Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Apr, 2025

By Samantha Lipana and David Hayes

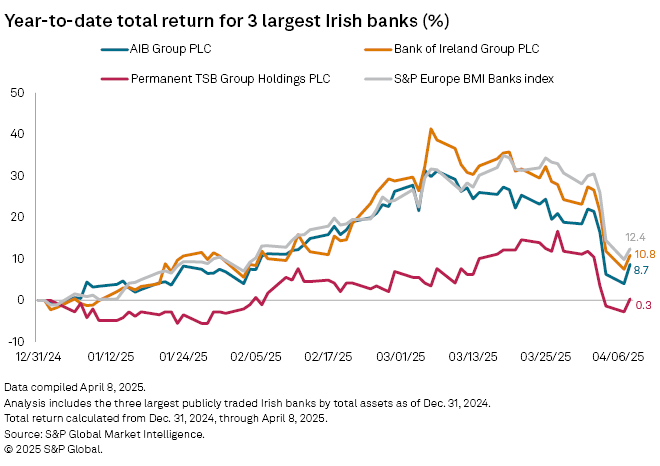

Irish banks enter a period of global economic uncertainty with strong asset quality, capital levels and profitability, S&P Global Market Intelligence data shows.

US President Donald Trump on April 2 unveiled sweeping tariffs on global trading partners. As of April 11, the EU faces a 10% levy.

Impact on the Irish economy

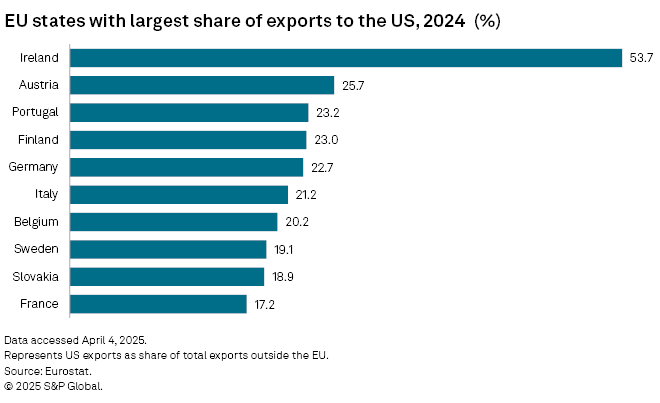

New US trade tariffs could have a more pronounced effect on the Irish economy, which is heavily reliant on the US as an export market. Irish goods exports to the US accounted for more than half of its total exports outside the EU in 2024, surpassing other countries in the bloc by a wide margin, according to Eurostat data.

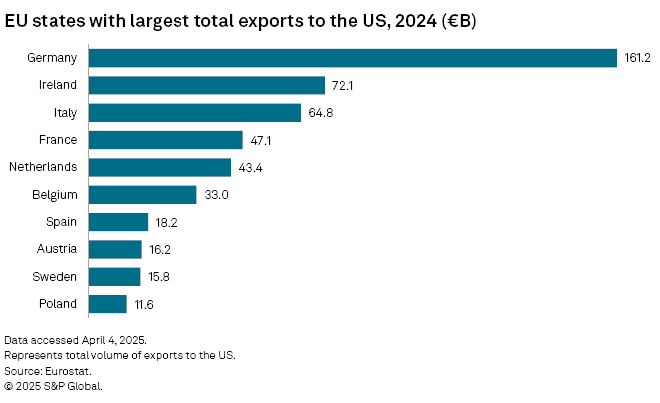

In terms of volume, Ireland is second only to Germany among EU nations with the largest total exports to the US. Ireland's goods-trade surplus with the US came in at just over €50 billion in 2024, based on data from the Irish Central Statistics Office (CSO).

Potential major US tariffs on imported pharmaceuticals could also hit Ireland as its main export products are chemicals and related goods, which include medical and pharmaceutical products. Ireland generated more than €72 billion in total revenue from exports to the US in 2024, €58.32 billion of which were exports of chemicals and related goods, including medical and pharmaceutical products, according to CSO data.

Irish banks in good health

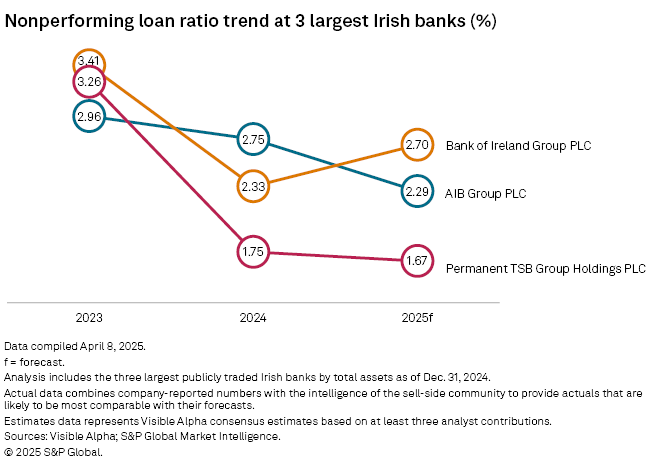

AIB Group PLC, Bank of Ireland Group PLC and Permanent TSB Group Holdings PLC (PTSB) have seen significant improvements in asset quality. Their nonperforming loan (NPL) ratios declined in 2024, ranging from 1.75% to 2.75%.

