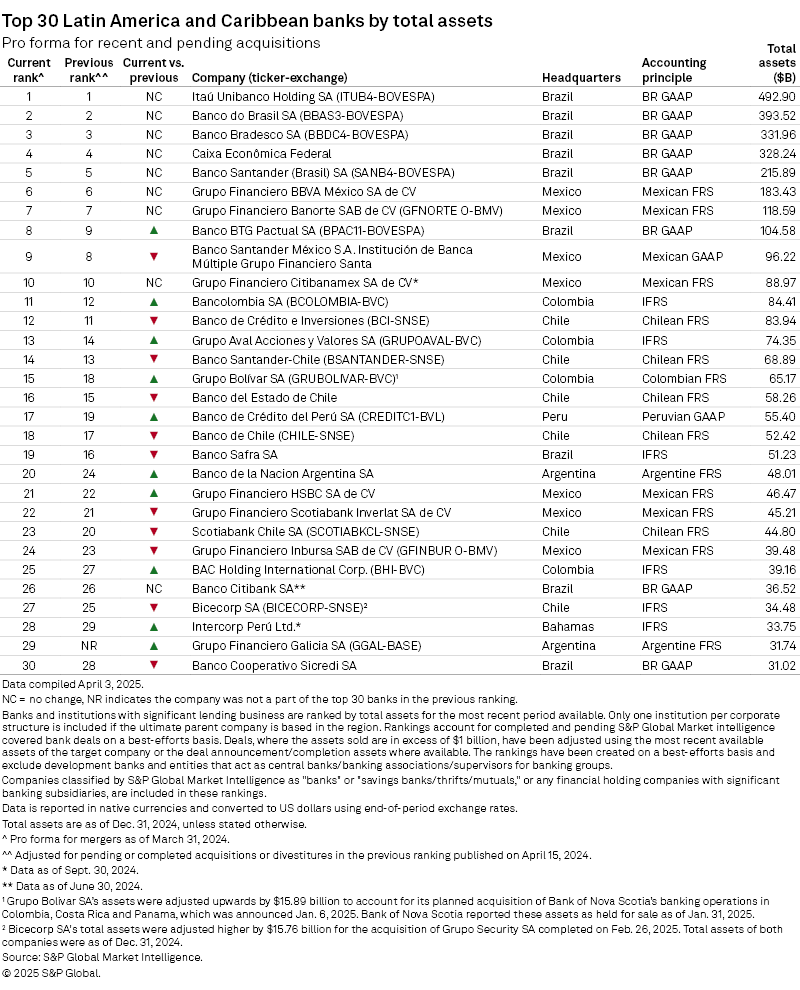

Argentina-based Grupo Financiero Galicia SA became one of Latin America's 30 largest banks by assets following its acquisition of HSBC's Argentinian operations in 2024.

With total assets of $31.74 billion, Galicia placed 29th in S&P Global Market Intelligence's 2025 ranking, above Brazil's Banco Cooperativo Sicredi SA

The region's five biggest banks are all Brazilian — Itaú Unibanco Holding SA Banco do Brasil SA, Banco Bradesco SA, Caixa Econômica Federal and Banco Santander (Brasil) SA. Itaú Unibanco's assets totaled $492.90 billion at the end of 2024.

Mexican banks Grupo Financiero BBVA México SA de CV, Grupo Financiero Banorte SAB de CV, Banco Santander México SA and Grupo Financiero Citibanamex SA de CV, and Brazil's Banco BTG Pactual SA complete the top ten.

Colombia's banks gained ground in 2024 and each climbed at least one spot in the ranking: Bancolombia SA to 11th from 12th; Grupo Aval Acciones y Valores SA to 13th from 14th; Grupo Bolívar SA to 15th from 18th; and BAC Holding International Corp. to 25th from 27th.

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the period. To be eligible for inclusion in pro forma adjustments, the amount of assets being transferred had to be at least $1 billion, unless otherwise noted. Assets reported by non-US-dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of banks were ranked by total assets as of Dec. 31, 2024. In the previous ranking, published April 15, 2024, most company assets were as of Dec. 31, 2023, and were adjusted for pending and completed M&A as of April 24, 2023.

To view an Excel spreadsheet containing the top 30 Latin America banks, click here.

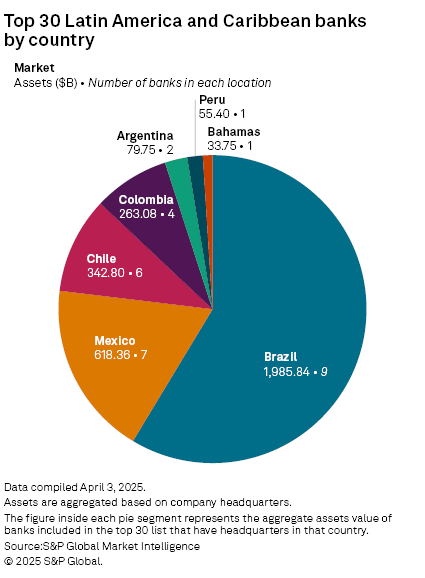

Brazil has the most banks in the ranking, with nine lenders holding a total of $1.986 trillion in assets. Next is Mexico with seven banks, then Chile with six and Columbia with four.