Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2025

Short sellers reduced their positions in information technology stocks in January. The decline in short positions coincided with a market selloff in some of the more speculative names, possibly prompting short sellers to take profits.

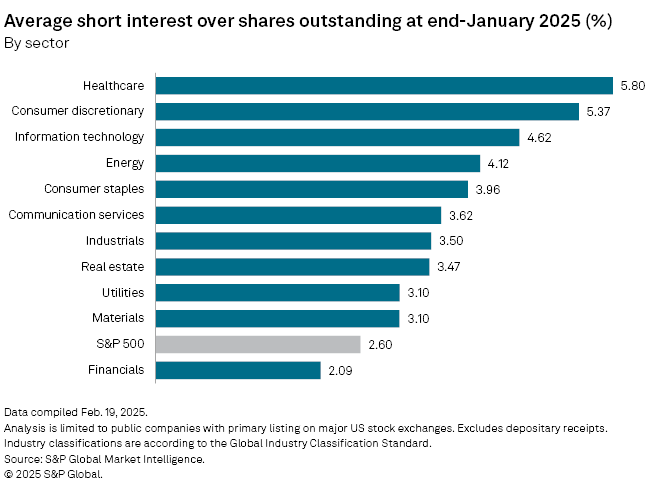

The average short interest in the North American IT sector dropped to 4.62% of shares outstanding in the first month of 2025, down 18 basis points from December 2024, according to S&P Global Market Intelligence data.

Year over year, short interest increased 122 basis points from 3.40% at the end of January 2024.

Overall, information technology was the third-most shorted sector at the end of January, behind consumer discretionary and healthcare.

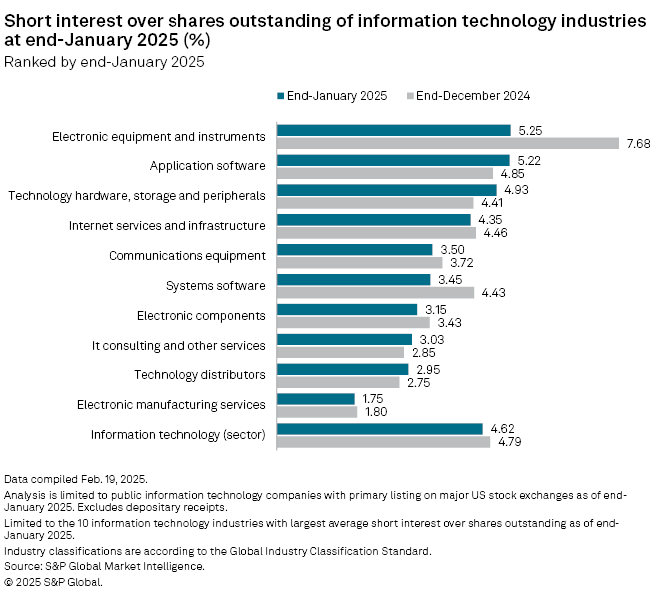

Within the information technology sector, electronic equipment and instruments was the most shorted industry at the end of January 2025, at 5.25%, down from 7.68% in December 2024.

Application software stocks ranked second at 5.22% short interest, a jump from 4.85% in the previous month. Electronic manufacturing services stocks were the least-shorted IT stocks during the month.

– Set email alerts for future Data Dispatch articles.

– For further global market analysis, try the Market View Excel template.

– Read some of the day's top news and insights from S&P Global Market Intelligence.

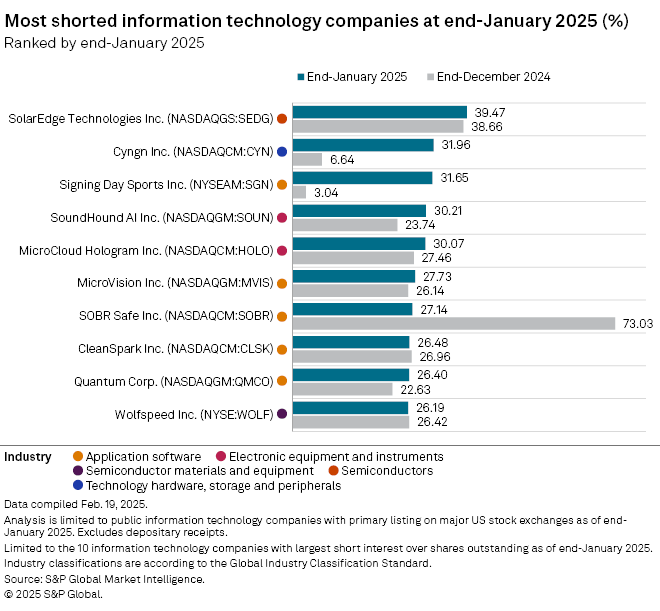

SolarEdge Technologies Inc. was the most shorted information technology stock at the end of January 2025 with 39.47% short interest, up from 38.66% at the end of December 2024.

The maker of advanced solar inverters and energy storage solutions had a rocky 2024, with revenue falling by two-thirds and the stock plummeting more than 90% from its peak. Demand for solar products crashed in 2024, forcing the company to write down assets. Product promotions in Europe, one of its key markets, have failed to boost product uptake.

Autonomous vehicle technology company Cyngn Inc. was the second most shorted IT stock in January, at 31.96%, up 2,532 basis points sequentially.

In January, the company said it raised $33.0 million to scale its production of autonomous forklifts and tuggers, and struck deployment agreements to expand in the automotive sector and automate logistics. Investors remain skeptical, however, as the company has no revenues.

Sports recruitment platform Signing Day Sports Inc., which in January entered into a binding agreement to acquire 99.13% of Dear Cashmere Holding Co., was the next most shorted IT stock at the end of the month with short interest of 31.65%. The company also saw the greatest increase in short interest month over month.

SOBR Safe Inc. recorded the steepest drop at month-end, falling 4,589 basis points to 27.14% of shares outstanding from 73.03%.