Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Mar, 2025

By Rica Dela Cruz and Zuhaib Gull

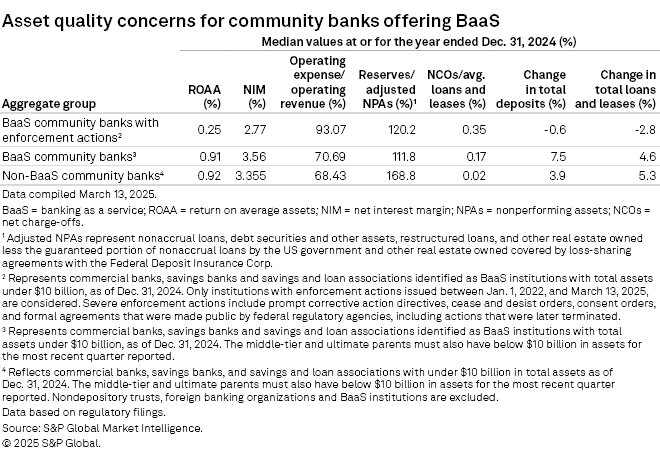

US banking-as-a-service community banks operating under enforcement actions underperformed compared with their peers in several financial metrics in 2024.

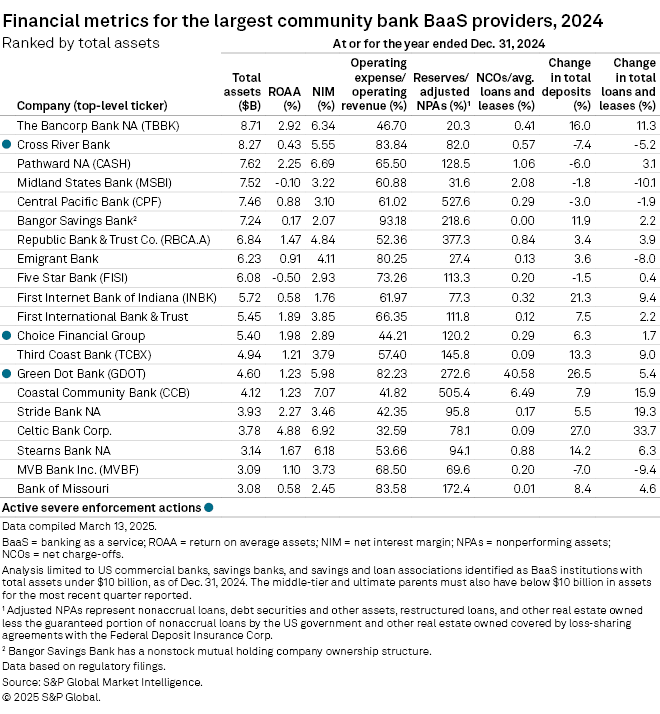

Banking-as-a-service (BaaS) community banks with enforcement actions issued between Jan. 1, 2022, and March 13, 2025, reported higher net charge-off and operating expense ratios as well as lower returns on average assets and net interest margins in 2024 compared to BaaS community banks overall, based on median values, according to an S&P Global Market Intelligence analysis. These banks also booked a median decline in total deposits and total loans and leases.

BaaS banks operating under consent orders have expenses connected with complying with the requirements of the orders, affecting profitability, Piper Sandler analyst Frank Schiraldi said in an interview.

The underperformance happened during a year in which BaaS players grappled with heightened scrutiny. The enforcement actions issued to sponsor banks significantly affected the BaaS sector, according to Carey Ransom, managing director at BankTech Ventures.

"It spooked many other sponsor banks, several banks considering entering into BaaS, and even a number of fintechs who had to reconsider their approach to bank partners and infrastructure," Ransom said in an interview.

Additionally, more US states are "challenging or severely restricting" BaaS by exercising the opt-out provision of the 1980 Depository Institutions Deregulation and Monetary Control Act (DIDMCA), said James Kim, a partner at Troutman Pepper.

