Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Mar, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Expanding European defense budgets presents a major opportunity for private market investors.

With Russia's invasion of Ukraine, new defense technologies such as unmanned aerial drones spurred a surge in venture capital funding for defense tech.

As US support for Ukraine is wavering under President Donald Trump, European leaders are planning to step up. Increased military spending, along the lines of the €500 billion infrastructure and defense fund approved earlier in March by German lawmakers, is likely to draw the attention of private equity (PE) and venture capital investors.

Europe-based companies have attracted just 12% of global private equity investment in the aerospace and defense sector since 2020, while 83% flowed to businesses in North America. But the outlook for defense investment is also shifting in the US as the Defense Department refocuses on the strategic priorities of the Trump administration.

Read more about private equity investment in aerospace and defense.

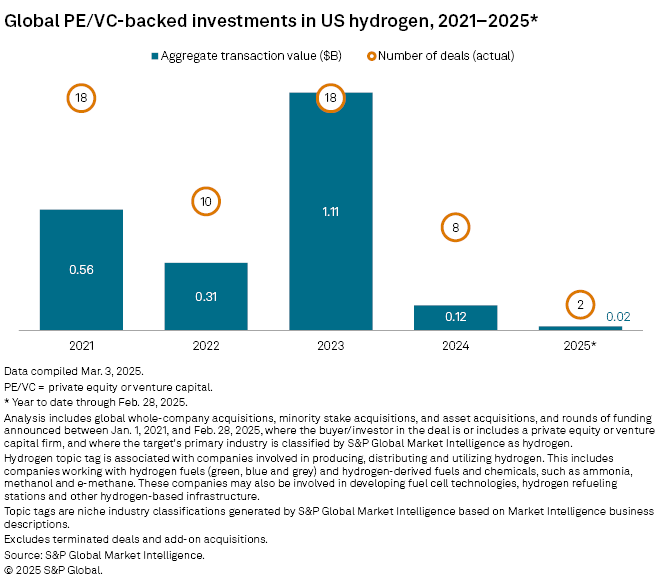

CHART OF THE WEEK: Private equity investments in US hydrogen plummet

⮞ Private equity- and venture capital-backed investment in the US hydrogen industry fell nearly 90% year over year to $120 million in 2024 from $1.11 billion, according to S&P Global Market Intelligence data.

⮞ The drop coincided with concerns about the outlook for US hydrogen investment as the new administration pivots on government support for renewable energy sources.

⮞ About 75% of the $80 million private equity invested in hydrogen this year through Feb. 28 targeted Europe, where a more supportive policy environment is brightening the outlook for deals.

TOP DEALS

– Cinven Ltd. agreed to sell German life insurance consolidator Viridium Group GmbH & Co. KG to a consortium including Allianz SE, BlackRock Inc. and T&D Holdings Inc. The transaction values Viridium at €3.5 billion, including debt.

– General Atlantic Service Co. LP agreed to make a $500 million minority investment in Nerdio Inc., an IT management company. Lead Edge Capital Management LLC and StepStone Group Inc. participated in the series C investment.

– A consortium comprising EQT AB (publ), Canada Pension Plan Investment Board and other institutional investors completed the acquisition of private school operator Nord Anglia Education Ltd. The deal valued the business at $14.5 billion.

– Funds managed by Apollo Global Management Inc. affiliates agreed to buy a majority stake in UK-based offshore energy solutions provider OEG Offshore Ltd. from an investor group including Oaktree Capital Management LP and other investors. The deal implies a headline valuation exceeding $1 billion for OEG.

TOP FUNDRAISING

– Turn/River Management LP raised $2.5 billion in total commitments at the close of Turn/River Capital Fund VI. The fund seeks to invest in software companies.

– Pantheon Ventures (UK) LLP secured $1.1 billion for Pantheon Secondary Opportunities Fund II at final close. The vehicle invests in the general partner-led segment of the secondaries market.

– Stafford Capital Partners Ltd. raised $1.04 billion at the close of its flagship timberland fund. The Stafford International Timberland Fund X will invest in timberland assets.

– New State Capital Partners LLC raised $700 million at the close of its Fund IV. The firm invests in middle-market companies.

MIDDLE-MARKET HIGHLIGHTS

– Blue Point Capital Partners LLC sold commercial and industrial solutions provider Sylvan Inc. to E3Tech. As part of the deal, Blue Point made a rollover investment in the company.

– Comvest Partners sold waste management services provider Atomic Transport LLC.

FOCUS ON: SOFINNOVA'S BIOTECHNOLOGY ACTIVITY

– Sofinnova Partners SAS raised €165 million at the final close of its Sofinnova Biovelocita II fund, which will invest in biotechnology companies across Europe.

The fund close highlights the private equity firm's recent investments in biotechnology companies. Sofinnova has participated in the private placement of GenSight Biologics SA and the angel round of funding for Bioptimus.

Sofinnova's previous biotechnology-focused funds include Sofinnova Industrial Biotech II Fund, which raised $163 million, and Sofinnova Industrial Biotech I Fund, which raised $136 million.

The firm has 62 current direct investments in biotechnology totaling $2.84 billion, according to Market Intelligence data.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter