Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Mar, 2025

By Brian Scheid

The Trump administration's immigration policy shift has caused a steep decline in potential workers coming into the US and will likely trigger a near-term drop in domestic job growth, economists said.

In the early days of his second White House term, President Donald Trump declared a national emergency at the southern border and issued executive orders aimed at "enhanced vetting" of border security, visa applicants, asylum-seekers, refugee programs and more narrowly defining the right to citizenship for those born in the US.

These actions will likely be reflected in labor market data, potentially in the government's March jobs report set for release April 4, said Julia Pollak, chief economist at ZipRecruiter. She said declines in movement across borders will likely stall US job growth and could weaken key portions of a US labor market that has remained surprisingly resilient in spite of relatively high interest rates and recession fears.

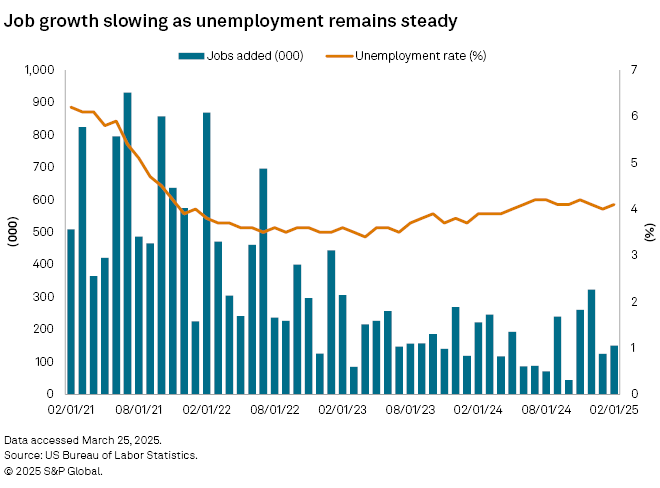

"The overall effect should be a slowdown in monthly nonfarm payroll gains, with figures bouncing around 100,000 over the coming year, but the unemployment rate holding steady," said Pollak. "Theoretically, unemployment could even tick downwards, since it tends to be fairly high among new immigrants initially, and that population is shrinking."

The sudden end of some of the programs for immigrants from Afghanistan, Ukraine, Colombia, Nicaragua and Venezuela alone could result in a drop of about 500,000 immigrant this year, Pollak said. Since many of these migrants received work-eligible visas, the impact could be a drop in net payroll gains of 20,000 to 30,000 per month, Pollak said.

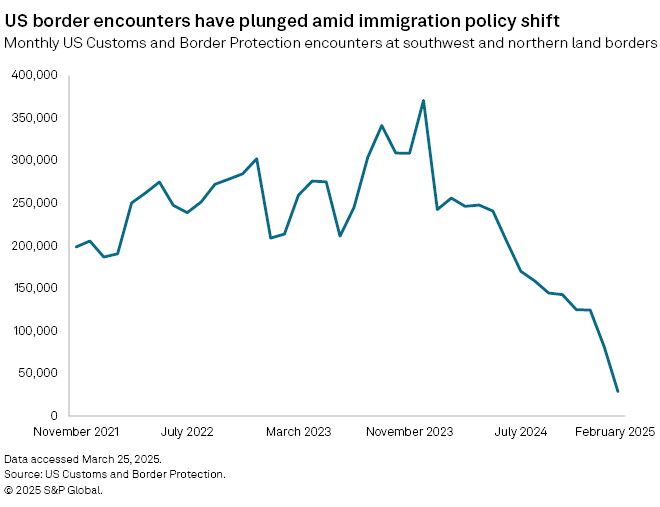

After peaking at over 370,000 per month at the end of 2023, the number of encounters — the number of people who have attempted to unlawfully cross US borders — fell below 29,000 in February, according to the latest US Customs and Border Protection data.

Through the first two months of 2025, the Trump administration's tightening of US policy caused the pace of net immigration to slow by nearly 60%, according to an analysis by Elsie Peng, an economist with Goldman Sachs.

In a March 17 note, Peng projected net immigration into the US to reach 500,000 this year, about half the pre-pandemic pace and less than a third of the level reached in 2024. This will result in a decline in monthly US jobs growth to about 80,000 by the end of 2025, compared with the 168,000 monthly average in 2024, and a 0.1% decline in US GDP growth, Peng estimated.

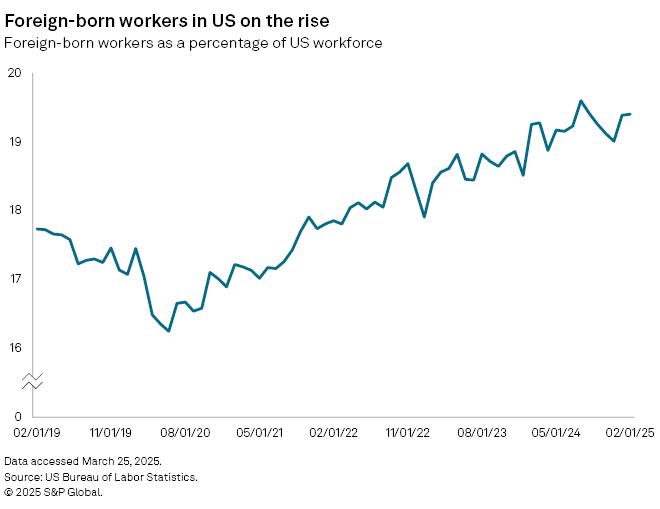

The affect of this policy shift has been mixed for immigrants already in the US, with the immigrant workers in the US labor force relatively unchanged, joblessness slightly lower and job-finding rates slightly higher in February, Peng wrote. But the number of immigrant respondents to the government's labor market survey has declined in 2025, a sign that workers may be fearful to respond to a survey in the middle of an immigration crackdown.

"If we assume that these recent immigrants who did not respond to the survey were also afraid to go to work, then the decline implies that around 20,000 immigrant workers were likely not at work over the past two months," Peng wrote. "Their at least temporary unemployment would not be captured in the official data."

As immigration slows, participation rates will likely decline as the US population ages, a trend that was being offset by higher immigration rates in recent years, ZipRecruiter's Pollak said. It is unclear, however, what impact the shift in immigration may have on wage growth or inflation since immigrants produce and consume goods and services.

"The net effect will vary by industry and location," Pollak said.

Potential impacts

The largest, most immediate effect will likely be felt in specific sectors that rely on immigrant labor the most, such as food and agriculture, leisure and hospitality, and construction, said James Knightley, chief international economist with ING.

"Many of these jobs are in areas that aren't particularly attractive places of work — such as slaughterhouses — and getting US citizens to want to do it isn't easy," Knightley said. "So, in general, they sense that it will mean higher rates of pay being needed to attract workers and that means higher prices for consumers."

Overall, the Trump administration's decision to focus on immigration, trade tariffs and government austerity in its early days, rather than tax cuts and deregulation as expected, has boosted anxiety over household budgets and soured the economic outlook as millions of Americans now fear that government job cuts could spread, Knightley said. This could ultimately lead to a larger weakness in the domestic labor market.

"If we see people really worry then they are more likely to pull back on expenditures and these fears come to fruition and the jobs market rapidly cools," Knightley said.