DIDMCA allows banks to apply the interest rates permitted by the state in which they are located, regardless of the borrower's location or any conflicting state law. However, states can opt out of DIDMCA, and some such as Colorado have pursued opt-out legislation.

"Most US banks involved in banking as a service are state-chartered banks," Kim said in an interview. "So more states opting-out of DIDMCA would negatively impact banking as a service in the US."

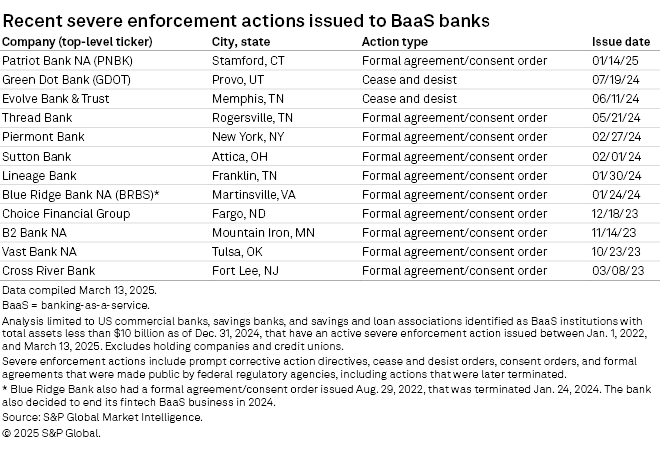

Recent severe enforcement actions

In 2024, seven BaaS community banks received severe enforcement actions. The cascade of regulatory actions issued to BaaS banks helped remind the parties in a bank-fintech partnership that "the fintech is a third-party provider to the bank, and not the other way around," Ransom said.

Among those banks, Blue Ridge Bank NA

Despite the heightened scrutiny, Troutman Pepper's Kim believes BaaS, in general, is "a net positive."

"Just because there are a few bad apples, I don't think you can say that 'Banking as a Service is broken. It's too risky. It needs to be shut down.' Those overstatements are wrong," Kim said.

Patriot Bank NA is the first BaaS bank to receive a severe enforcement action in 2025. The bank's parent company, Patriot National Bancorp Inc., announced an evaluation of strategic options in 2024 and recently entered into securities purchase agreements to raise over $50 million in a private placement.

Outlook

BaaS is an attractive business for banks with "the back office and the expertise to support the more stringent regulatory oversight," Piper Sandler's Schiraldi said.

"Generally, this is only possible for the largest players in the space, which is why we have [overweight] ratings on both [Pathward Financial Inc. and The Bancorp Inc.]," Schiraldi added.

Earlier in March, The Bancorp announced it had "inappropriately filed" its annual report for 2024 and was working to complete additional closing procedures related to accounting for consumer fintech loans in its allowance for credit losses. However, Schiraldi said in a March 19 research report that the company's stock will likely be positively affected in the near term by the sale of its large other real estate owned property.

The Bancorp's banking subsidiary, The Bancorp Bank NA, underperformed the median for BaaS community banks in terms of reserves as a percentage of adjusted nonperforming assets and net charge-offs as a percentage of average loans and leases. Pathward Financial's subsidiary, Pathward NA, underperformed the median for BaaS community banks in terms of net charge-off ratio and changes in total deposits and total loans and leases.

In 2025, BaaS players will see a more favorable environment at the federal level, though there will also be a continuation of active states seeking to strictly regulate BaaS, Troutman Pepper's Kim said. "You're going to, I believe, see divergent approaches at the federal level versus the state level."

BankTech Ventures' Ransom expects more BaaS banks that are unwilling to wait for returns or are seeing slow growth in their first few programs to step away from the BaaS sector in 2025.

Additionally, there could be more aggressiveness at some larger banks, given that "some fintech partners seek even larger banks as [they are] perceived more stable partners, which may or may not be real," Ransom said.