AIB's loan book grew 6% to €71.2 billion in 2024, while Bank of Ireland's increased 3.5% to €82.5 billion. At PTSB, new lending volumes were offset by the sale of an NPL portfolio during the year.

For 2025, the NPL ratios of PTSB and AIB are projected to further decline to 1.67% and 2.29%, respectively, while Bank of Ireland's is seen ticking up but remaining below 3%, according to Visible Alpha estimates.

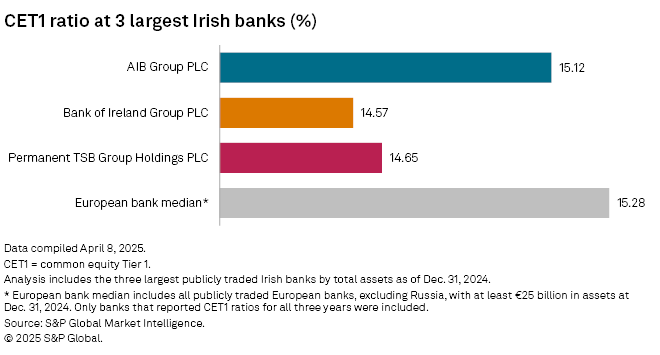

In terms of capital, the banks had common equity Tier 1 (CET1) ratios between 14.57% and 15.12% at the end of 2024 — well above the minimum regulatory requirement of 4.5% and just slightly below the 15.28% median ratio for EU banks.

AIB recently announced plans to repurchase shares worth €1.2 billion directly from the state, after Finance Minister Paschal Donohoe said the government could exit the bank in 2025. Bank of Ireland, meanwhile, has set out a €590 share buyback plan.

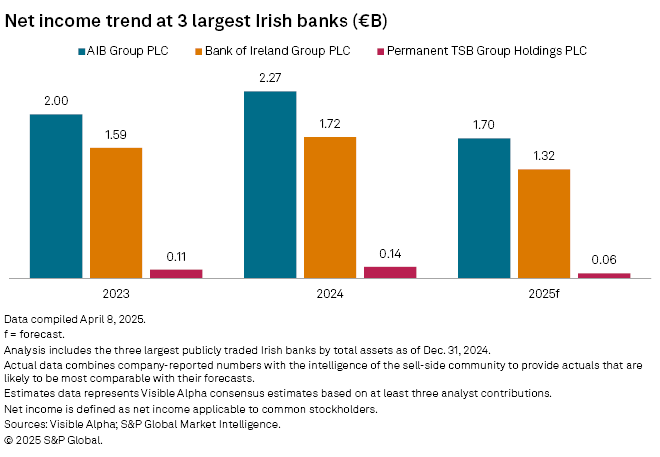

The three lenders also posted higher profits for 2024, with AIB and PTSB booking double-digit growths and Bank of Ireland recording a more than 8% increase.

Irish banks' risk-adjusted profitability should remain solid in 2025 despite declining interest rates, backed by credit growth, tight cost control and a still benign economic environment, S&P Global Ratings said in a report published in January, three months before the sweeping US tariffs were announced.

The Irish economy remains vulnerable to external shocks given its high reliance on international investment.

"Turbulence from global geopolitical and trade tensions could directly affect the small, open Irish economy and indirectly affect Irish banks through transmission channels such as financial market volatility," Ratings said.

For 2025, net income at AIB and Bank of Ireland is expected to drop between 22% and 24%, while PTSB is projected to achieve just half of its 2024 profit, according to Visible Alpha estimates as of April 8.

Knock-on effects on Irish banks

The risk US tariffs pose for banks is a little more abstract. "The real risk [to banks' lending] is an increase in unemployment, should the pharma companies decide to leave Ireland," a move that seems "highly unlikely," Keefe, Bruyette & Woods said in a March 28 research note.

Improved balance sheet and profitability put Irish banks in a strong position to weather uncertainties brought by the tariffs, Davy Research analysts said in a research note on April 4.

"We view tariffs in general as a negative for the operating environment of banks, especially [those] with operations in countries that rely on key exports to the US," Jason Graffam, senior vice president for global sovereign and financial institution ratings at Morningstar DBRS, told Market Intelligence.