Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Feb, 2025

By Iuri Struta

The technology sector is poised for a surge in M&A in 2025 amid an improved regulatory landscape and a growing tolerance of current interest rate levels.

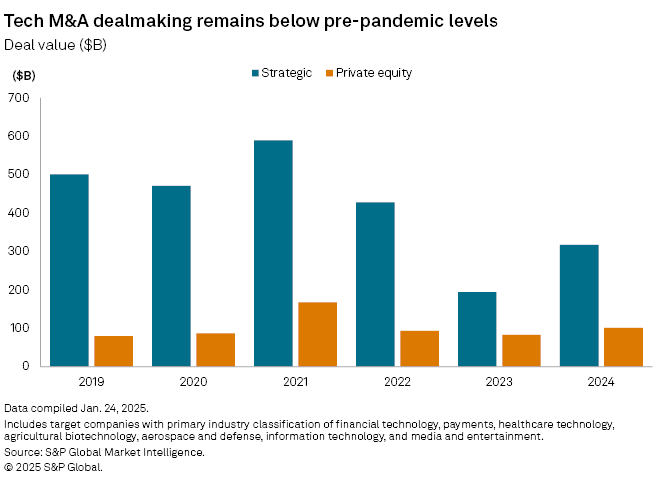

For the past two years, a number of factors have limited M&A in the technology sector, including increased regulatory scrutiny, higher interest rates and a shift in strategic focus toward investments in artificial intelligence. In the face of those pressures, technology M&A spending totaled $277 billion in 2023 and $418 billion in 2024 — below both the pandemic-fueled boom seen in 2021 and the pre-pandemic values seen prior to 2020, when totals consistently exceeded $500 billion.

Market participants are optimistic that 2025 will be a year of true recovery in tech dealmaking, as valuations improve and sellers get off the sidelines.

"Many sell-side clients in 2024 decided they preferred to go to market with their full '24 results," said Joseph Radecki, managing director and head of TMT Investment Banking at KPMG Corporate Finance. This meant many companies started the M&A process early but have been waiting for a better market to hit the trigger.

Better but not good enough

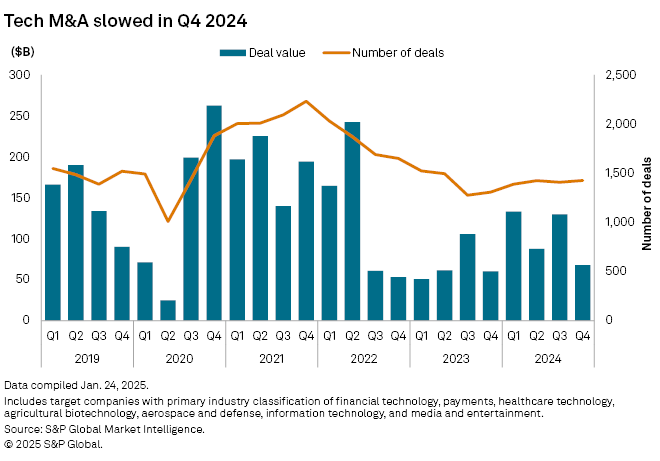

Tech M&A activity in 2024 experienced several false starts, with periods of apparent growth followed by declines in subsequent quarters. The fourth quarter recorded the slowest deal activity since the last three months of 2023, a trend likely influenced by the heightened uncertainty posed by the US elections.

Strategic buyers, in particular, stepped back from the market in 2023 and 2024.

"What a lot of corporates have been in the midst of doing is really taking a hard look at their own operations in the face of the changing world, changing economies, technologies and the like, to say, what is our core business? What is going to allow us to unlock the value for our shareholders and does the entirety of our organization represent that?" said Mahvesh Qureshi, an M&A partner at Hogan Lovells, in an interview with S&P Global Market Intelligence.

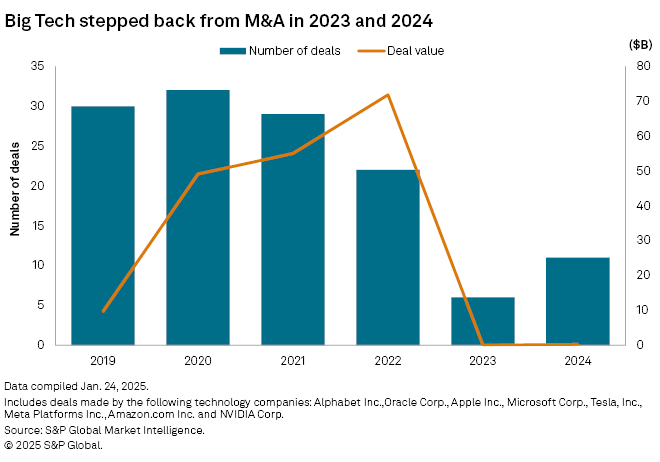

The decline in dealmaking among strategic buyers is particularly apparent among the largest technology companies: NVIDIA Corp., Alphabet Inc., Microsoft Corp., Meta Platforms Inc., Apple Inc., Tesla Inc., Oracle Corp. and Amazon.com Inc. M&A fell off a cliff in 2023 and barely budged in 2024 as an antitrust environment coincided with an AI gold rush, prompting many of these companies to ramp up capital expenditures on AI infrastructure like datacenters. Additionally, a lot of capital was directed at investing in AI startups versus outright M&A.

Looking ahead

2025 could mark a turning point. Although the new Trump administration is unlikely to create a significantly more permissive environment for tech M&A, many law firms expect some kind of revision to the 2023 merger guidelines issued by the Antitrust Division of the Department of Justice and Federal Trade Commission. Those guidelines lowered the thresholds at which a merger was considered anti-competitive, making a larger swath of deals subject to regulatory scrutiny.

"We are going to see more of a reversion to the mean, a reversal back to more traditional theories of harm," said Larry Chu, a partner in Goodwin's Technology and M&A practice, in an interview with S&P Global Market Intelligence.

While further interest rate cuts were expected to boost tech M&A in 2025, the combination of a strong US economy and tariffs could lead to higher inflation and higher-for-longer interest rates. According to the January 2025 Investment Manager's Index, central bank policy represented a drag on equity returns for the first time since June 2024.

Still, dealmakers believe private equity firms are learning to live with higher interest rates.

"A generation of PE folks grew up with very cheap capital," Radecki said. "They've had to dust off their firm's old playbook with lenders coming back to support M&A at much higher rates."