Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Mar, 2025

By Audrey Elsberry and Ayesha Shahbaz

Market volatility and a dismal showing from the year's first bank initial public offering have dampened the outlook for depositories looking to launch an IPO.

Banks, like companies from many other sectors, have faced stock price pressure during recent trading sessions as concerns about economic growth and uncertainty stemming from the Trump administration's policies have erased most gains that followed Election Day in late 2024. Much of the drop has come in the weeks after the Feb. 13 IPO of Northpointe Bancshares Inc., the first bank to go public in 2025.

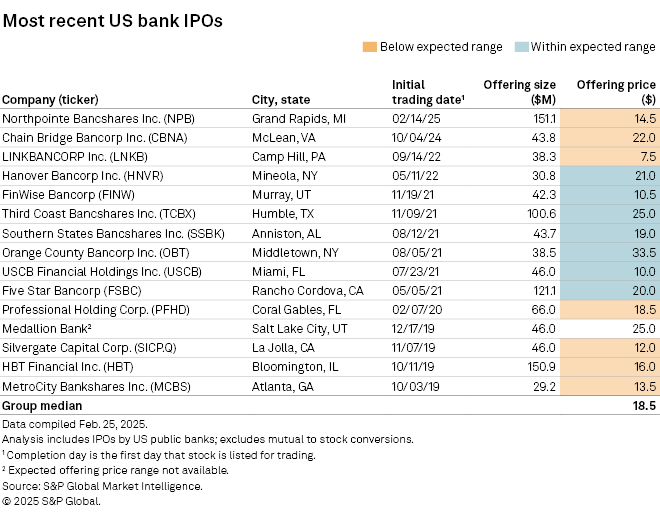

Northpointe Bancshares' IPO priced at $14.50 per share, 14.7% below the average of the $16 to $18 filed price range. While one data point does not make a trend, the deal's outcome is not going to entice "people to the capital markets," said Bill Burgess, Piper Sandler Cos. co-head of financial services investment banking, in an interview.

"The first IPO of 2025 was a bit of a gut," Burgess said.

Still, Northpointe Bancshares' pricing may have been a reflection of its business. Northpointe Bancshares' high concentration of certificates of deposits and emphasis on mortgage origination likely contributed to the performance of the IPO, said Sam Haskell, managing member of investment firm Colarion LLC, in an interview.

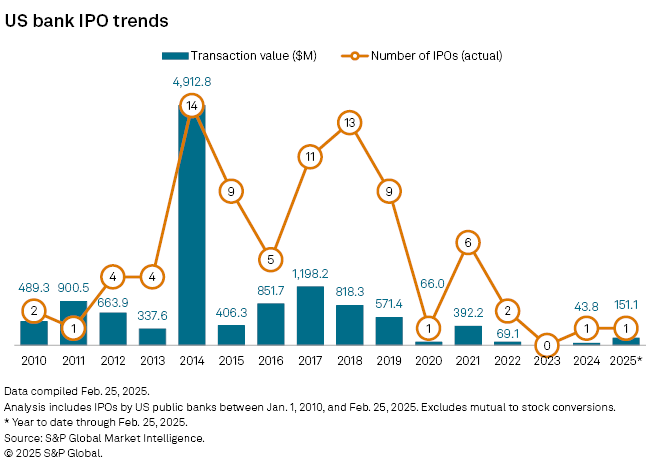

Banks have not had much of a track record in the IPO market in recent years. When excluding mutual stock conversions, only one bank went public in 2023 and 2024, and a bank IPO has not priced within the expected range since Hanover Bancorp Inc.'s 2022 offering. IPOs from LINKBANCORP Inc. in 2022 and Chain Bridge Bancorp Inc. in 2024 also priced below their filed ranges, according to S&P Global Market Intelligence data.

'Wait and see'

Hopes for bank IPOs grew more optimistic in November 2024 when financial stocks surged in wake of the US presidential election, Burgess said. Investment bankers encouraged their bank clients to consider pursuing an IPO.

"There were more conversations about an IPO in November and December than there were probably for the first 10 months of 2024 combined," Burgess said.

But bank stocks cooled over the holidays, and the lack of immediate regulatory movement on the behalf of banks in the early days of the administration did little to boost investor interest in the industry, Haskell said. Bank stocks continued to underperform as stubborn inflation numbers made another interest rate cut from the Federal Reserve less likely. The lack of enthusiasm made IPOs a less attractive avenue for those pursuing liquidity, Burgess said.

There are also concerns that the federal job cuts could deplete staff at the Federal Deposit Insurance Corp. and US Securities and Exchange Commission, making it more challenging for regulators to process IPOs and mergers, Haskell said.

"The mood is reserved, and we're having to wait and see," Haskell said. "We need more action in order to get valuations going, without question."

Haskell noted that issuers with the right profile have a better chance of going public. A bank is more likely to have a successful IPO if there is a differentiated loan or deposit vertical, particularly one that generates fee income, Haskell said. A bank in an interesting M&A market may also fare better, such as those with a presence in Texas and Florida, he said.

Financial technology capabilities can increase interest in an IPO; however, bank investors are more cynical than technology investors, Haskell said.

"By and large, an IPO is always interesting because it's shiny and new, we just are a bit fatigued of having banks coming to us wanting to dump their problems off," Haskell said. "We would like banks to give us an opportunity to benefit from a business that's going in the right direction."

What can work

Smaller institutions can also pursue IPO alternatives

IPOs aside, investors have supported common equity issuance deals from banks over the past few weeks, Haskell said.

Despite the many unknowns, there is a general sense of optimism that market conditions will improve.

Investors are still actively deploying capital, Burgess said, pointing to Toronto-Dominion Bank's completed sale of $13.1 billion of Charles Schwab Corp. stock, announced Feb. 10.

Banks are still taking the option of issuing an IPO seriously, said Kirk Hovde, Hovde Group LLC head of investment banking, in an interview. Capital markets have turned a corner compared to the past four years.

"But everything can change — like we've seen over the last five years, something could happen on a geopolitical or macro front, and it could spook investors again," Hovde said.