Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Apr, 2025

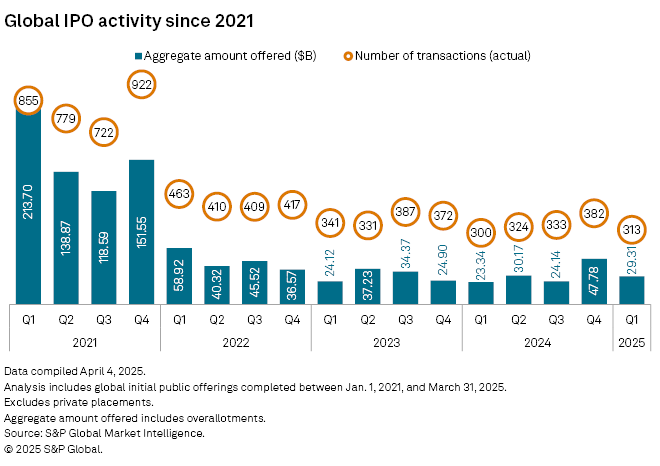

The recovery in global IPO activity throughout 2024 stalled out in early 2025 as transactions in the first quarter fell to the lowest level in a year and the aggregate amount offered fell to a fraction of where it was just four years earlier.

There were 313 IPOS worldwide in the first quarter, down 18% from the previous quarter and the first quarterly decline in activity since the first quarter of 2024. The offerings in the first quarter of 2025 came to an aggregate of $29.31 billion, down about 39% from the fourth quarter of 2024, according to the latest S&P Global Market Intelligence data.

Worldwide IPO activity so far this year has outpaced activity in the first quarter of 2024, when there were 13 fewer IPOs and the aggregate amount offered was nearly $6 billion less.

"Market volatility — driven largely by uncertainty surrounding the impact of tariffs — has led to a broader pause in deal activity, including IPOs," Daryl Lansdale, vice chairman and M&A partner at Norton Rose Fulbright, told Market Intelligence. "Despite these near-term headwinds, there is optimism that greater clarity around tariffs and policy initiatives could reignite IPO activity and result in a strong close to 2025 for new issuances."

Despite reaching an all-time high in February, the S&P 500 fell 4.4% in the first quarter of 2025. The large-cap index is down nearly 8% so far in 2025 as of April 14 following a broader sell-off and slight recovery in the aftermath of President Donald Trump's April 2 announcement of global tariffs.

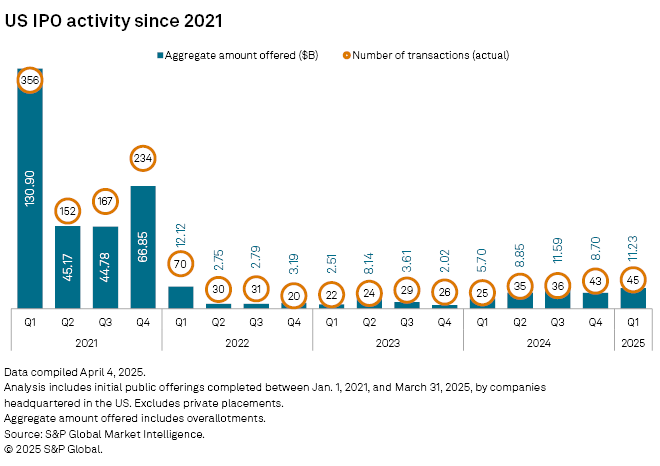

US activity

In the US, activity rose from 43 IPOs in the fourth quarter of 2024 to 45 in the first quarter of 2025, the highest amount since the first quarter of 2022 when there were 70 IPOs.

An aggregate $11.23 billion was offered in the first quarter, a 29% increase from the fourth quarter of 2024.

The largest IPO in the US in the first quarter of 2025 was for Venture Global Inc., a US liquefied natural gas provider, with $1.75 billion offered. In the first quarter, the IPOs for Venture Global, CoreWeave Inc., which offered $1.50 billion, and SailPoint International Inc., which offered $1.38 billion, made up three of the top five largest IPOs in the past 12 months.

Lineage Inc., a real estate investment trust for temperature-controlled warehouses, has been the largest IPO over the past 12 months, with $5.10 billion offered.

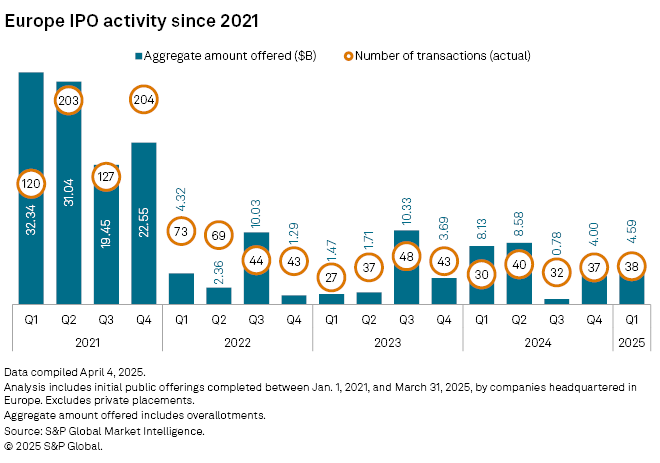

European activity

European IPO activity was relatively flat from the fourth quarter of 2024 to the first quarter of 2025, with 38 IPOs and $4.59 billion offered, compared to the 37 IPOs and $4 billion offered in the previous quarter.

In the first quarter, there were eight more IPOs than in the first quarter of 2024, but $3.54 billion more was offered in the first quarter of 2024.