Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Apr, 2025

Major North American and European banks' securities services revenues are expected to stay resilient amid tariff-led market turbulence in the first few months of 2025.

Banks' securities services business — including areas such as custody services, fund accounting and administration, broker-dealer clearing and settlement, and corporate trust and depository receipt services — has been booming in recent years due to interest rates, growing client activity and rising custody fees.

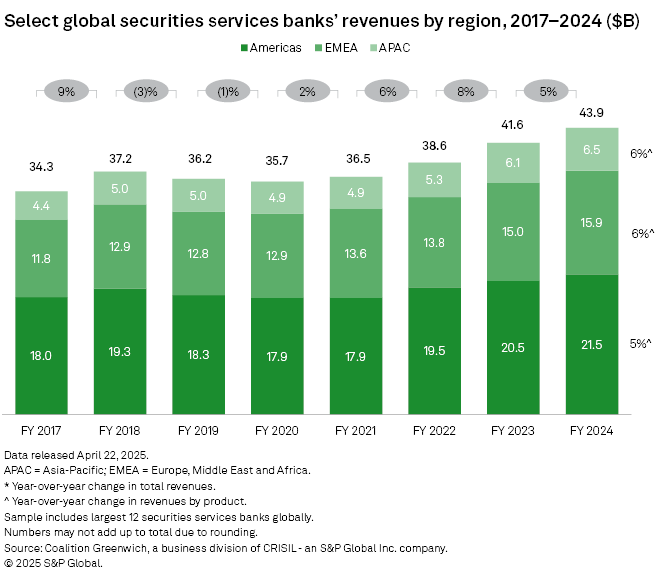

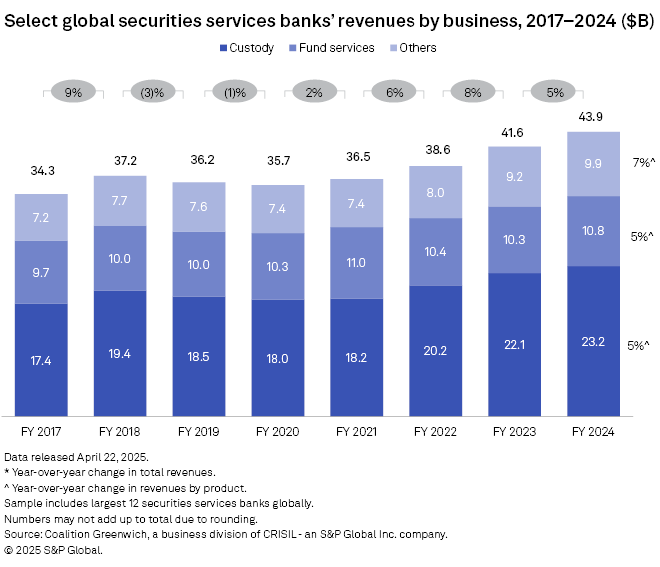

Combined revenues of the world's 12 largest securities services banks increased by 5% year over year to $43.9 billion in 2024, reaching their highest level since 2013, according to data from research company Coalition Greenwich. Sector revenues have been on a continuous rise since 2020, Coalition Greenwich's latest index report shows.

Tariff impact

The announced US tariffs have been increasing market volatility since mid-February amid concerns about slower economic growth and potentially higher inflation. The shift in expectations has also affected the pace of the Federal Reserve's interest rate cuts. At its latest meeting in March, the Fed left rates unchanged to keep inflation in check.

Higher for longer rates will likely give a boost to banks' net interest income (NII), which will benefit securities services revenues, although rising deposit betas and client deposits will also have an impact, said Duncan Woodward, senior research manager, competitor analytics at Coalition Greenwich.

In 2024, NII growth was a key driver of global securities services revenues alongside higher fees, according to the Coalition Greenwich index report.

Positive outlook

Securities services revenues are less exposed to risks posed by short-term market volatility and its impact on investor flows, Woodward said. "It would only have a material impact if there was a general cooling in investor activity across global markets throughout the year leading to lower valuations and transaction volumes," the expert said.

The largest securities services banks are well capitalized, liquid and able to manage the credit risk on their balance sheets to deal with elevated volatility and market uncertainty, Woodward said.

Coalition Greenwich — a division of CRISIL, an S&P Global company — tracks securities services revenues at Brown Brothers Harriman & Co., BNP Paribas SA, Bank of New York Mellon Corp., CACEIS Bank SA, Citigroup Inc., Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Northern Trust Corp., Royal Bank of Canada, Société Générale SA and State Street Corp.

In 2024, the banks' combined revenues grew across regions, with business in Asia-Pacific and Europe, the Middle East and Africa gaining a little more than that in the Americas, which still accounted for the bulk of total sector revenues, Coalition Greenwich data shows.