Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Mar, 2025

The Trump administration's proposed fees on Chinese shipping vessels or operators "literally would shut down the US coal export industry by May or June," said Ernie Thrasher, CEO and chief marketing officer of coal marketing and logistics firm XCoal Energy & Resources LLC.

The US Trade Representative (USTR) proposed charging $1 million per instance for vessel operators from China to enter a US port. Fleets with Chinese-built vessels would be charged up to $1.5 million per entrance based on the percentage of such vessels in the fleet.

The USTR said the rule would boost shipbuilding efforts in the US and reduce dependence on China's fast-growing commercial fleet. China owned over 19% of the world's commercial fleet as of January 2024, the USTR said.

The higher costs to ship coal would incapacitate the global market if the rule is finalized, Thrasher told Platts, a part of S&P Global Commodity Insights. The US coal industry has increasingly come to rely on international sales as domestic demand shrinks.

"If there's a $1 million fee for that vessel to come, we're not going to sell it. The customer is going to buy it from another source," Thrasher, who has worked in the coal industry for five decades, said on the sidelines of S&P Global's CERAWeek energy conference in Houston. "That's my number one priority now, focusing on trying to explain to USTR how challenging it is."

China's dominance

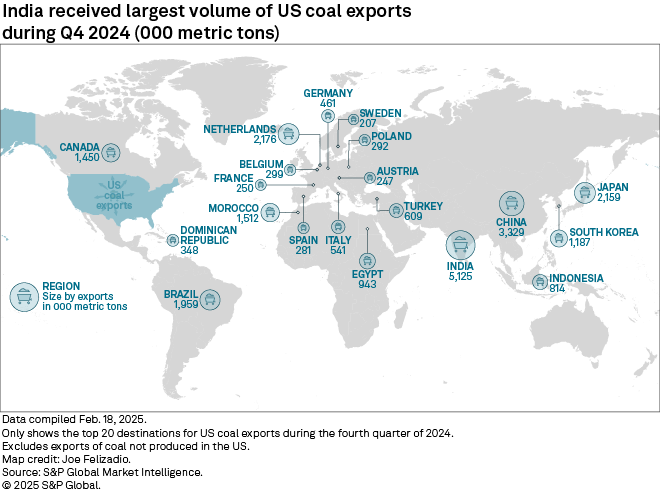

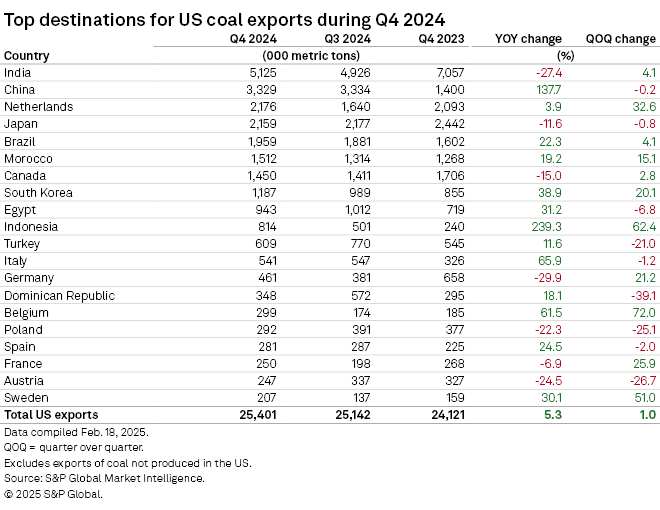

The US exported 107.6 million short tons of coal in 2024, according to the US Energy Information Administration's latest short-term energy outlook. That represents about 21% of the coal produced that

The proposed rule said

"For nearly three decades, China has targeted the maritime, logistics and shipbuilding sectors for dominance and has employed increasingly aggressive and specific targets in pursuing dominance," the USTR wrote in the rule.

"China has largely achieved its dominance goals, severely disadvantaging US companies, workers and the US economy generally through lessened competition and commercial opportunities and through the creation of economic security risks from dependencies and vulnerabilities."

The USTR released the current proposal under the Trump administration, but it stems from an investigation responding to a petition filed during the Biden administration. The petition, filed in March 2024 by unions representing the steel, energy, forestry, shipbuilding and maritime trades, sought a ruling on whether China's actions at sea violated Section 301 of the Trade Act of 1974.

Widespread effects

Other industries, including agriculture, have been mobilizing in response to the proposed fees.

"I think a lot of people were slow to respond" to the comment period, which opened Feb. 21, "but there's a lot of people now realizing how significant and catastrophic this could be," Thrasher said. "It's not just coal. It could be the grains that's in your cereal bowl."

The uncertainty caused by the trade action is already reverberating throughout the coal industry.

Thrasher said the effort to penalize Chinese-built vessels, rather than just China-operated vessels, is particularly cumbersome. The shipowners number in the hundreds and there is no central party to step up and represent those stakeholders.

"The problem is these shipowners, maybe they're in Greece, maybe they're in Panama, you don't know where they're at. They're not going to show up in DC and tell the president, 'This is what's going to happen,'" Thrasher said. "We, as members of the industry, have to go out and tell USTR, 'This is what you're going to do to us.'

"And it's not only coal; it's grain, aggregates, gypsum, bauxite, fertilizer and more," Thrasher said.

The US cannot simply build out its own fleet of ships in the months the administration is proposing to allow before the rule takes effect. It would take a decade, Thrasher estimated, to mobilize the labor force needed to build enough vessels to convert the fleet to US-made ships.

This is not the first time the industry that produces what President Donald Trump has called "beautiful, clean coal" has been ensnared in the administration's trade policies. Early in Trump's second term, Chinese officials announced tariffs on US coal imports in response to tariffs the US placed on China.

"The Chinese identify coal very quickly because they recognize the coal industry support for the president," Thrasher said.