Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Feb, 2025

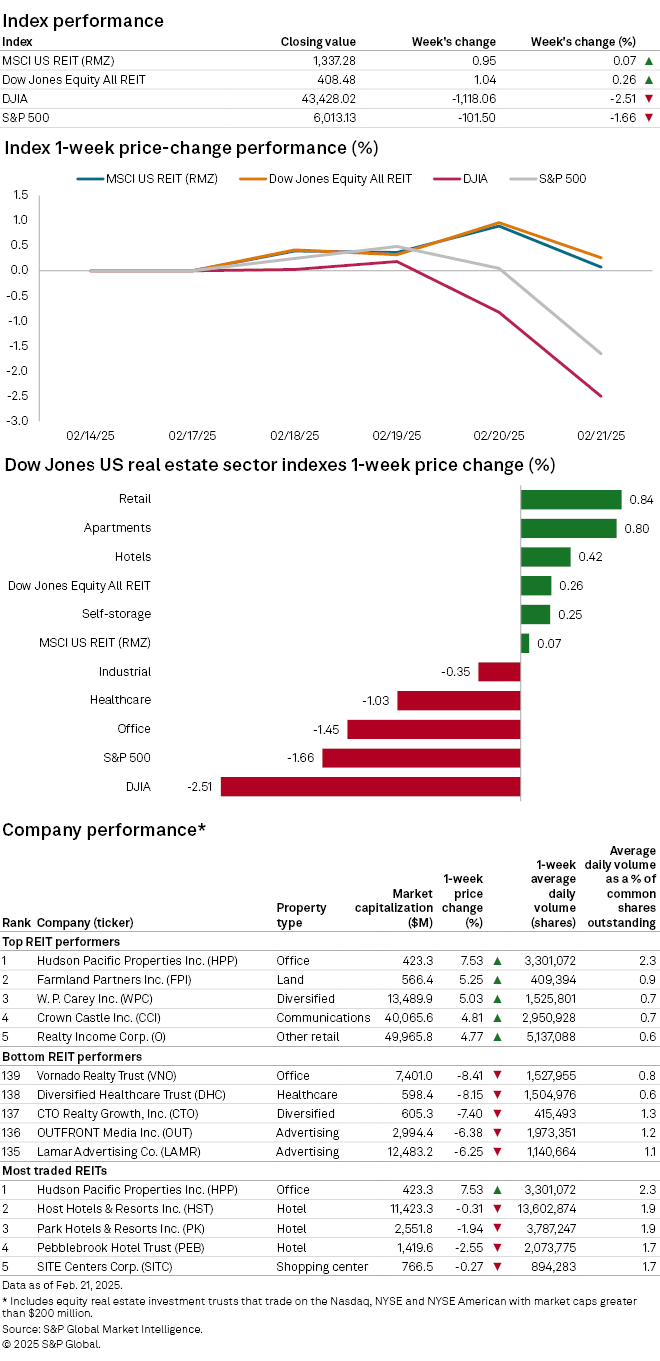

Share prices for US equity real estate investment trusts ticked up slightly during the week ended Feb. 21, outperforming the broader stock market.

The Dow Jones Equity All REIT index closed the recent week up 0.26%, compared to a 1.66% decline for the S&P 500 and a 2.51% drop for the Dow Jones Industrial Average.

Looking at the Dow Jones US real estate property sector indexes, the retail REIT index logged the largest increase during the recent week, up 0.84%, followed by the apartment REIT index at 0.80%.

On the other end, the office REIT index recorded the largest drop during the week at 1.45%, followed by the healthcare index, down 1.03%, and industrial down 0.35%.

Among US REITs with at least $200 million in market capitalization, office REIT Hudson Pacific Properties Inc. logged the largest share price increase during the week, up 7.53%. Farmland Partners Inc. followed with a 5.25% increase, while W. P. Carey Inc. ranked third with a share-price increase of 5.03%.

Office REIT Vornado Realty Trust's share price fell the furthest this past week, down 8.41%. Healthcare REIT Diversified Healthcare Trust ranked next with a share-price drop of 8.15%, followed by CTO Realty Growth Inc. down 7.40%.