Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Apr, 2025

| As clean energy contract prices drop, corporate demand for deals is on the rise, also to shore up visibility. Source: sinology/Moment via Getty Images. |

Solar and wind power purchase agreements in Europe have become cheaper and remain in demand in 2025 as renewables buyers seek to counter rising power price volatility.

Falling contract prices are welcome news for corporate buyers in Europe, power purchase agreement (PPA) platform LevelTen Energy Inc. said in its market report for the fourth quarter of 2024.

More volatile wholesale power prices are making fixed-price PPAs more attractive, LevelTen added.

Corporate buyers learned a lesson around price volatility during the energy crisis, said Domenico Franceschino, head of origination for Western and Eastern Europe at Swiss power producer and trader Axpo Holding AG.

While many had a time horizon of one to two years before the crisis, and a focus on low prices, "the mentality has evolved since then," Franceschino said in an interview.

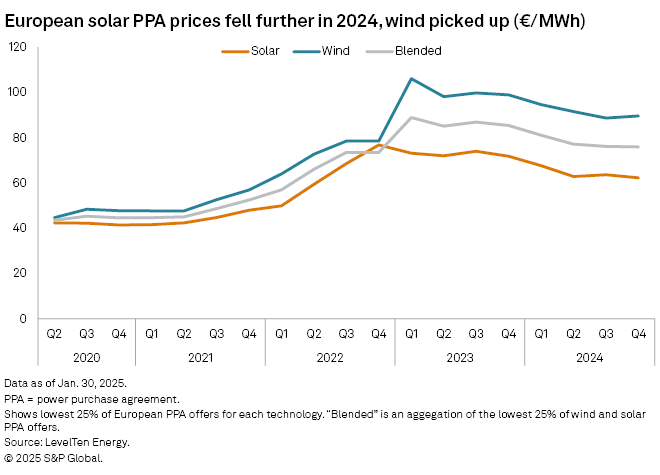

According to LevelTen, European solar PPAs stood at an average of €62.31/MWh in the last quarter of 2024, down from €71.84/MWh a year prior. Wind PPAs averages were gauged at €89.62/MWh, down from €98.92/MWh in the last quarter of 2023.

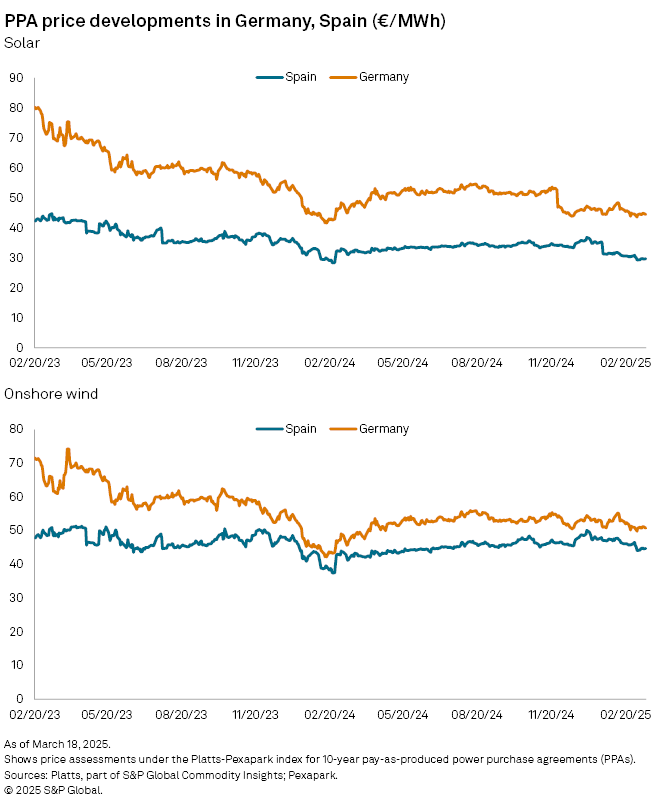

Data from PPA marketplace Pexapark and Platts, part of S&P Global Commodity Insights, showed Spanish solar PPA values below €30/MWh in March 2025, while German wind deals sat around €50/MWh.

In 2024, overall PPA volumes fell in Europe while the number of deals rose, data from Pexapark showed. Spain remained the leading market, with Iberdrola SA the top seller by volume.

Market can move quickly

Amid a wider economic slowdown, demand for PPAs is now at a similar level as it was in early 2024, according to Johan Hernström, head of revenue at Nordic solar developer Alight AB.

The Nordic region is expected to see growth in overall power demand in the coming decades, partly due to the electrification of industry. Momentum in the PPA market is driven by datacenter operators, Hernström said.

"Datacenters, they go after every PPA they can see, and that has, I think, a trickle-down effect on others. They see that if we don't act now, we won't get access to these long-term hedges," Hernström said in an interview. "And I would hope that there is still an urgency around the climate crisis."

PPAs as an energy-sourcing tool have become more widely used in recent years, with procurement teams becoming increasingly sophisticated, Axpo's Franceschino said. While this comes with a growing list of questions, negotiation periods are shortening.

"They realize that the market can move very, very quickly. To have a price valid for weeks — that doesn't exist anymore," Franceschino.

PPA terms and conditions remain varied, and depend on a counterparty's risk appetite, Franceschino added. Pay-as-produced deals can be done at lower prices but present risks in the volatility of generation.

Many buyers are instead looking for generation profiles that suit their consumption patterns, Franceschino said. For a supermarket with daytime opening hours, the generation profile of solar can be a good fit, for instance.

With colocated battery storage increasingly common in solar development, the market may also start seeing integrated hybrid PPAs in the future, according to Alight's Hernström.

Until recently, the cost of longer-duration battery storage "has not been low enough. But now we're seeing two-hour or even four-hour batteries," Hernström said. "That is typically what you need to make a dent on the solar profile."

Credit risk still key bottleneck

Creditworthiness remains a limitation to the pool of PPA offtakers.

In Alight's addressable market of potential counterparties in the Nordics, "we would probably have to disqualify more than 50% for bankability reasons," Hernström said. "It's a significant bottleneck."

Meanwhile, trade tariffs announced by US President Donald Trump have also raised the prospect of a broader economic crisis, according to Danielle Jarski, managing director for Northern and Central Europe at Iberdrola.

"Counterparty risk might come sooner than we thought," Jarski said April 8 on a panel at trade group WindEurope's annual conference in Copenhagen, Denmark, pointing to growing financial risks. Policymakers in the European Commission and national European governments need to step in to help manage this, Jarski said.

The commission has already pledged to support PPAs as a means of reducing price volatility for industrial consumers. As part of the EU's Clean Industrial Deal proposed in February, the European Investment Bank will provide €500 million in counter-guarantees for entities signing clean energy PPAs.

This approach is an important step in deepening the market and tackling the problem of credit exposure, Franceschino said.

'A lot of demand'

While lower than in 2023, wind PPA prices rose toward the end of 2024, with many markets still facing development constraints such as high turbine costs and congested interconnection queues, LevelTen said.

More projects could be brought to market in the UK, thanks to a lifting of England's moratorium on onshore wind by the Labour government in 2024, LevelTen noted.

In solar, Nordic markets like Denmark and Finland made strong showings in PPA activity in late 2024, LevelTen said.

Due to high penetration of wind in the Nordic systems, solar deals offer an attractive complement for industrials, Hernström said.

Alight signed a 100-MW solar PPA for its Eurajoki solar farm in southern Finland April 3, in a cross-border deal with Swedish automotive security company Autoliv Inc. Alongside this, Autoliv announced a separate deal with Danish wind developer Eurowind Energy A/S for a 48-MW wind farm in Romania.

"Climate targets were our starting point," said Kaisa Tarna-Mani, vice president of sustainability at Autoliv. "But there are a lot of other benefits, such as more predictable prices and volumes."

The deal was Autoliv's first large-scale PPA and took several months to complete, Tarna-Mani said in an interview. The process involved identifying potential partners and projects, narrowing down the selection and coordinating across procurement, sustainability and legal functions.

While there is a good selection of projects in the market, buyers do have to be decisive, Tarna-Mani said.

"There are options, but there is also a lot of demand," Tarna-Mani said.